Note: This information is from 2021 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

The first quarter of 2021 was marked by several macro- and micro-economic surprises that resulted in increased market volatility compared to the fourth quarter of 2020, but additional economic stimulus combined with accelerating COVID-19 vaccine distribution and a decline in coronavirus cases helped stocks start the new year with solid gains. Take a look back with us at the first quarter of 2021. Review what actions we took on client portfolios as market dynamics changed. And learn what we expect for this year in our 2021 economic outlook.

Part 1: Looking back at the first quarter of 2021

Part 2: What actions did we take in McKinley Carter portfolios in Q1?

Part 3: A look ahead - Our outlook for remainder of 2021

Looking back at the first quarter of 2021

The first quarter of 2021 was marked by several macro- and micro-economic surprises that resulted in increased market volatility compared to the fourth quarter of 2020, but additional economic stimulus combined with accelerating COVID-19 vaccine distribution and a decline in coronavirus cases helped stocks start the new year with solid gains.

The first surprise of 2021 came on January 5th when both Democratic candidates won Georgia Senate seats in the runoff election, giving the Democratic party a majority in the Senate and control of Congress and the presidency. The very next day, during confirmation of the November 2020 presidential election results, protestors stormed the U.S. Capitol, causing a temporary delay to the election certification and marking a historically tragic day in the U.S. democratic process. But after that short delay, Joe Biden was certified as the winner of the 2020 election and became president-elect. Both the surprise election results and the incident at the Capitol caused a volatile start to the new year.

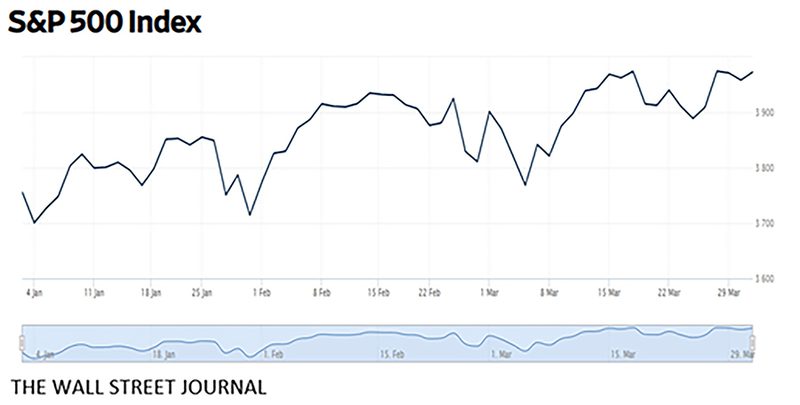

In late January, after two weeks of relative calm, market volatility returned, this time driven by a historic short squeeze in videogame retailer GameStop (GME). A short squeeze occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall, to buy it in order to prevent even greater losses. The disorderly trading in GameStop and select other stocks caused broader market volatility, primarily due to fears of losses inflicted on large hedge funds because of the various short squeezes. Those factors combined to pressure stocks and the S&P 500 finished January with a modest loss.

But concerns of widespread losses due to GameStop trading ultimately proved unfounded, and the volatility linked to the GameStop saga dissipated in early February. And as trading returned to normal, investors began to focus on macro-economic positives. First, the Democratic controlled government immediately began steps to pass another massive economic stimulus bill, and that helped stocks rally in early February. Second, vaccine distribution throughout the U.S. meaningfully accelerated in February. That increased distribution combined with the authorization of a single-dose Johnson & Johnson COVID-19 vaccine helped investors embrace the idea that the end of the pandemic was now possibly just months away, and that sentiment helped stocks rally further. Finally, COVID-19 cases began to decline rapidly in the U.S., leading to economic reopenings in several states. The S&P 500 recouped all of January’s losses and ended February slightly positive for the year.

