Note: This information is from 2020 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

Whether in portfolios of our own or for those for whom we have fiduciary responsibility, like our favorite non-profit organizations, it's important for us to remain aware of anticipated net distribution rates and investment returns for the asset allocation strategy selected for the portfolio's investments.

Whether in portfolios of our own or for those for whom we have fiduciary responsibility, like our favorite non-profit organizations, it's important for us to remain aware of anticipated net distribution rates and investment returns for the asset allocation strategy selected for the portfolio's investments.

As much as we'd like to believe these are "set it and forget it" decisions, they need regularly reviewed, ideally every year or two. Distributions fluctuate to meet the needs of an organization’s mission and, because account values fluctuate too, we must regularly compare the ratio of distributions to account values.

Without regular reviews and occasional resets of these calculations, the non-profits we care about may be unnecessarily starved of assets during a period in which they could prudently distribute more… or they may be unknowingly depleting reserves that would fund future distributions.

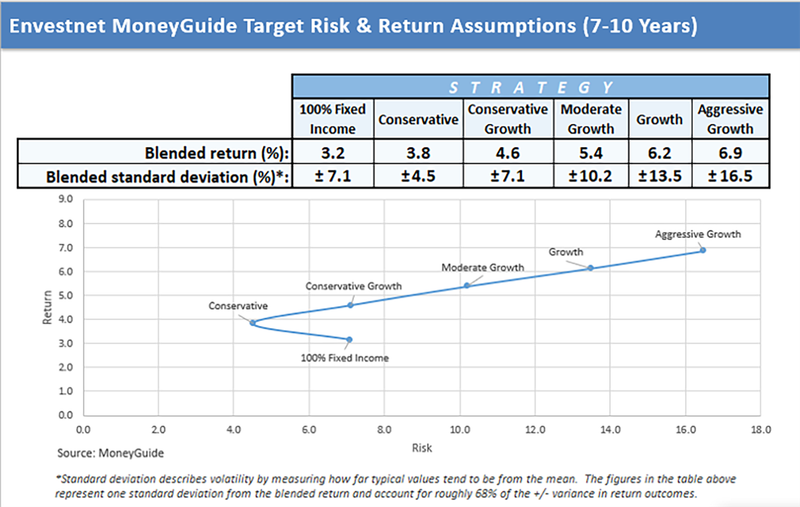

But, what is a reasonable and sustainable ratio? We first must have up-to-date capital market assumptions which include an anticipated inflation rate to net against estimates of return and standard deviation for each major asset class as well as correlations of each asset within the overall portfolio.

For example, a well-diversified $10 million portfolio invested for growth with a moderate level of risk may produce average returns of 5.4% over the next full market cycle of 7-10 years. From this return, subtract the estimated 2.25% average inflation rate for a sustainable distribution rate of 3.15% or $315,000.

Thankfully, relationships between account values and capital market assumptions are often negatively correlated. This means that when asset values have appreciated significantly, expectations for future returns are often much lower. This negative correlation can smooth prudent distribution rates.

For example, if the same $10 million portfolio declined in value by 20% to $8 million but assumptions for future returns rose to 6.5% and inflation remained at 2.25%, it would be just as prudent to distribute up to $340,000 a year or 4.25% of the portfolio. (6.5% return - 2.25% inflation = 4.25% x $8 million)

Another important factor in assessing a sustainable annual distribution amount is the level of annual fundraising. If the same $10 million portfolio receives $500,000 of contributions, these funds would increase the portfolio value by 5% and reduce turnover to fund distributions, allowing for longer term investing.

A way we've found effective in meeting the many needs of non-profits we serve, is to meet with their finance committee throughout the year splitting our focus to address both finance (budgeting, forecasting, and reviewing fundraising plans) and investment (portfolio construction and returns) concerns.

Kathleen McDermott heads up our advisory teams for non-profits and is a great resource to propose a schedule of focuses among meetings throughout the year. In our effort to help non-profits achieve and maintain sustainability, do not hesitate to contact her for help thinking through your own calendar.

Of course, we can also help you think through sustainable distribution rates based on current assumptions. You can read more about the broader scope of our work with non-profits by visiting the McKinley Carter website.