It’s not surprising that as financial planners, we often find our clients experience many changes throughout the course of our working relationship. Sometimes these are motivated by choice, and sometimes just by chance. In many of these instances, when life changes, money changes; so it’s important for financial planners to help clients navigate these events with confidence, ensuring long-term security for themselves and their families while helping them maintain and achieve their goals.

A ‘Real Life’ Situation

- Husband is diagnosed with a serious medical condition requiring major surgery and an extended recovery period.

- Wife decides to reduce her workload to focus on caring for her husband, her personal health, and spending more time with family.

- Wife receives a substantial inheritance and is not experienced in these matters. As the only beneficiary, the estate settlement is adding to her anxiety.

- The couple wants to consider estate planning and legacy given their current situation.

Our Approach

After conducting a comprehensive financial analysis, we identified the following strategies for immediate attention due to the life transition events that were unfolding:

Current & Short Term

- Increase their cash reserves liquidity to ensure enough liquidity for medical bills and potential loss of income during recovery.

- Segment a bucket of money for some unexpected future healthcare costs in case disability or long-term healthcare insurance options aren't applicable.

- Strengthen the wife's life and disability insurance to bring additional protection to the family's cash flow.

- Reallocate some investments to create a more consistent income stream from dividends and interest.

Inheritance Management & Investment Strategy

- Incorporate the required retirement distributions into their lower expected work income and use some for charitable giving purposes to reduce their tax burden.

- Reallocate portions of the inheritance into tax-advantaged vehicles.

- Minimize capital gains taxes of their non-inherited assets by holding onto appreciated assets longer.

- Direct investments from the inheritance into tax-efficient municipal bonds to provide stable cash flow.

- Direct remaining inheritance investments into private equity, alternative investments, and a balanced risk portfolio that is aligned with long-term growth objectives.

Estate Planning & Legacy Strategy

- With estate planning counsel, create revocable living trusts to avoid probate and ensure efficient wealth transfer to the children.

- Establish Donor Advised Funds (DAFs) to direct charitable donations and provide immediate tax deductions.

- With legal counsel, create LLCs to hold gifted assets as a wealth transfer strategy.

Retirement & Long-Term Financial Security Strategy

- Optimize withdrawal strategies from tax-deferred and taxable accounts to maximize post-retirement income.

- Utilize health savings accounts (HSAs).

- Balance risk and return in retirement portfolios to reduce exposure to market volatility as they near retirement.

- Commit to reviews to see how new life transitions may impact the financial plan.

Life Transition Results

- Health and Career Flexibility: After the husband's recovery, he was able to reduce his workload without significant financial strain due to the implementation of cash reserves and insurance coverage.

- Financial Stability: The inheritance was successfully integrated into their financial plan allowing for tax-efficient growth from the investments while securing long-term income.

- Legacy Plan: A sustainable wealth transfer plan was created that would minimize estate taxes, maximize the impact of their charitable contributions, and set the children up with an efficient way to transfer money to them while learning how to manage wealth.

- Retirement Readiness: The financial planning gave them the confidence to know they are on track to retire comfortably in their early 60s, with a clear strategy in place to sustain their lifestyle, provide for their children, and contribute to causes they care about.

Beyond Invested

Helping you achieve your goals with clarity and purpose.

At McKinley Carter, your wealth is more than just numbers on a balance sheet. We understand the complexities that come with significant assets and are dedicated to empowering you to achieve your financial goals and aspirations.

Our team of seasoned advisors provides specialized expertise and a highly personalized approach to wealth management. We uphold the highest fiduciary standards of integrity and care, ensuring your financial well-being is always our top priority.

How Can We Help You Hit Your Goals?

Here is a video about stuff from Vimeo

Lorem ipsum dolor sit amet consectetur. Lectus praesent sagittis laoreet nec et blandit. Platea orci turpis tempus arcu interdum eget in habitant. Id pellentesque pharetra neque venenatis quis vel volutpat euismod fermentum. Et mauris viverra lectus ultricies vitae proin ut

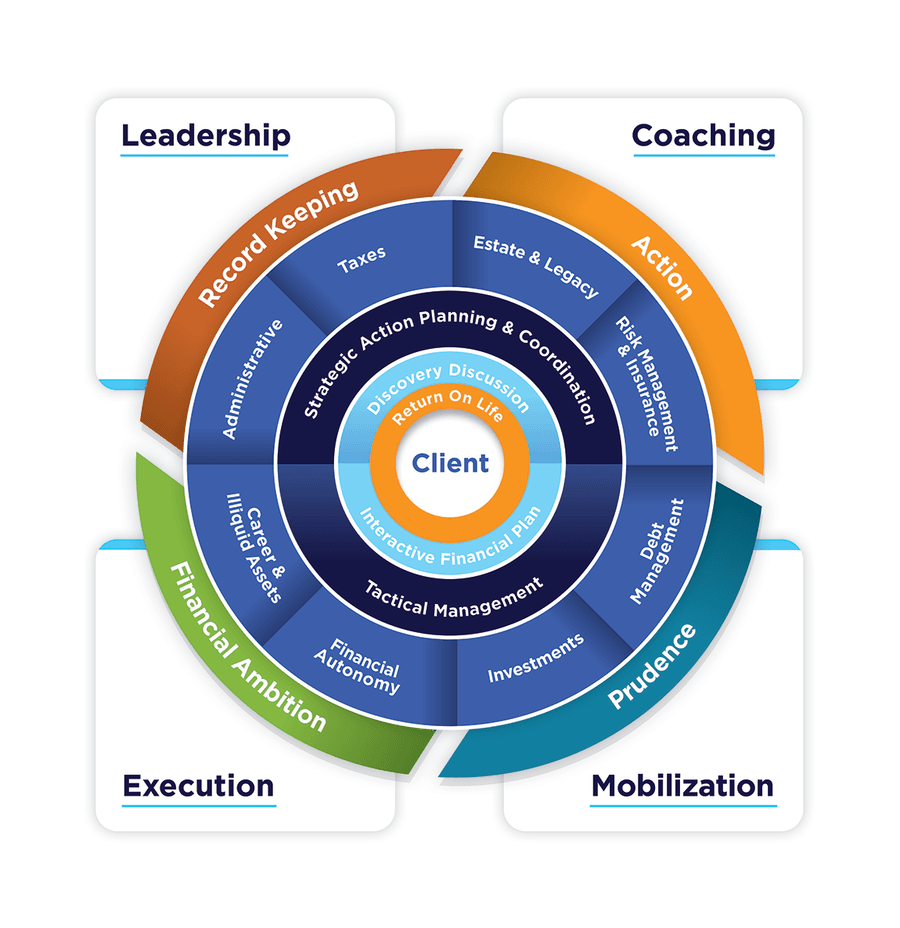

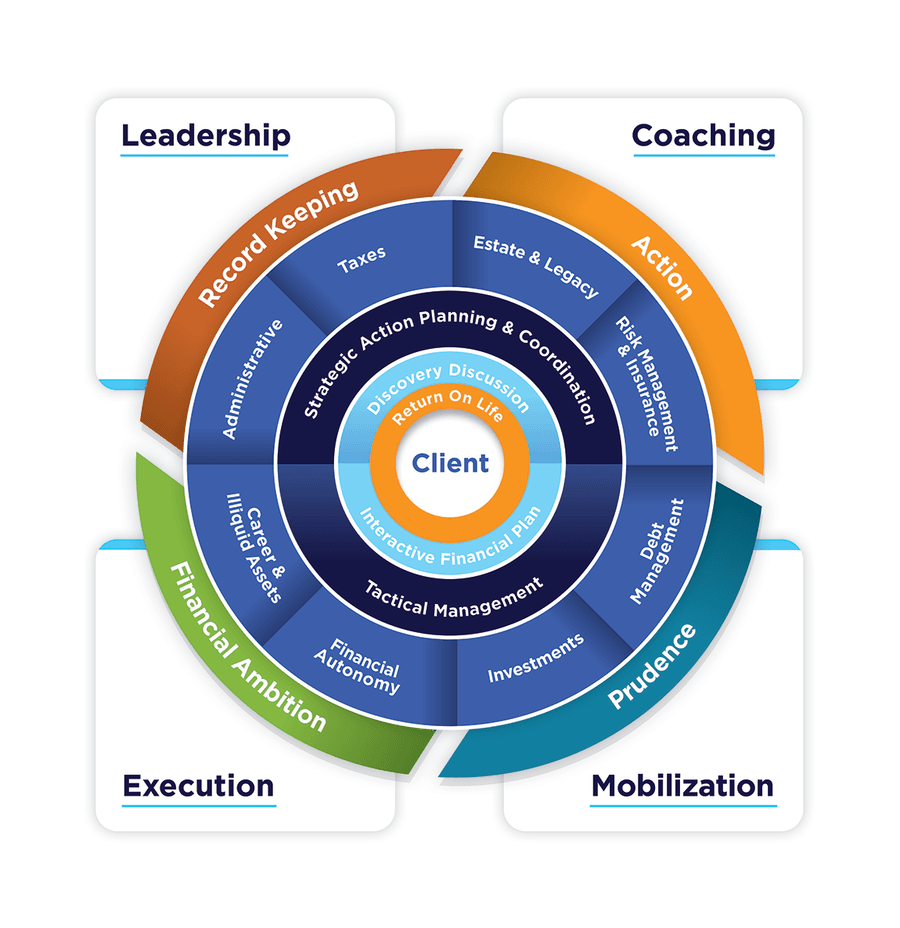

How We Work With You

Lorem ipsum dolor sit amet consectetu

-

1

Understand Your Unique Goals

What keeps you up at night? What gets you out of bed in the morning? By diving into your hopes and dreams—along with your fears and challenges—we’ll determine something much more important than financial goals: life goals.

-

2

Achieve Competitive Performance While Managing Risk

he real risk you face isn’t market volatility or short-term fluctuations in your portfolio. It’s not accomplishing your life goals. We’ll work with you to create holistic, goal-based strategies—and measure performance by ach

-

3

Adjust Along the Way

Will your life goals change? Probably. We’ll revisit your goals regularly to confirm what’s most important to you and what may have changed over time, adjusting your portfolio—and risk tolerance—accordingly

-

4

Sharpen Your Financial Instincts

not just tangible assets that shape a person’s worth. We strengthen your financial instincts along with your wealth—so you can stay in control of your financial life and be confident in making even the big decisions yoursel

Beyond Invested

Sharpen Your Financial Instincts

not just tangible assets that shape a person’s worth. We strengthen your financial instincts along with your wealth—so you can stay in control of your financial life and be confident in making even the big decisions yoursel