Markets continued to rally in early March as investors began to price in a looming economic recovery following the passage of the massive $1.9 trillion economic stimulus bill, which President Biden signed on March 11th. That new stimulus, combined with COVID-19 vaccine distribution reaching 2.5 million doses/day, resulted in growing expectations for a full economic reopening and recovery in the coming months. But expectations for an acceleration in economic growth also pushed Treasury yields higher during the month of March. The 10-year Treasury yield surged to fresh one-year highs and the rapid rise in bond yields weighed on stocks periodically throughout March, as higher borrowing costs could become a future headwind on economic growth. But while the risk of higher bond yields must be monitored going forward, it was not enough to offset historic economic stimulus and improved pandemic data, and stocks drifted higher to finish the quarter with solid gains.

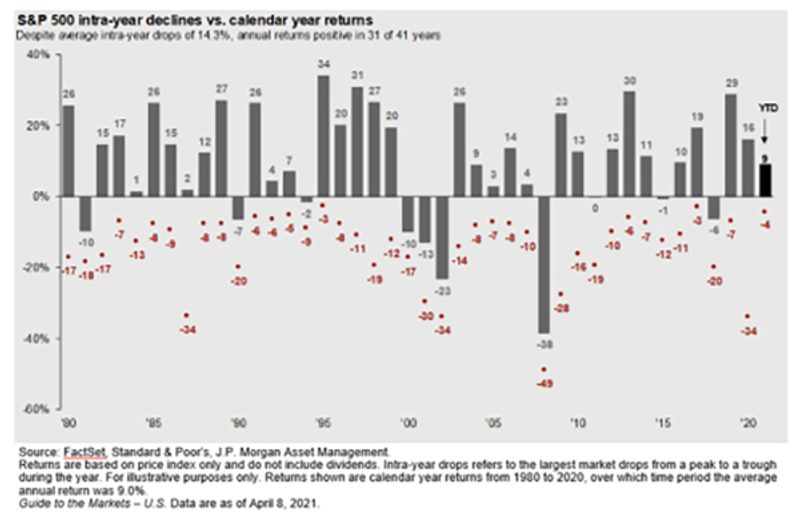

The first quarter of 2021 at times reminded investors of the volatility and unpredictable nature of markets that we all witnessed in 2020; however, just as markets proved resilient last year, stocks overcame multiple surprises during the first quarter to provide another positive quarterly return.

1st Quarter Performance Review

Expectations of a post-COVID-19 economic recovery drove market performance in the first quarter, as the Dow Jones Industrial Average outperformed both the S&P 500 and the Nasdaq 100 due to the underperformance of technology shares. Domestic stocks, apart from the Nasdaq 100, outperformed international stocks. Commodity prices, excluding gold, rose sharply in the quarter due to rising inflation expectations. High yield bonds, whose performance is closely tied to stocks, offered the only positive return among the major bond indexes.

By market capitalization, small-cap stocks, which are historically more sensitive to changes in economic growth, outperformed large-cap stocks as COVID-19 cases declined and numerous states partially or fully reopened their economies, leading investors to expect a broad acceleration in future economic activity.

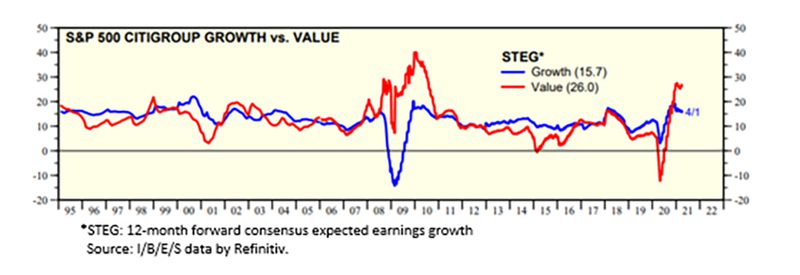

From an investment style standpoint, value handily outperformed growth for a second consecutive quarter. The substantial outperformance by value stocks once again underscored increasing investor optimism for an economic rebound in the coming months.

| U.S. Equity Indexes | Q1 Return |

|---|---|

| S&P 500 | 6.17% |

| DJ Industrial Average | 8.29% |

| Nasdaq 100 | 1.76% |

| S&P MidCap 400 | 13.47% |

| S&P 600 Small Cap | 18.24% |

Source: YCharts

| International Equity Indexes | Q1 Return |

|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 3.60% |

| MSCI EM TR USD (Emerging Markets) | 2.34% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 3.60% |

Source: YCharts

| Commodity Indexes | Q1 Return |

|---|---|

| S&P GSCI (Broad-Based Commodities) | 13.55% |

| WTI Crude Oil | 22.54% |

| Gold Price | -9.77% |

Source: YCharts/Koyfin.com

| US Bond Indexes | Q1 Return |

|---|---|

| BBgBarc US Agg Bond | -3.37% |

| BBgBarc US T-Bill 1-3 Month | 0.02% |

| ICE US T-Bond 7-10 Year | -5.81% |

| BBgBarc US MBS (Mortgage-backed) | -1.10% |

| BBgBarc Municipal | -0.35% |

| BBgBarc US Corporate Invest Grade | -4.65% |

| BBgBarc US Corporate High Yield | 0.85% |

Source: YCharts

What actions did we take in McKinley Carter portfolios in Q1?

In order to reposition accounts to take advantage of the changing market dynamics (global economic expansion and the associated rise in interest rates), we recently made the following portfolio changes:

Changes in March:

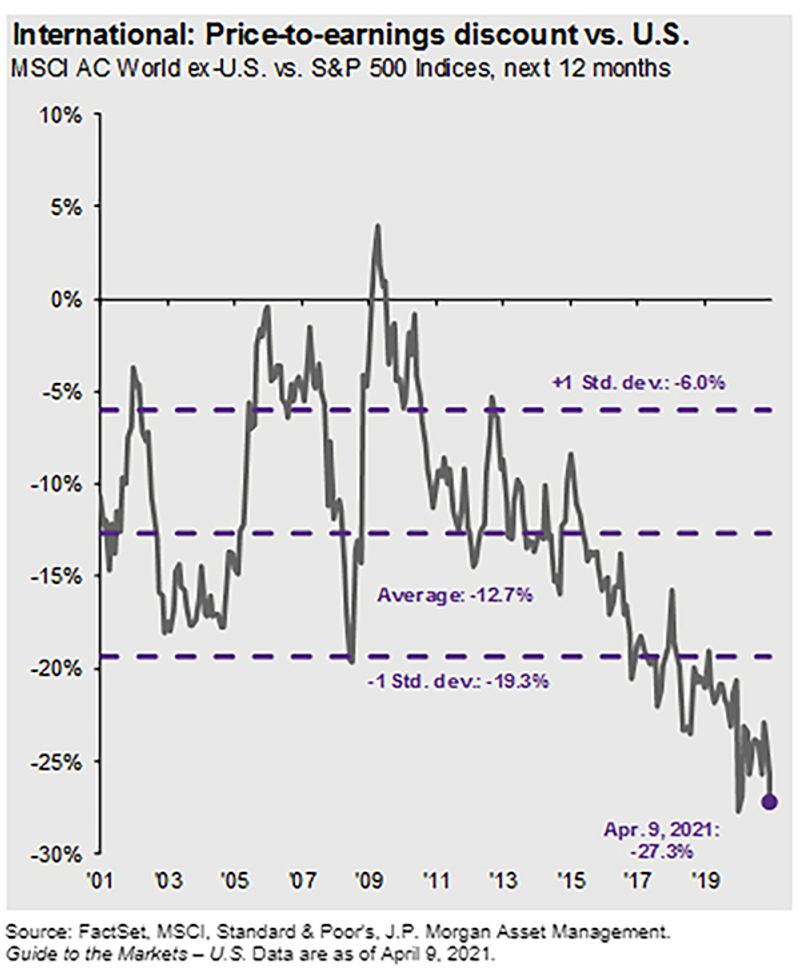

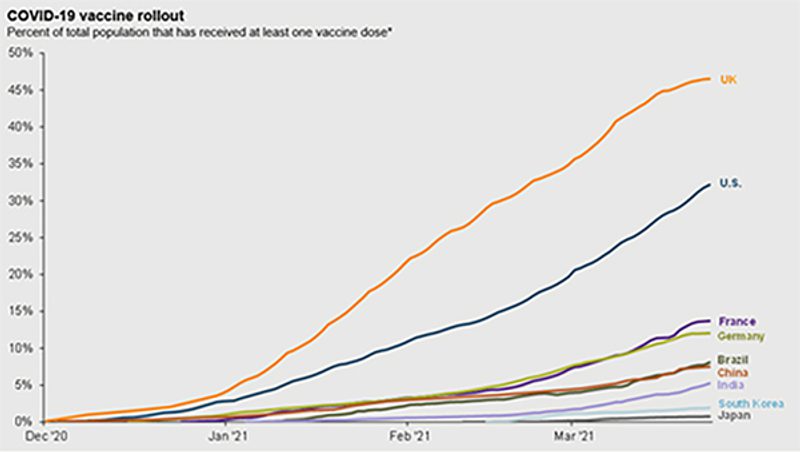

1. Due to less expensive valuations and superior growth prospects for international markets, the Strategy Committee increased international equity exposure from 32% to 38% as well as targeted a 35% emerging markets weighting within the international sleeve. While some developed markets in Europe (such as France and Germany) are lagging the U.S. in their vaccine rollouts, the Strategy Committee feels that European economies will strengthen, and earnings will follow as the year progresses and vaccinations are more prevalent.

- In ActiveTrack accounts, we accomplished this increased international stock exposure primarily through the elimination of the iShares MSCI USA Quality Factor ETF (QUAL) and the purchase of the iShares Core MSCI Emerging Markets ETF (IEMG) to supplement our existing position in the growth stock-oriented JPMorgan Emerging Markets Equity Fund (JEMSX). In Earnings Focus accounts, we eliminated three underperforming stocks to fund the additional international equity exposure.

- Emerging markets in Asia have rebounded from the effects of COVID-19 more quickly than developed markets and have compelling demographic trends (expanding middle class). To make room for additional exposure to the emerging markets allocation and to add more economically sensitive stocks, we eliminated our position in the MFS International Growth Fund (MQGIX).

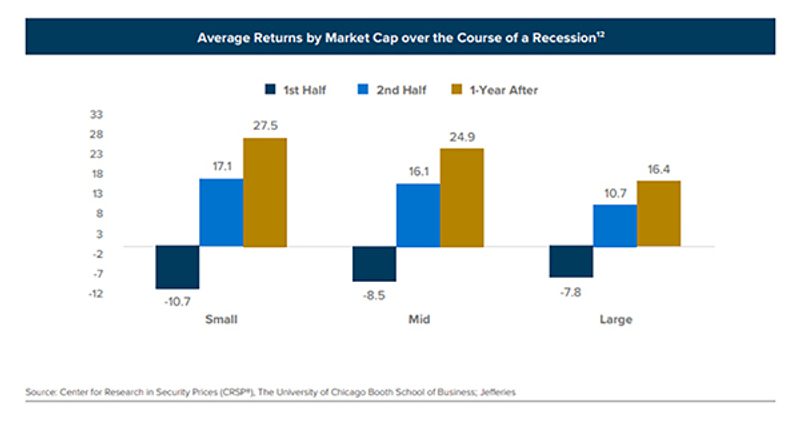

2. With an expected strong economic recovery this year, the Committee increased our portfolio weighting to smaller cap stocks. Small cap stocks tend to outperform large cap stocks in the period immediately following recessions. In ActiveTrack accounts, the removal of large cap funds QUAL and MQGIX from our portfolio along with an increase in our existing position in the iShares Russell 2000 Value ETF (IWN) allowed us to accomplish that goal.

3. Additionally, the Committee decreased our overweight in growth stocks (from 59% to 52%) in our ActiveTrack accounts by the removal of QUAL and MQGIX. As the markets are responding to economic expansion by moving to more economically sensitive stocks with higher near-term growth rates, the higher quality stocks found in QUAL are expected to underperform. Adding to our existing positions in the iShares S&P 500 Value ETF (IVE) and the iShares Russell 2000 Value ETF (IWN) achieved that target goal. In Earnings Focus accounts, we replaced the iShares Russell Mid-Cap Growth ETF (IWP) with an additional allocation of the iShares Core S&P Small-Cap ETF (IJR).

Recent Changes in April:

1. In all programs and strategies except for MarketTrack, the Strategy Committee elected to reduce interest rate risk in our fixed income portfolios by eliminating the iShares U.S. Treasury Bond ETF – GOVT (pure Treasury bond exposure with a greater than target duration). GOVT’s duration (price sensitivity to interest rates) is 7% vs. the Committee’s target of 5.75%. The proceeds from the sale of GOVT will be allocated to our BlackRock-managed core bond fund, MAHQX.

- With the Committee’s expectation of expanding GDP growth in 2021 and 2022, a greater allocation to MAHQX is warranted to better exploit ongoing tactical opportunities in the fixed income market. BlackRock’s worldwide credit expertise allows for a more global approach to bond investing than U.S.-centric investing only.

A look ahead - Our outlook for remainder of 2021

As we begin the second quarter, the outlook for markets remains broadly positive. Monies from the recently passed stimulus bill are now entering the economy on a personal, corporate and government level, and those funds should help to spur economic growth in the months ahead.

Additionally, while the short-term COVID-19 outlook has recently dimmed in Europe, the outlook for the U.S. remains generally positive. Vaccine distribution continues to accelerate, with the goal of having vaccines available to all adults nationwide by May. As a result, it is not unreasonable to think the pandemic will be declared “over” by the early summer (although COVID-19 inflections will likely continue, just not at a pandemic level that requires a large-scale government response).

Meanwhile, the outlook for the economic recovery remains bright, with improvement across multiple economic indicators, while the Federal Reserve has pledged numerous times in recent months to continue to keep interest rates low and its quantitative easing (QE) program ongoing until the economy returns to pre-COVID activity levels.

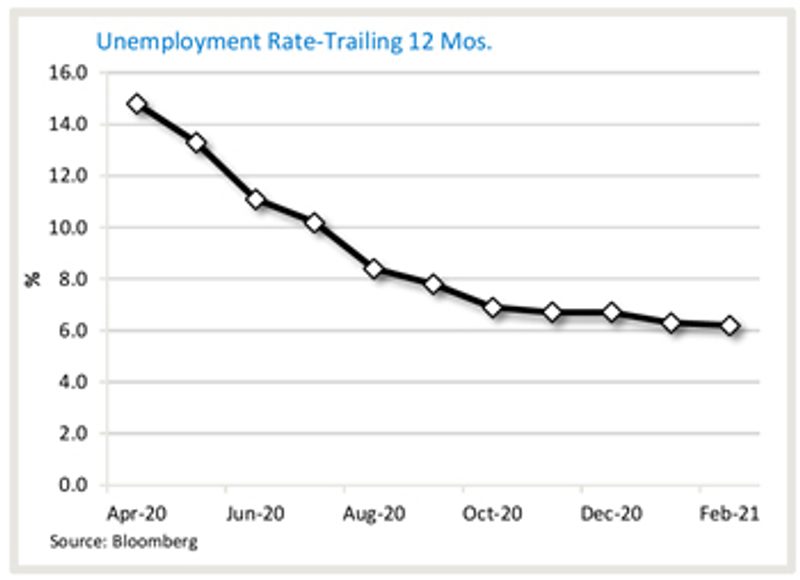

On April 2, the Bureau of Labor Statistics released the March 2021 employment data, and payrolls increased a staggering 916,000 for the month, easily beating the consensus expected 660,000. The unemployment rate fell to 6.0%, the lowest level since the pandemic began.

