Note: This information is from 2020 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

From an early age, we learn the fundamental principles of gathering and accumulating. Yet, most individuals and families in the U.S. freely give away their assets to support others. Here's a deeper dive into who, how, and why people give, along with some commonly held philanthropy myths and who benefits from the generosity.

Society teaches us to prepare for our future by earning, saving, and investing. We learn the fundamental principles of gathering and accumulating from a young age. Yet, most individuals and families in the U.S. freely give away their assets to support others. In An Urge to Give we look at who, how, and why people give, some commonly held philanthropy myths, and who benefits from the generosity.

People Do Give

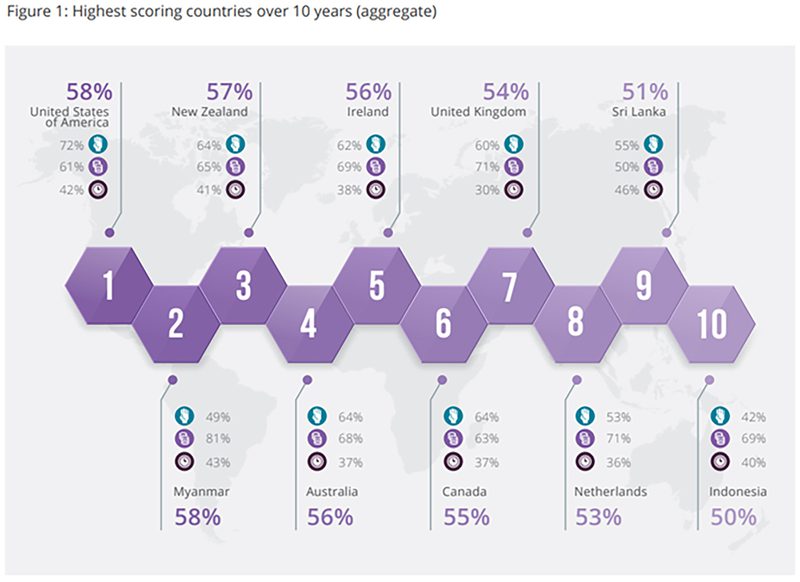

Of the 128 countries and more than 1.3 million people represented in the World Giving Index, the United States has been the most generous country over the past decade, but is generosity simply giving away money? In this most comprehensive study of giving, the index uses three criteria to measure key approaches to giving and tracks giving trends.

- Helping a Stranger

- Donating Money

- Volunteering Time

The CAF World Giving Index1

According to the Charities Aid Foundation (CAF), “There is no one trait that points to a country’s generosity. Top performing countries represent a wide range of geographies, religions, cultures and levels of wealth – what they all have in common is simply an inspiring willingness to give.2

From where does this willingness to give come? What makes one country embody generosity while another gives at a much lower rate, regardless of wealth?

Why Do People Give?

Historically, studies have cited motivations like cultural pressure, a

sense of community, belief in a cause, and simply being asked; but

recently, a study summarizing the responses of 819 Americans who had

previously given to charities highlighted five key motivations and one

common barrier. From most important to least important they identified

altruism, trust, social, egoism, and taxes while financial constraints

remain as the largest factor that drives reluctance.3

| Key Motivation | |

|---|---|

| Altruism | An urge and genuine concern for others in need. |

| Trust | Donors are more likely to give and volunteer with organizations they trust are making a difference and are excellent stewards of their resources. |

| Social | People give to causes they, a family member, or friend have been impacted by personally. |

| Egoism | A lower motivation but still relevant is when a donor perceives a personal benefit such as feeling good or looking good to others. |

| Taxes | The tax benefits of giving are a major factor for many people. |

While the key motivations of charitable intent are neatly packaged in the research, I suspect the Urge to Give is a complex blend of these motivations along with other unstated influences.

Focusing on just one of these key motivations is unlikely to incite any action. Organizations really need to connect with at least two of these key motivations to induce donors to act.

Missy Gale, CFRE, President & CEO of M. Gale & Associates reminds us, “The size of a major gift is qualified differently from one nonprofit to the next…a major gift is one that requires a personal ask. To make a personal request of someone, you need to have a relationship with them."4

While the research shows that people are giving and gives us some insight as to why, we still hold many outdated beliefs about altruism. Donors and recipients alike are stricken by such faulty beliefs, and generosity is deeply and negatively impacted.

