Note: This information is from 2021 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

What a year we experienced in 2020! The most tumultuous year in recent memory ended on a high note for markets as the fourth quarter brought greater political and medical clarity — one that resulted in substantial market gains over the past three months, which helped to make 2020 a surprisingly strong year for market returns. What can we expect in 2021?

Part 1: Looking back at 2020

Part 2: What actions did we take in your portfolio last year?

Part 3: A look ahead — Our outlook for 2021

Part 1: Looking back at 2020

What a year we experienced in 2020! The most tumultuous year in recent memory ended on a high note for markets as the fourth quarter brought greater political and medical clarity — one that resulted in substantial market gains over the past three months, which helped to make 2020 a surprisingly strong year for market returns.

The fourth quarter started with investors facing substantial uncertainty across multiple fronts. Politically, President Trump contracted COVID-19 which underscored the prevalence of the virus and added further uncertainty to the looming election. Regarding the pandemic, after several months of relative stability in COVID-19 cases, infections began to rise rapidly across much of the United States as fall set in. Additionally, despite multiple rounds of negotiations, Congress and the White House were unable to come to a compromise on a new economic stimulus bill. That uncertainty weighed on markets in October, and the S&P 500 finished the month with modest losses.

But the first two weeks of November provided the clarity markets desired, and that paved the way for substantial gains in stocks over the next month. With the elections out of the way, investors turned their attention to progress being made against the pandemic. Less than a week after the elections, Pfizer announced that its COVID-19 vaccine was more than 90% effective at preventing infection, which was substantially better than initial estimates. A week later, Moderna announced its COVID-19 vaccine was 95% effective at preventing infection. This double dose of positive medical news provided hope for investors that the end of the pandemic was now only months away, and that fueled a strong rally that lasted for the remainder of the month, sending the S&P 500 to new all-time highs.

As we began December, the consistency of the good news in November helped investors look past the surging number of new COVID-19 cases and the growing intensity of lockdown measures implemented across the country to slow the spread of the virus. But by mid-December, New York City school closures and new dining restrictions, along with a near state-wide “Safer at Home” order in California, began to weigh on economic activity and that became a headwind on stocks. Shortly thereafter, however, the FDA approved the distribution of both the Pfizer and Moderna vaccines, and the roll out of the vaccine helped to remind investors that the end of the pandemic was hopefully only months away. As such, the surging number of coronavirus cases and widespread economic lockdowns did not cause a material decline in stocks. Finally, just before the end of the year, Congress approved a $900 billion stimulus bill that would help support the economy as it continues to recover from the pandemic. That news helped the S&P 500 hit a new all-time high just before year-end.

In sum, markets ended a historic year on a high note, as federal economic support, record-breaking vaccine development, and an incredibly resilient corporate America helped to more than offset the worst pandemic in more than a century.

4th-Quarter and Full-Year 2020 Index Performance Review

S&P 500 Total Returns by Month in 2020

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|

| -0.16% | -8.41% | -12.51% | 12.68% | 4.53% | 1.84% | 5.51% | 7.01% | -3.92% | -2.77% | 10.75% | 3.71% |

Source: Morningstar

| U.S. Equity Indexes | Q4 Return | 2020 Return |

|---|---|---|

| S&P 500 | 12.15% | 18.40% |

| DJ Industrial Average | 10.73% | 9.72% |

| NASDAQ 100 | 13.09% | 48.88% |

| S&P MidCap 400 | 24.24% | 13.10% |

| Russell 2000 | 31.37% | 19.96% |

Source: YCharts

| International Equity Indexes | Q4 Return | 2020 Return |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 16.09% | 8.28% |

| MSCI EM TR USD (Emerging Markets) | 19.77% | 18.69% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 17.08% | 11.13% |

Source: YCharts

| Commodity Indexes | Q4 Return | 2020 Return |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | 14.49% | -23.72% |

| S&P GSCI Crude Oil | 20.64% | -20.14% |

| GLD Gold Price | 0.70% | 24.81% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q4 Return | 2020 Return |

|---|---|---|

| BBgBarc US Agg Bond | 0.67% | 7.51% |

| BBgBarc US T-Bill 1-3 Mon | 0.02% | 0.54% |

| ICE US T-Bond 7-10 Year | -1.30% | 10.00% |

| BBgBarc US MBS (Mortgage-backed) | 0.24% | 3.87% |

| BBgBarc Municipal | 1.82% | 5.21% |

| BBgBarc US Corporate Invest Grade | 3.05% | 9.89% |

| BBgBarc US Corporate High Yield | 6.45% | 7.11% |

Source: YCharts

Part 2: What actions did we take in your portfolio last year?

During the depths of the market sell-off in February and March, we quickly acted to sell appreciated bonds and buy into stocks, taking advantage of what we believed was temporary weakness in the stock market brought on by the economic impact of COVID-19 layoffs and shutdowns. We articulated our position that, as the stock market is a discounting mechanism of future earnings, investors would return to the market when evidence of effective therapies and vaccines for COVID-19 appeared.

Quoting from the April edition of our Huddle publication, “With the stock market having experienced a 35% drop in value at the March 23rd lows, with interest rates at historic lows, and with unprecedented monetary and fiscal stimulus in the pipeline, we believe that we will look back on this period as a unique opportunity to invest in America at very reasonable prices.”

As pandemics eventually run their course (just as with the Spanish Flu in 1918), we believed markets would anticipate recovery well in advance of actual confirming data and that massive liquidity injections by the Federal Reserve and Congress would be supportive of the economy and would serve to reassure investors. This was indeed the outcome as stock markets around the world staged dramatic comebacks from their March lows despite rising cases of COVID-19 which led to massive job losses and economic hardship.

While many adjustments were made to client portfolios in 2020 as result of actions taken by the McKinley Carter Investment Strategy Committee, the following were notable changes:

- March: Opportunistic rebalancing and tax loss harvesting

During the spring, we took advantage of falling stock prices to do “tax loss harvesting.” This involved the selling of equity positions that had an unrealized loss (in taxable accounts) and replacing those positions with similar holdings that would participate in a stock market comeback. This allowed many clients to book a tax loss to offset future capital gains while maintaining their targeted stock allocation.

- April: Expanded investments in technologies benefitting from the COVID-19 environment

We added the ARK Innovation ETF (up 152% for the calendar year) to our Earnings Focus program. The fund was previously only held in our ActiveTrack program.

- May: Profit taking in appreciated U.S. Treasuries

In our ActiveTrack, Earnings Focus, and Dividend Focus programs, we reduced U.S. Treasury Bond exposure by adding more investment grade corporate bonds to take advantage of higher yields and the prospects for an improving economy.

- July: Preparation for a new economic expansion and threat of inflation

In our MarketTrack program, we eliminated U.S. Treasury Bond exposure and added Treasury Inflation Protected Securities and high yield bonds in the annual review to better hedge against future inflation concerns as the economy recovers.

In ActiveTrack, we reduced market capitalization and shifted from growth to value - Reduced large cap stock allocation to reflect our belief that, in the upcoming economic rebound, small and midcap stocks would benefit more than large cap stocks.

- Reduced growth stock allocation to add more value-oriented ETFs: IVE (large cap), IWS (midcap), and IWN (small cap) were added to the portfolio.

- The historically excessive performance experienced by growth stocks (vs. value stocks) over the past ten years warranted a repositioning into the more economically sensitive stocks found in value stock indices.

Part 3: A look ahead — Our outlook for 2021

As we begin a new investing year, we are pleased to say that, from a macroeconomic standpoint, the outlook for 2021 is materially more positive than it was for the majority of 2020.

Three Keys to a 2021 Recovery

- Vaccinations: Despite new daily highs in COVID-19 cases and deaths, the path of COVID-19 outbreaks may soon approach peak levels with two vaccines approved and currently being administered in the U.S. A third vaccine from Astra Zeneca has been approved in the U.K. and two additional vaccines are in Phase Three (final) trials.

- Stimulus: Congress has finally agreed on another historically large fiscal stimulus bill which will help the economy weather the still ongoing COVID-19 pandemic and related economic lockdowns. Politically, while Democrats have functional control of both the White House and Congress, neither party has a material majority in either house of Congress and as such, markets are not reflecting major concerns about policy risks to the economy (e.g., substantial tax increases, excessive regulation, or major initiatives like healthcare reform). Additionally, with bipartisan support for infrastructure spending, the likelihood of another significant stimulus bill that would include a large allocation to infrastructure is greatly enhanced.

