This was an emotionally charged election season, wasn’t it? Whether you are elated or depressed with the election results, now is an especially important time to make sure you are making investment decisions based on facts rather than emotions.

U.S. presidential elections can cause ripples, and even waves, in the stock market. Like any other event that produces market volatility, changing your investment strategy in response to the political news of the day or the market’s short- term ups and downs have shown to do more harm then good. Here’s a look at how elections impact the market and how

to stay invested for the long-term in spite of short-term volatility.

This was an emotionally charged election season, wasn’t it? Whether you are elated or depressed with the election results, now is an especially important time to make sure you are making investment decisions based on

facts rather than emotions.

U.S. presidential elections can cause ripples, and even waves, in the stock market. Like any other event that produces market volatility, changing your investment strategy in response to the political news of the day or the market’s short- term ups and downs have shown to do more harm then good. Here’s a look at how elections impact the market and how to stay invested for the long-term in spite of short-term volatility.

Generally speaking, elections and the resulting political makeup in Washington, D.C. do not affect the underlying trends shaping the stock market and the economy in the long term. These trends tend to continue across administrations after the White House changes hands.

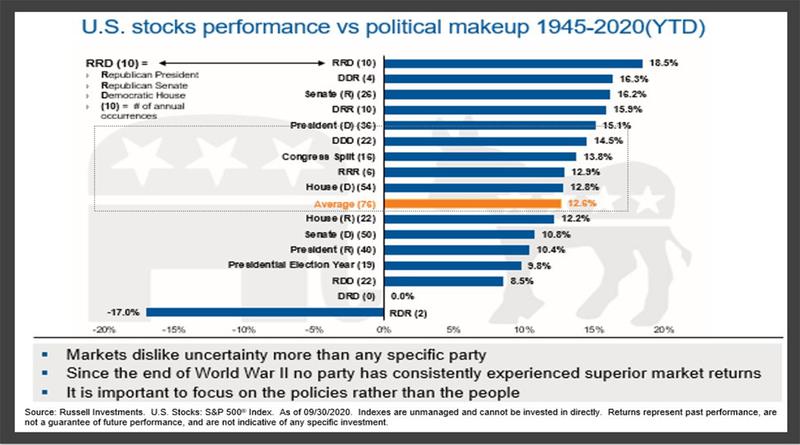

This chart breaks down stock performance under a variety of political power arrangements in Washington. Bullet point two makes the summary nicely — “Since the end of World War II no party has consistently experienced superior market return.”

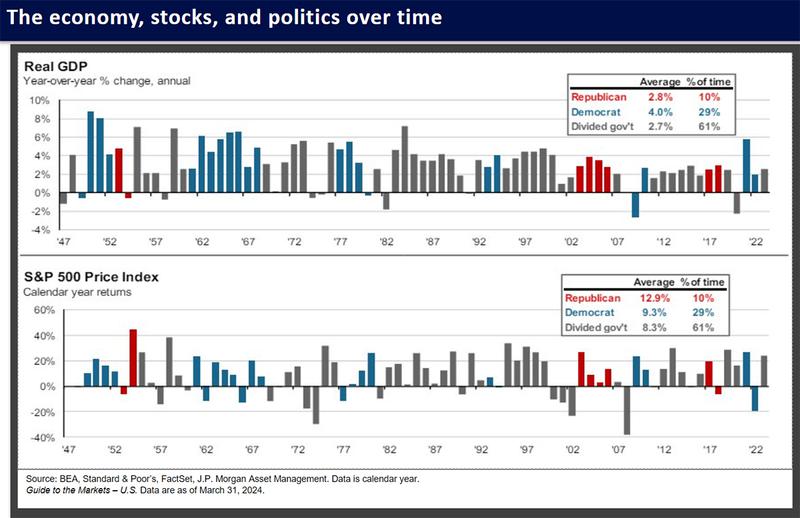

We know that new leadership in Washington can mean shifts in tax law, regulations, and spending priorities, all of which can affect businesses. But we have yet to see a scenario when the economy is radically re-engineered. This chart shows Real GDP (Gross Domestic Product, used to measure the general health of the economy) and the S&P 500 performance under different political leadership arrangements. It summarizes nicely that economic high and lows occur in every political scenario.

The bottom line is, whether your candidate wins or loses, whether you agree or disagree with what is happening in Washington, you can still reach your financial goals.

How?

- Build a long-term plan and stick to it. Long-term investment plans are built with your goals, time horizon, and risk tolerance in mind. The risk, including the volatility we see around election season, is managed through asset allocation and diversification.

- Focus on the big picture. Stock market downturns are a natural part of the market cycle; and even with these periods of poor performance, the market has historically produced positive returns over 15 year rolling periods. Sticking with your long-term plan helps you capture some of these gains.

- Avoid making emotional decisions. Humans are not always rational. Reacting emotionally to short-term market developments can have long-term consequences. To help manage your emotions, consider limiting how often you review your portfolio performance or reduce your intake of news that can sensationalize the economic impact of the election.

As we prepare for the transfer of power in January, remember that many variables can affect your portfolio in the short-term and politics is just one of them. We encourage you to stick to your long-term plan, focus on the big picture, and avoid emotional decision-making.