Note: This information is from 2020 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

Your bonds are facing challenges not seen in our lifetimes – historically low interest rates have benefitted current bondholders as their prices have risen sharply in value; but the low current rates leave bonds exposed to losses, assuming rates rise in the future. Wondering if you should sell your bonds? Here are some strategies to consider.

Your bonds are facing challenges not seen in our lifetimes – historically low interest rates have benefitted current bondholders as their prices have risen sharply in value; but the low current rates leave bonds exposed to losses, assuming rates rise in the future. With looming massive federal deficits exacerbated by the coronavirus response by Congress and the need for future funding of expensive social programs like Medicare, Medicaid, and Social Security, it is likely that significant bond issuance by the Treasury is in the cards. This addition to the supply of Treasuries, along with possible rising inflation due to COVID-19 related supply chain shortages around the globe and a Federal Reserve that has recently increased their targeted inflation thresholds, will ultimately put pressure on interest rates to rise over time. As a result of this increase in rates, bond prices will fall leaving bond owners with losses in what they consider the “safe” portion of their investment portfolios.

Low interest rates, combined with current inflation expectations, have reduced

the current “real” return (yield minus inflation) on Treasury bonds to

less than zero. This means that the purchasing power of your bond

investments will lose ground to inflation each year even without the principal loss associated with rising rates.

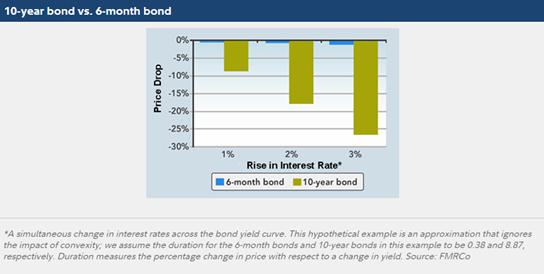

With interest rates so low, a 1% increase in the 10-yr. Treasury bond yield would result in an approximate 9% decline in the value of that bond – not something for which conservative investors would likely be prepared.

Should I sell all my bonds then?

Not necessarily. Bonds come in many forms and there are strategies that can mitigate interest rate risk. While U.S. Treasuries carry no real risk of defaulting, other bonds such as corporate bonds and tax-free municipal bonds have much higher yields than Treasuries but do have some default risk and should be reviewed carefully by investors before investing. Also, U.S. Treasury bonds behave well when investors fear economic contraction coming, such as what happened this spring, and can serve as a risk “hedge” for those investors with a heavy allocation to stocks.

To avoid the interest rate risk scenario described above, there are several strategies that can be employed:

1. Own individual bonds that mature in a specific schedule. This is known as a bond “ladder” and involves buying a series of bonds (Treasuries, corporates, or municipals) that mature each year over a certain time frame such as 10 years. This way, the investor always has a bond maturing into the higher interest rate environment and can buy a new, higher-yielding bond at the end of their ladder (e.g., buying a new 10-yr. bond when your 1-yr. bond matures).

2. Own shorter-maturity bonds and reinvest the proceeds into additional shorter-term bonds when the bonds mature. This will prevent any ultimate loss of principal but will result in lower bond yields than the laddered approach.

3. Own actively managed bond funds that buy short-to-intermediate bonds. While this strategy will involve some loss of principal in a rising rate environment, it may be mitigated by higher portfolio yields and any new money flows into the fund. These new money flows can then be used by the manager to purchase bonds that are now cheaper due to rising rates.

Conclusion

While returns on bonds will be challenged going forward, there are steps that investors can take to lessen the impact of rising interest rates on their bond portfolios. The article below from the Huffington Post further describes the risks of rising rates to your bond portfolio.

Source: