Note: This information is from 2022 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

For individuals who have thought about getting into rental properties as an easy way to make cash while building assets for retirement, it will be important that you do your homework and set appropriate expectations of the venture. Learn more about calculating the returns on rental property.

Many individuals who become focused on accumulating wealth look for ways that they can use their savings to try to generate more income for themselves with the thought that they may be able to build a more comfortable lifestyle. Who could argue with that! After all, we should all seek ways to make our money work for us, right?

My intent is certainly not to discourage individuals who find real estate investing or renting a fulfilling endeavor as they help make their communities better places to live; the cause is certainly a noble one that could be rewarding on many levels. However, for individuals who have thought about getting into rental properties as an easy way to make cash while building assets for retirement, it will be important that you do your homework and set appropriate expectations of the venture.

The Allure of Real Estate Investing

Why do individuals consider getting into real estate as a go-to investment? Here are several reasons one might kick around the idea:

- It is real. You can see it and touch it. Seems obvious, but many feel more comfortable investing in assets they feel that they understand. Financial investments, such as stocks or bonds, can be intimidating due to a fear of the unknown.

- Income can be spent…now. With so much focus on tax savings and tax-deferral, much of what investors save is tied up until retirement.

- Thinking gross rent will be your income. While it is fun to muse on a napkin about all the money you will make on a rental property in terms of the rent you will charge, make sure you subtract the expenses to arrive at your actual income you’ll earn.

- Assuming that keeping renters is a given. Vacancy can really hit your bottom line as you may be saddled with a mortgage payment you didn’t intend to afford, along with other necessary expenses as the property owner. Eviction proceedings can be particularly painful, as rent may not be paid, but expenses continue, and you can’t bring in a new renter until the proceedings are completed.

- Assuming the property value will go up. Location, location, location. Also, as we learned in 2007-2009, real estate is not exempt from market risk. Whether a real estate bubble burst is imminent, or the location of the rental is on the decline, don’t over-assume you’ll make capital gains over your holding period.

Calculating Returns on a Rental Property

There is a large range of possible outcomes when dealing with rental properties and thinking of them as an investment. Setting aside all the risks involved in running a rental property, there are 2 components you’ll need to consider when calculating a return on your investment over the term of your holding period:

- Capital Gain on Investment (per year, compounded)

- Yield on Investment (per year)

To illustrate how to figure out a rate of return for a given year, here is a purely hypothetical calculation. Caveat: Don’t consider this example to be realistic or instructive of your potential to make returns on a rental property. This is merely an example of how you might crunch the numbers.

ASSUMPTIONS:

- Buy a rental property in 2022 for $150,000 with 25% down and a 15-year business mortgage @ 5.000%; payments are $900/mo. Total closing costs (including mortgage origination) were $9,000 (paid out of pocket).

- Property taxes are $2,500/year.

- Insurance on the property costs $750/year.

- The property value grows a straight 2%/year over your holding period (over-simplified).

- You rented the property for 10 months out of the year for $1,400/mo.

- You had to replace the air conditioning unit costing $3,500 (installed). All other maintenance requests combined for the year cost you $2,400. You did the work on most of the repairs to save on the cost.

- Toward the end of your initial renter’s term, you made weekly trips to the property as they were behind on their rent and wouldn’t answer your calls; the property is 20 miles from your house, you made the trip 8 times at a cost of $0.56/mi.

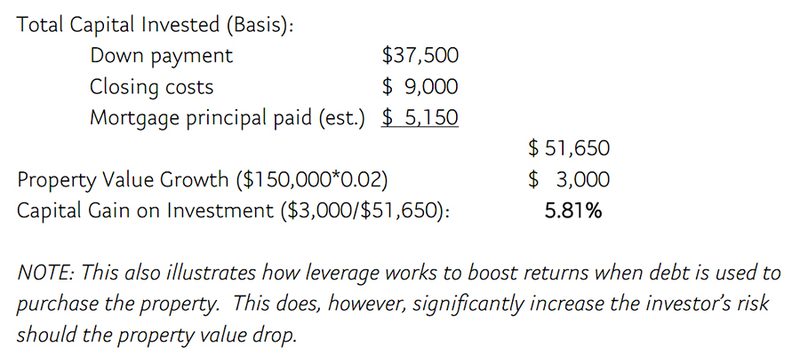

STEP 1: Capital Gain on Investment –Year One (Assuming 2% price growth):

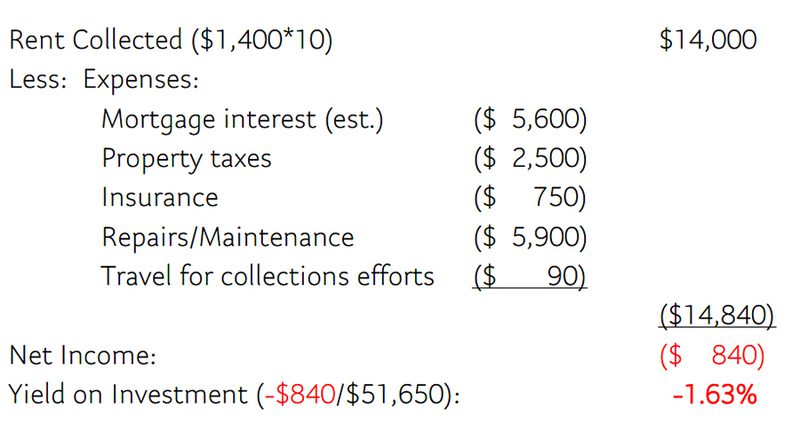

STEP 2: Yield on Investment – Year One:

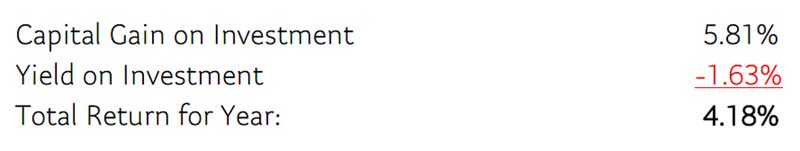

STEP 3: Total Return for Year One: Combine Capital Gain/Loss on Investment and Yield:

Not bad! This hypothetical investor already achieved a positive return on their investment in the rental property in year 1! That said, while only hypothetical in nature, this illustrates how quickly a rental property can actually result in negative cash flow for those hoping to increase lifestyle spending as a result of owning a rental property.

Remember That Time Is Money

In the hypothetical example above, my intent was to illustrate how to really calculate a rate of return earned on a real estate rental property if we are thinking of it as an investment. However, you’ll find that the owner above never accounted for the time they put into this venture over the course of that year:

- Time spent researching what property to buy, and buying it;

- Time spent listing the rental, seeking to get new renters in the property twice;

- Time spent paying the bills for the property;

- Time spent shopping for a product and installer to replace the air conditioner;

- Time spent making repairs, including travel/mileage;

- Time spent making trips to try to collect rent when the first renter got behind; and

- Time spent keeping tax records and communicating with their CPA.

If the above tasks took 22 hours of the investor’s time in that year (though probably more!), at $100/hour, the $2,160 made on this venture was really compensation for a job done, not so much a return on investment. Better luck next year! You then have to ask if said work was the kind of work they wanted to be doing. Even so, the more you outsource the work, the less likely your financial position is improved by the venture.

Know Your Goals Before You Jump In

In the hypothetical example, had this individual gone into the rental venture hoping to gain more spending cash that year, they were sorely disappointed. To the (potentially positive) contrary, had this individual been looking for a way to diversify their assets for the long-term with little regard for short-term cash flow risks, they may yet be successful with it. Perhaps, your intent is to give back to your community with little regard for return. Or, maybe your focus is making money. Make sure you know your ultimate goals for getting involved in a rental property, and make sure you can afford any downside risk to the property value or to your cash flow (if only temporary), so that you — and your rental property — can weather any storm.