Since 1990, the Financial Crimes Enforcement Network (FinCEN) has been a bureau of the U.S. Department of the Treasury. They are tasked with promoting national security and safeguarding our financial system by combatting financial crimes like money laundering and terrorist financing.

As of January 1, 2024, FinCEN has been given a new responsibility. Under the Corporate Transparency Act of 2021, FinCEN is now collecting required reports from U.S. companies that identify their beneficial owners and detail information. Is your business or entity one that is now required to report beneficial owners? Learn more.

Does Your Business or Entity Need to Report Beneficial Owners to FinCEN?

Since 1990, the Financial Crimes Enforcement Network (FinCEN) has been a bureau of the U.S. Department of the Treasury. They are tasked with promoting national security and safeguarding our financial system by combatting financial crimes like money laundering and terrorist financing.

FinCEN has been given a new responsibility as of January 1, 2024. Under the Corporate Transparency Act of 2021, FinCEN is now collecting required reports from U.S. companies that identify their beneficial owners and detail information.

It’s important to understand whether or not your business or entity is now required to report beneficial owners. Penalties for not reporting are steep — $500 for each day the violation continues, and/or imprisonment for up to two years, and/or a fine of up to $10,000. Moreover, it is the entity's senior officers who are held accountable for the failure to comply.

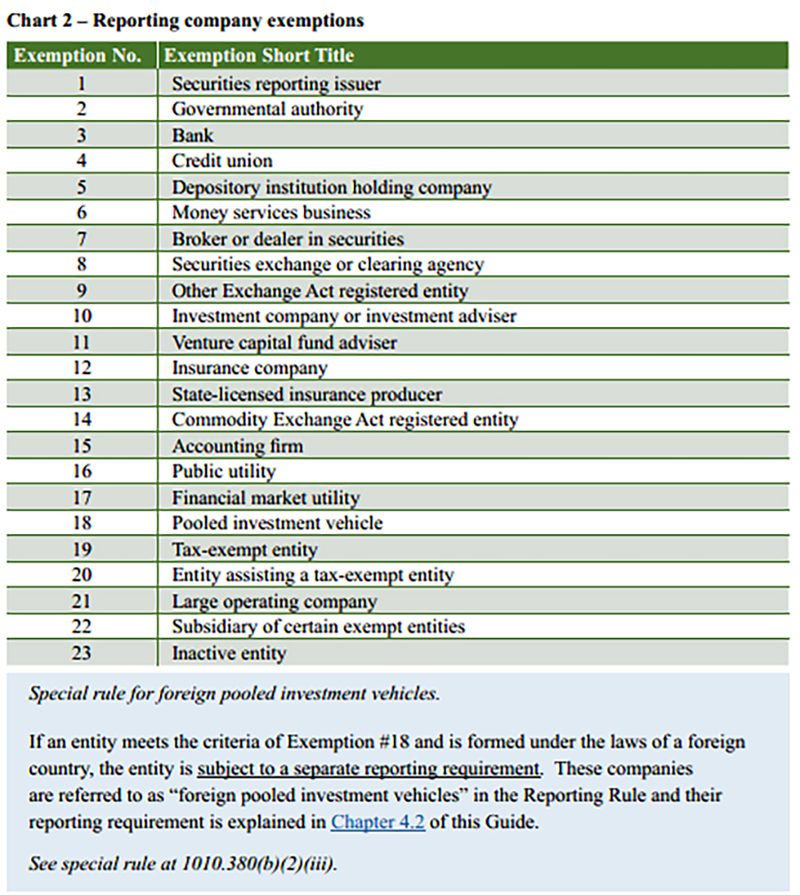

So how do you know if your business or entity is required to file? This law impacts corporations, limited liability companies, and any other entities created by filing documentation with a government office. This includes less obvious entities like family LLCs or limited partnerships, or LLCs created solely to hold real estate. There are 23 types of entities that are exempt from filing as long as they meet qualifying criteria. If your entity type is listed on the chart below (taken from the FinCEN BOI Small Compliance Guide) you may be exempt:

If your business or entity is not exempt, you are considered a “Reporting Company” and you need to report your beneficial owners.

Next you must determine who is a beneficial owner, defined as any individual who exercises substantial control over a reporting company or owns or controls at least 25% of the ownership interests of a reporting company. Additionally, if your company was created or registered on or after January 1, 2024, you will also need to report company applicants along with beneficiary owners. Section 3.2 of FinCEN BOI Small

Compliance Guide gives more detail on company applicants, if this situation applies to you.

Once you’ve identified who needs to be reported as a beneficial owners (and company applicants, if applicable), gather the following information to report:

- For the company: Name and trade or “doing business as” name, address, Taxpayer Identification Number (social security number or employe identification number).

- For beneficial owner and company applicants: Name, date of birth, address, image of government issued ID and unique identifying number from ID

Now that the needed information is gathered, you are ready to report! You must file electronically through the FinCEN filing system: BOI E-FILING. Existing reporting companies must file their initial report by January 1, 2025. New reporting companies, those created or registered in the US after January 1, 2024 MUST file within 90 days.

Once your initial report has been filed, no additional action is needed unless there are changes to previously reported beneficial owners or if error on the initially submitted report are discovered and need corrected. Updates and corrections must be submitted within 30 days.

For more details, review in full the FinCEN BOI Small Compliance Guide or visit the U.S. Department of the Treasury Financial Crimes Enforcement Network.