Myths of Philanthropy

Charitable organizations, and therefore donors, are hindered by long-held myths about philanthropy that need to be eradicated. The cumulative effect of holding these misconceptions negatively impacts resources and mission achievement while standing in direct opposition to the key motivations discussed in the previous section. Wealth Management recently published the article “Ten Entrenched Myths About Philanthropy”5. They identified the following myths:

- Religious giving is declining

- Women are less philanthropic than men

- Immigrants take rather than give

- African Americans are just now emerging as donors

- Small gifts don’t matter

- Endowments tie up cash

- People give for solely altruistic reasons

- Great wealth is needed

- High administrative costs are a negative

- Executives should get low pay

The misguided support for any of these ten myths is a much broader narrative than we will uncover here. However, if you are a donor, non-profit executive, or board member, you need to be aware of how detrimental they can be and be prepared to educate those around you. The consequence of ignoring the research or allowing dangerous myths to pervade your organization can be dire.

One myth that could be included in the list above is the idea that young people do not give. The events of 2020 may trigger a shift in giving behaviors across the generations. Creating a strong connection with the 15-29 age group right now is sure to create current donors and build the foundation of future major givers

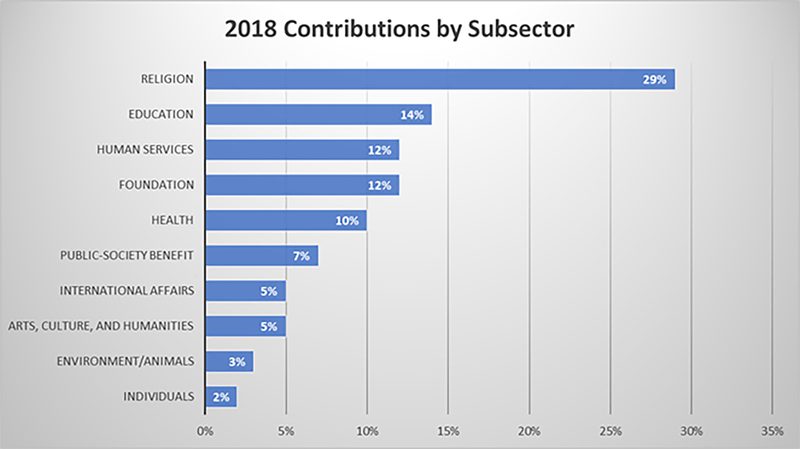

Who Benefits from the Urge to Give?

In the United States, our generosity spans a broad spectrum of causes. The Giving USA Foundation identifies many types of charitable subsectors. Some of the largest recipients of the giving urge are:

- Religious Charities

- Education

- Human Services

- Health Organizations

- Public-Society Benefit Organizations

- Organizations that promote the Arts, Humanities, and Culture

- Environmental and Animal Welfare Organizations

The Giving USA 2019 Infographic (https://store.givingusa.org/)

Can We Afford to Give considering the Impact of 2020?

While many individuals, families, and organizations are motivated to give, they wonder about their ability to financially support the special organizations in their lives. A trusted financial advisor with an understanding of the rules, benefits, and strategies can be critical to accomplishing your philanthropic desires in a way that has the most meaningful impact for the charities you care about.

Our wealth management team of advisors is frequently asked to work a client’s ambition to give into their multi-year financial model. This allows our advisors to concretely illustrate the possibilities and the positive or negative impact on their own financial autonomy. Families of all levels of financial means have taken this insight to act confidently in their giving.

While the physical, psychological, and economic toll of 2020 is yet to be fully understood, we all acknowledge the impact is severe. We have observed a heightened sensitivity to the needs of others and those organizations that are attempting to meet mounting demands with constrained resources. From Donors to Board Members to Non-profit Staff/Leadership we all seem to be seeking ways to positively impact our community, country, and society-at-large.

In spite of COVID-19 and its devastating impact on the world, we want to join in the countless measures that have been undertaken by governments, public enterprises, community organizations, and individuals to direct resources to those greatest in need. We want you, and all the others that we serve, to thrive and transform the lives and communities where we work.

To find out more about the Urge to Give, how donors are turning their key motivations into impactful action, or how your organization can position itself most effectively, we invite you to visit www.mckinleycarter.com. Our team of fiduciary advisors work each day to make a difference for our clients and community.

In fact, we have a service dedicated to meeting the needs and challenges of the non-profit community. Learn more.

To continue the conversation or go deeper on any topic, I can be reached directly at (724) 719-3251 or bgongaware@mc-ws.com.

Resources:

Footnotes:

1https://www.cafonline.org/docs..., page 7

2 https://www.cafonline.org/docs..., page 5

3https://www.psychologytoday.co...

4https://givingusa.org/raising-...

5https://www.wealthmanagement.c...