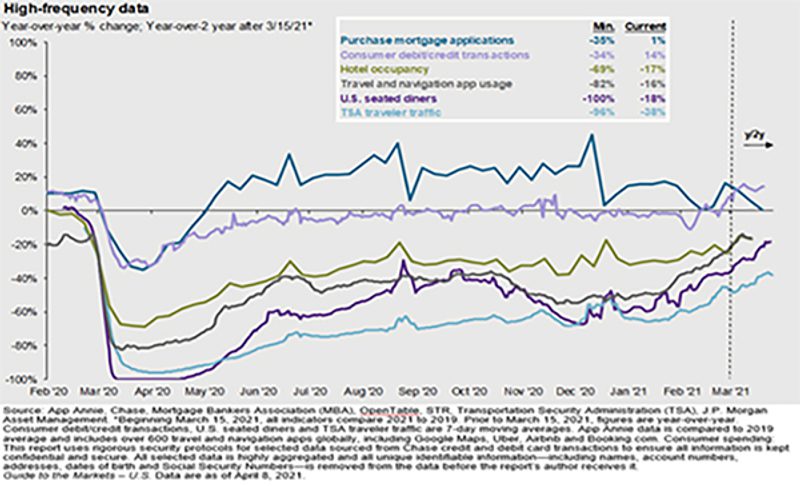

Despite the surge in jobs in March, total payrolls are still 8.4 million short of where they peaked pre-COVID, with the leisure & hospitality sector accounting for 3.1 million of that deficit. Most of those gaps will likely be closed by the end of this year as federal stimulus programs supplement the recovery. Even as the economy is behind pre-pandemic levels, “high frequency” (recent) data points indicate a sharp recovery in consumer transactions, travel, and restaurant activity.

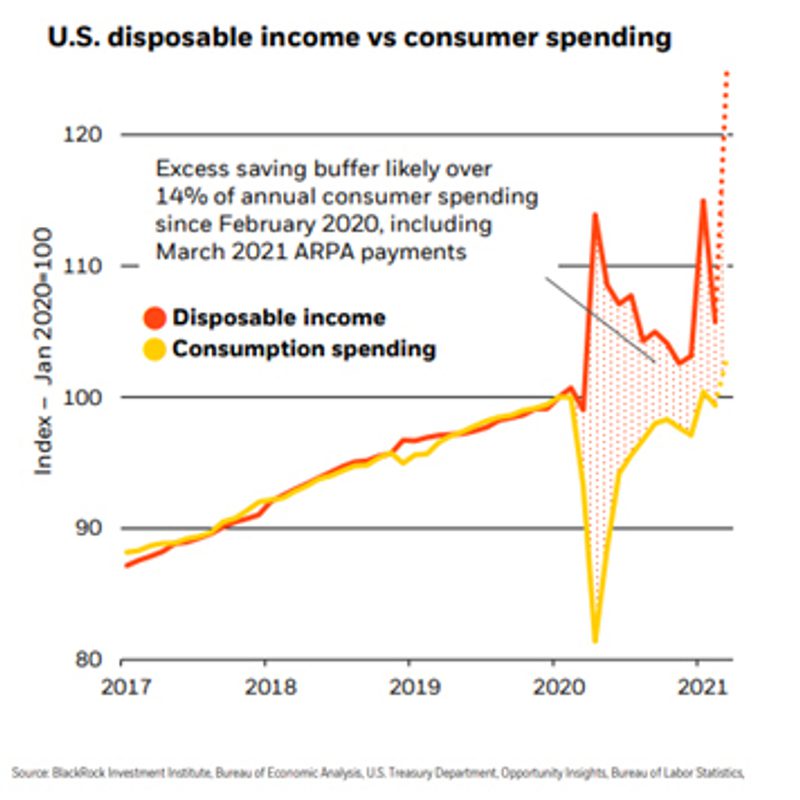

During the pandemic, consumers have been aggressively adding to savings, and with states reopening and stimulus checks having been distributed, the economy should benefit from pent-up demand for goods and services.