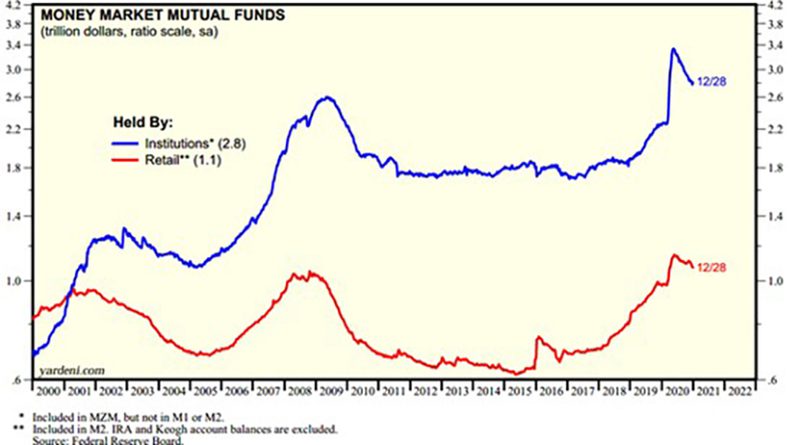

- Low interest rates: The Fed is continuing its historic Quantitative Easing (QE) program and has indicated its intention is to keep short-term rates low for years to come. That should continue to help to support asset markets broadly. Also, despite these low rates, investor cash (almost $4T) is at highly elevated levels, providing support for the equity markets.

In addition to these positives, corporate America has once again demonstrated itself to be both resourceful and resilient, and while some industries (airlines, cruise lines, hotels) face a long road to total recovery, many American companies have exited 2020 in strong financial shape. Disruptive companies in the technology and health care sectors (such as those found in our clients’ position in the ARK Innovation ETF) have experienced explosive growth over the past year as the pandemic accelerated trends already in place pre-pandemic such as cloud computing and genomic research. Additionally, many companies promoting online retail sales saw dramatic sales growth last year as consumers transitioned their in-store purchases to online. These secular, long-term trends should continue well into the future.

