As the U.S. stock market hits new highs in 2024, it begs the question, “Should I diversify some of my stock market risk into non-traditional assets like alternatives?” While the answer varies from person to person, the concept is one worth exploring for many investors.

Alternative investments are financial assets that fall outside the traditional categories of stocks, bonds, and cash. They are often used in investment allocations to diversify portfolios, hedge against risks, and seek higher returns. Learn more about the common types of alternative investments and their characteristics.

As the U.S. stock market hits new highs in 2024, it begs the question, “Should I diversify some of my stock market risk into non-traditional assets like alternatives?” While the answer varies from person to person, the concept is one worth exploring for many investors.

First, what are alternatives?

Alternative investments are financial assets that fall outside the traditional categories of stocks, bonds, and cash. They are often used in investment allocations to diversify portfolios, hedge against risks, and seek higher returns. Here are some common types of alternative investments and their characteristics:

Common Types of Alternative Investments

1. Private Equity:

- Description: Investments in private companies, often through direct ownership or buyouts.

- Characteristics: Typically illiquid, long-term investments with the potential for high returns.

- Examples: Venture capital, leveraged buyouts, growth capital.

2. Private Credit (Debt):

- Description: Loans or debt instruments issued by private entities.

- Characteristics: Can offer higher yields compared to public debt, but with higher risk.

- Examples: Direct lending, opportunistic credit, mezzanine debt, distressed debt.

3. Hedge Funds:

- Description: Pooled investment funds that employ diverse strategies to generate high returns.

- Characteristics: Often involve higher fees, use of leverage, and strategies like short selling, arbitrage, and derivatives.

- Examples: Long/short equity funds, market-neutral funds, event-driven funds.

4. Real Estate:

- Description: Investment in physical property or real estate-related securities.

- Characteristics: Can provide steady income through rents and potential appreciation in property value.

- Examples: Direct property ownership, Real Estate Investment Trusts (REITs), real estate funds.

5. Commodities:

- Description: Physical assets like metals, energy, agricultural products, and livestock.

- Characteristics: Often used as a hedge against inflation and currency risk.

- Examples: Gold, silver, oil, agricultural products.

6. Infrastructure:

- Description: Investments in public infrastructure projects.

- Characteristics: Typically, long-term and can provide stable cash flows.

- Examples: Toll roads, airports, utilities, renewable energy projects.

7. Collectibles and Art:

- Description: Investment in tangible items that have value due to their rarity and demand.

- Characteristics: Illiquid, with values often subject to market trends and individual buyer interest.

- Examples: Art, antiques, wine, classic cars, rare coins.

8. Cryptocurrencies and Digital Assets:

- Description: Digital or virtual currencies and other blockchain-based assets.

- Characteristics: Highly volatile and speculative, with potential for high returns.

- Examples: Bitcoin, Ethereum, non-fungible tokens (NFTs)

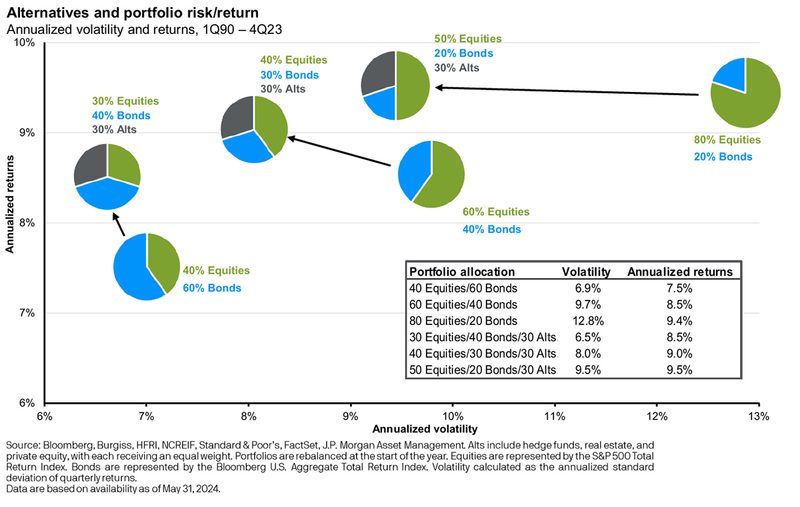

There are four primary outcomes when using alternatives:

1. Hedging – designed to increase in value when core exposures are falling.

2. Diversification – alternatives have a low/moderate correlation to core equities with different return drivers.

3. Modification – alternative investments are generally less volatile than core equities with similar return drivers.

4. Amplification – many alternatives produce higher returns than core equities but do so in less liquid markets.

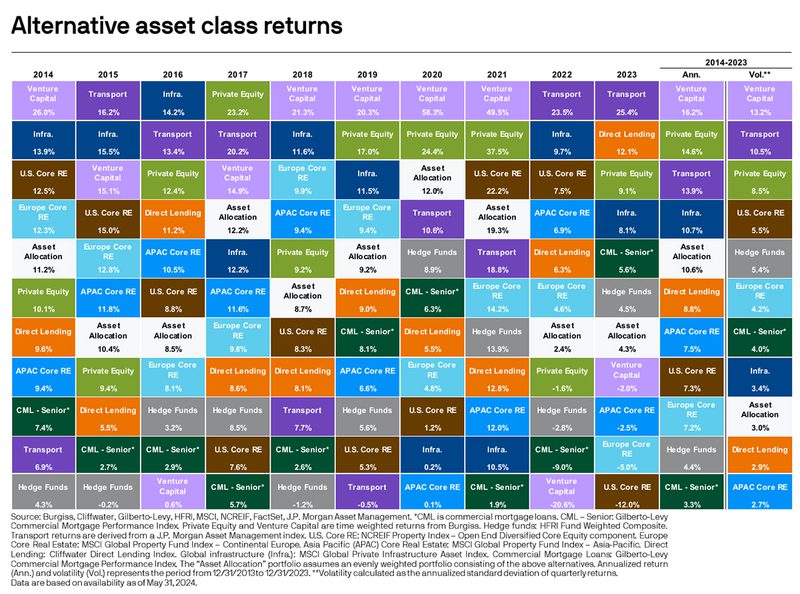

Alternative asset class performance:

Alternative investments can play a valuable role in investment allocations by providing diversification, potential for higher returns, and hedging against inflation and market volatility. However, they come with unique risks (such as illiquidity and higher fees than traditional investments) and complexities that require careful consideration and management. As with any investment strategy, it's important to align alternative investments with your overall financial goals, risk tolerance, and investment horizon.

Your McKinley Carter Financial Strategist would be happy to help you determine whether alternative investments are appropriate for you and, if so, which alternatives are best suited for your investment portfolio.