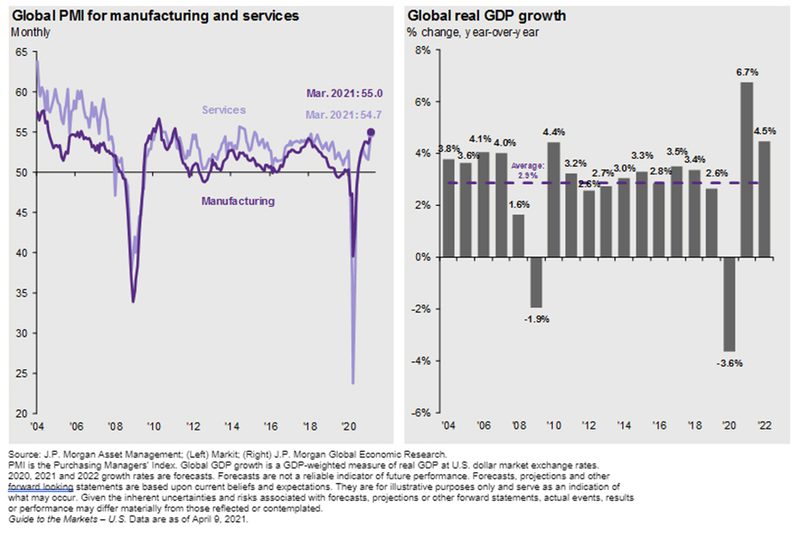

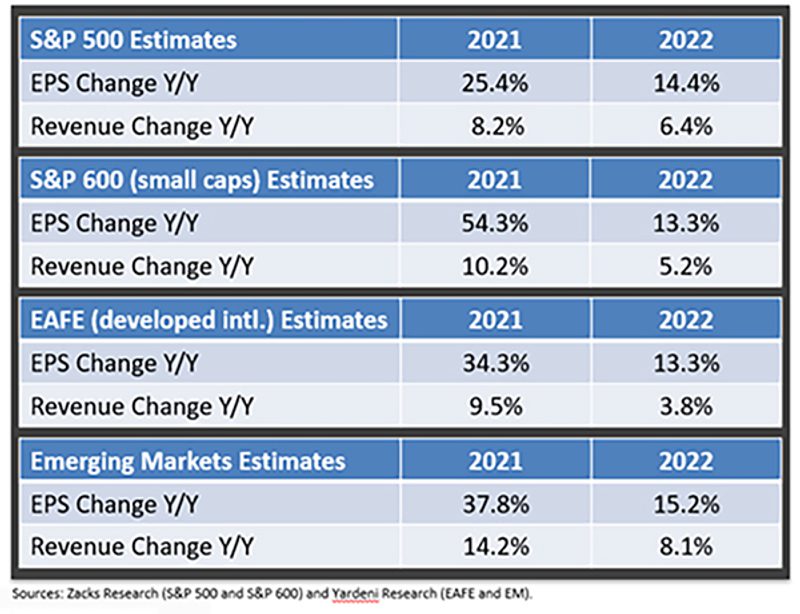

Additionally, a global recovery in manufacturing and services should provide a positive backdrop for global GDP growth over the next two years. Earnings projections continue to rise with momentum expected to continue through 2022.

These factors all provide substantial support for markets as we begin the second quarter.

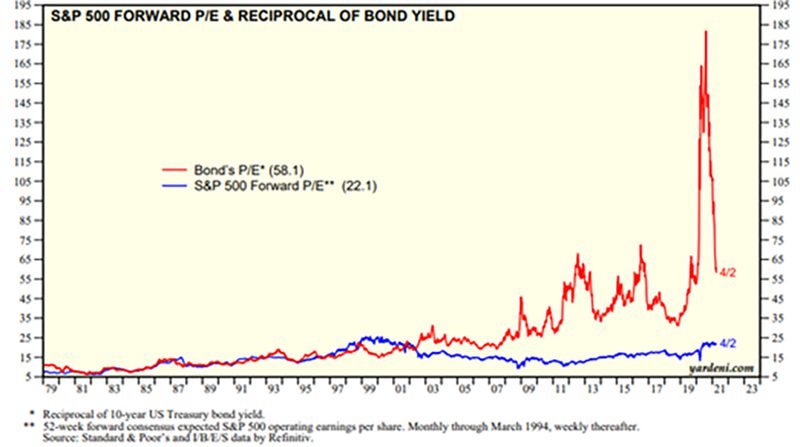

But as the first quarter clearly demonstrated, there are always risks that need to be monitored. First, rising bond yields caused volatility in late February and throughout March, and if the pace of the rise in bond yields accelerates, we can expect more stock and bond market volatility as high interest rates may pose a threat to the economic recovery. While increasing interest rates and elevated stock market valuations may eventually lead to a pullback in the equity markets, current bond yields are still not a serious competitive threat to stock prices as bond “price-to-earnings (PE) ratios” are still quite high relative to stocks’ PE ratios.