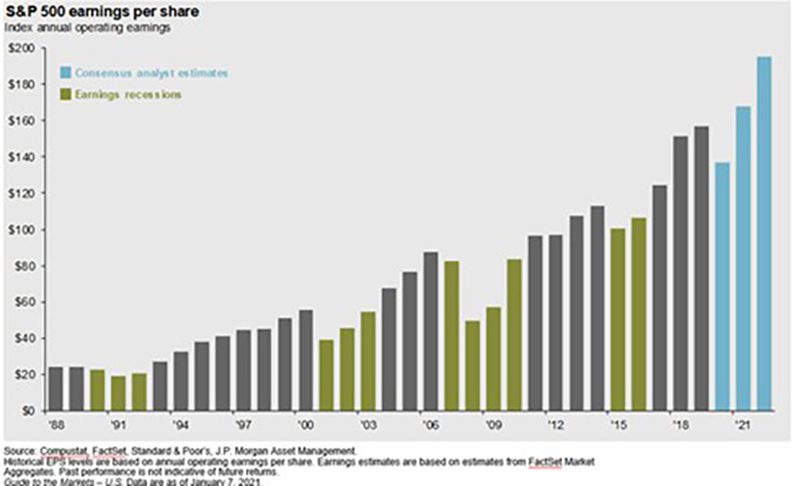

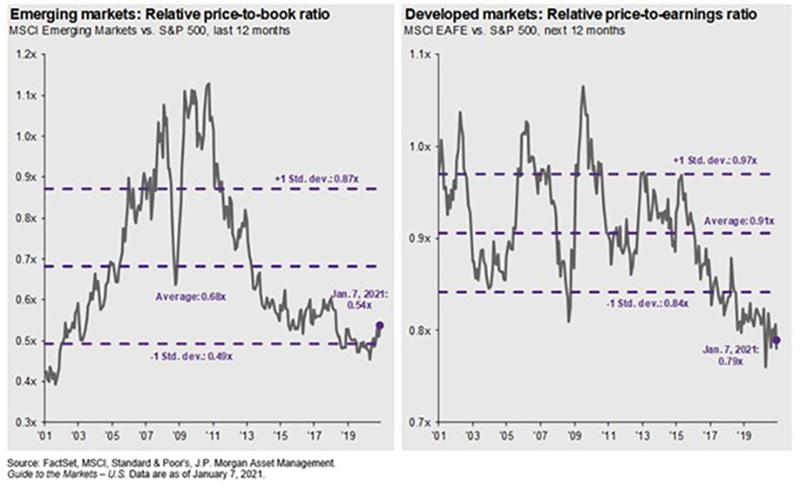

We are encouraged about the opportunity for stocks to perform well in 2021 as the large available cash savings of investors plus the post-pandemic recovery in economic activity should propel stock prices to new highs. While setbacks throughout the year are likely, forecasts for robust GDP growth in 2021 (full year GDP for 2021 is expected to grow at the fastest pace in 38 years) plus 20%+ earnings growth lead us to believe that stock prices will rise during the year. Small cap stocks (beneficiaries of faster economic growth) and international stocks (beneficiaries of the currently weak U.S. dollar) are projected to see 30%+ earnings growth in 2021 and represent good value vs. domestic large cap stocks.

With many Asians countries already well into recovery, and with the combination of the European Central Bank increasing its pandemic-related QE program and Brexit clarity, we are optimistic that robust vaccine distribution will result in a future rebound in global economic growth.

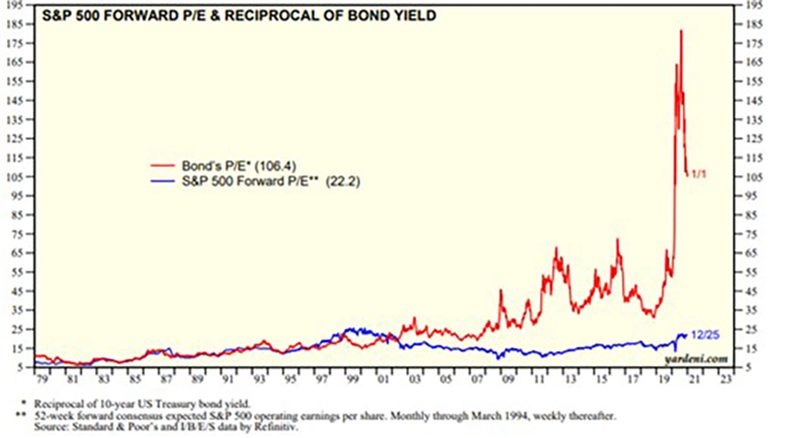

While the current U.S. stock market valuation (PE) is certainly elevated, the valuation on the 10-yr. Treasury note is substantially higher. This provides motivation for investors to move new investment dollars into stocks vs. very expensive bonds with low yields.

But, as 2020 has taught us all, nothing is guaranteed, and we must expect the unexpected. To that point, unemployment remains historically high (still well above levels we saw at the depths of the Great Recession) and, while many of those unemployed workers should return to work once the pandemic begins to recede, it is unclear how many small businesses will have survived to hire them back. Additionally, as the economy begins to normalize, the appetite for more stimulus from Washington will diminish; and again, it is unclear just how quickly we can expect economic growth to return to pre-COVID levels.

As 2021 progresses, investors will need to remain wary of the negative consequences of the ballooning federal debt and budget deficits. We will continue to closely monitor inflation and interest rates, as they are some of the most sensitive instruments to increased deficits and Federal debt. Also, a Democrat tax bill, which could potentially include increases on corporate taxes, capital gains taxes, and inheritance taxes, could possibly be in the cards after the newly elected senators are seated.

None of these risks, by themselves, offset the positive factors helping the economy and markets as we begin a new year; and again, the macroeconomic outlook for 2021 is positive. But there are certainly risks and we will continue to monitor them diligently.

Final Thoughts

In sum, as we consider all that has occurred in 2020 and look forward to 2021, one of the biggest takeaways from this historically volatile year in the markets is that a well-planned, long-term-focused, and diversified financial plan can withstand virtually any market surprise and a related bout of volatility, including the worst pandemic in 100 years.

At McKinley Carter, we understand the risks facing both the markets and the economy. We are committed to helping you effectively navigate this still-challenging investment environment. Successful investing is a marathon, not a sprint. Even intense volatility, like we experienced in the first half of 2020, is unlikely to alter a diversified approach set up to meet your long-term investment goals.

Therefore, it is critical for you to stay invested, remain patient, and stick to the plan. We have worked with you to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline.

Despite the resilient nature of markets in 2020, we remain vigilant towards risks to portfolios and the economy. We thank you for your ongoing confidence and trust. Please rest assured that we remain dedicated to helping you successfully navigate this market environment.

Please do not hesitate to contact us with any questions, comments, or to schedule a portfolio review.