Note: This information is from 2021 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

Have you received a significant financial gift or inheritance but don't know how to spend it wisely? Consider these three steps to help you make the best decision for your unique financial situation.

My Mom recently mailed my brothers and I a surprise. No matter how I probed and pleaded, she would not tell us what she was sending, but I could tell she was excited for us to receive it. As I waited for my package to arrive, the range of my imagination was extreme — Did she and Dad plan a family trip to Paris…or did she knit me some new socks? I had no idea what it could be!

When I finally received Mom’s surprise, it was so wonderful to see it fall toward the “Paris” end of my imagination. She had sent me a check — a generous gift from my grandparent’s estate.

This wasn’t a change-my-life sort of inheritance, but it was substantial enough that I wanted to make sure I thoughtfully considered how to use it. Of course, the CERTIFIED FINANCIAL PLANNER™ side of me knew the long-term benefits of investing it for my family's future, but I also wanted to indulge my fun-loving side and could not help but envision a dreamy Parisian holiday.

And, in between those two options, lay several other practical uses that also made sense, such as putting it toward a new vehicle purchase, or paying off the new HVAC system we unexpectedly had to have installed, or even just contributing it to our savings account and using it for the next project on our home improvement list.

With so many options, how could I choose what was right for me and my family? In our office we sometimes use a twist on the old adage “Physician, heal thyself;” we encourage each other with “Planner, plan for thyself.” So, I relied on my financial planning skills and sorted through the possibilities to land on a plan that worked best for my situation.

Here are my three steps for making better decisions about financial gifts and inheritances:

Step #1: Make a list of every way you would like to use this money. In my case, the list turned out as follows:

- Long-term savings goals

- Roth IRA contributions

- Kids' college savings accounts (529s) contributions

- Roth IRA contributions

- House projects

- New HVAC

- Replace siding

- New furniture

- Porch update

- Vehicle down payment

- Vacation/Travel

Step #2: Prioritize the items on your list. Make sure you are clear on your financial goals so you can rank your items in order of importance to your situation. Here’s a peek at my thought process:

- Long-term Savings: Taking advantage of every opportunity to save for retirement is high on our list. Ensuring our kids attend college is also an important goal and the time we have to save for this feels like it is flying by. PRIORITY: High

- House Projects: Between savings and regular household cashflow, we already have an expenditure plan for the new siding, furniture, and porch renovation projects, so we will not use any of the inheritance toward those expenses. However, the HVAC replacement was a major, unexpected expense. Applying a portion of the inheritance toward the HVAC system makes sense because it allows us to pay off the remaining amount owed from our household emergency fund while keeping the emergency fund balance at a comfortable level. PRIORITY: Medium

- Vehicle Purchase: A new car is something that must happen within the next few weeks. We have some money saved toward the purchase but are expecting to finance most of it. It would be great to increase the down-payment as we prefer to keep our debt as low as possible. Priority: Medium-High (the immediacy of this need bumped its priority up)

- Vacation/Travel: Someday I’ll enjoy that trip to Paris, but right now these other goals are more important. That said, using some of this money for a fun summer vacation with my family feels like a nice homage to my grandmother, who got a lot of joy out of traveling and spending time with her family. Priority: Low

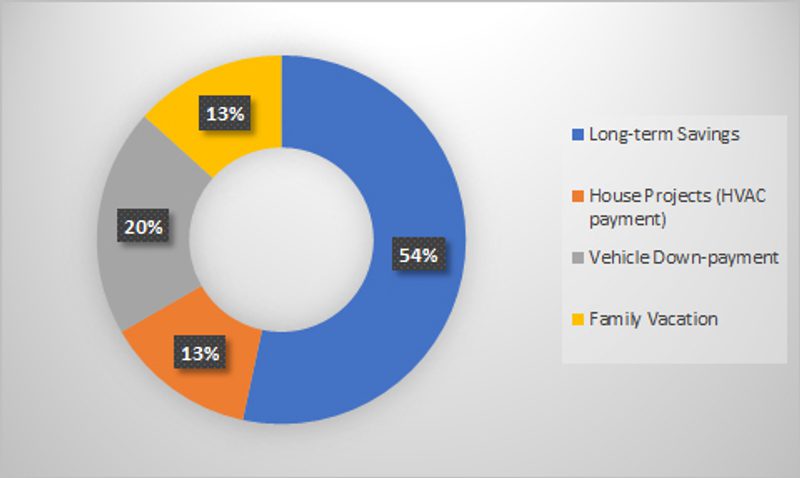

Step #3: Determine how to apply your inheritance gift to your goals based on your priorities. Here's my final plan:

- Long-term Savings – 53.3% (40% toward retirement, 13.3% toward 529s)

- House projects – 13.3% (all toward HVAC payment)

- Vehicle Downpayment – 20%

- Family vacation – 13.3%

This allocation felt like a good representation of our priorities as a household. Long-term goals receive the highest dollar amount to put the full weight of compounding growth to work for our family’s future. Short-term goals (home renovation projects and vehicle purchase) receive the next highest percentage to reinforce our focus on maintaining low household debt. And lastly, a small percentage is allocated to special family experiences.

No matter what the amount of your inheritance or financial gift, applying these three steps will allow you to build a plan you can feel confident about. We firmly believe living a "good life" is living a good life now and in the future.

Perhaps you would like some help working through this process with a knowledgeable advisor. Or perhaps you received a gift or inheritance that is substantial enough to change your life! In either scenario, please give us a call. Our advisors are well versed in helping people maneuver through these complex life situations; we are here to help you Master Your Wealth.