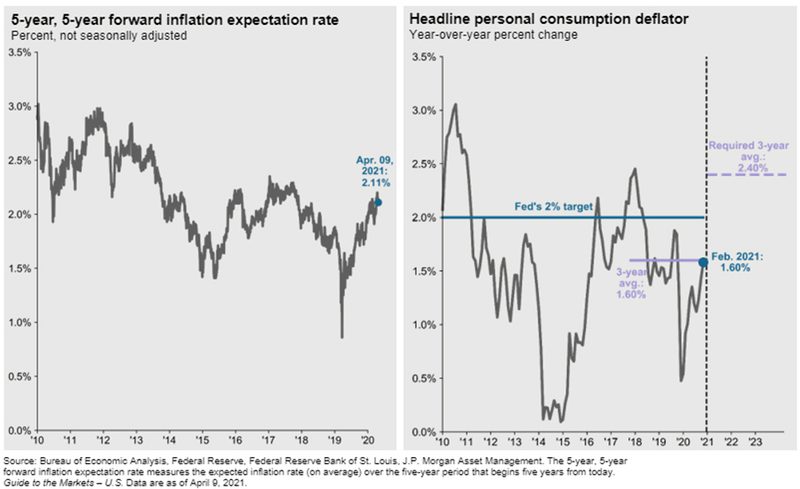

Similarly, investors are expecting inflation to accelerate as historically massive stimulus fuels the economic recovery. Right now, Federal Reserve officials expect any increase in inflation to be temporary, but if that expectation proves to be incorrect, then the Fed will have to remove stimulus via a reduction in the current Quantitative Easing (QE) program, and that is not priced into markets right now.

Regarding the pandemic, while the trend in the U.S. is clearly positive, parts of Europe are struggling with vaccine supply, and there is always the risk of a broader vaccine supply disruption or of a new COVID-19 strain that renders vaccines less effective, and any of those events would pose a threat to the rally in the stock market.

From a fiscal standpoint, the multiple rounds of stimulus that have been unleashed upon the economy since the pandemic began have resulted in very large increases to the national debt and federal deficits, and the recently passed stimulus bill only exacerbated those existing issues. So far, markets have not seen any negative impacts related to the growing debt or deficits, but these high levels of debt and deficits represent longer-term risks to U.S. financial stability, and it remains unclear when those risks will begin to impact asset prices.

Finally, so far in 2021 markets have embraced the Democratic agenda of more economic stimulus. But numerous prominent Democrats also are in favor of increased corporate, personal and investment taxes, and if those efforts gain momentum, we can expect that to increase market volatility. For now, these potential risks do not outweigh the actual positive influences pushing stocks higher, and as such, the macroeconomic outlook for the second quarter remains positive.

Final Thoughts

In summary, the start of 2021 showed that even though 2020 is behind us and the pandemic is likely closer to the end than the beginning, volatility and macro-economic surprises will remain with us, and as such investors should prepare for periodic bouts of market disruption. While challenges such as elevated U.S. stock valuations, rising rates, inflation concerns, COVID variants, and low international vaccination rates will move markets in the upcoming months, we believe:

- Equity markets will generate better returns than the bond market for the remainder of 2021 as powerful economic and earnings trends propel stock prices.

- International markets, though lagging U.S. markets YTD, should narrow the performance gap as they experience improving vaccination rates as the year progresses.

- Treasury bonds will likely remain under pressure this year as rising inflation data puts upward pressure on interest rates.

Importantly though, the start of 2021 again clearly demonstrated that a well-executed and diversified, long-term focused financial plan can overcome temporary bouts of volatility (red dots), just like it did in 2020 and preceding years.