Note: This information is from 2021 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

The S&P 500 hit new all-time highs again in the third quarter as investors looked past a resurgence of COVID-19 cases in the U.S. and instead focused on the positive combination of a resilient economic recovery, ongoing historic support from the Federal Reserve, and strong corporate earnings. Market volatility did pick up notably during the final few weeks of September however, reminding investors that the transition to a post-pandemic “new normal” isn’t always going to be smooth. We dig deeper into performance and outline the actions we took in McKinley Carter portfolios, plus provide our best-thinking on what's ahead.

For your convenience, we have provided a brief 5-minute video version of this quarterly investment update. To watch the video, please click on the link below, or scroll down to continue reading the blog version.

Part 1: Looking back at the third quarter of 2021

Part 2: What actions did we take in McKinley Carter portfolios in Q3?

Part 3: A look ahead - our outlook for the rest of 2021

Looking back at the third quarter of 2021

The S&P 500 hit new all-time highs again in the third quarter as investors looked past a resurgence of COVID-19 cases in the U.S. and instead focused on the positive combination of a resilient economic recovery, ongoing historic support from the Federal Reserve, and strong corporate earnings. Market volatility did pick up notably during the final few weeks of September however, reminding investors that the transition to a post-pandemic “new normal” isn’t always going to be smooth.

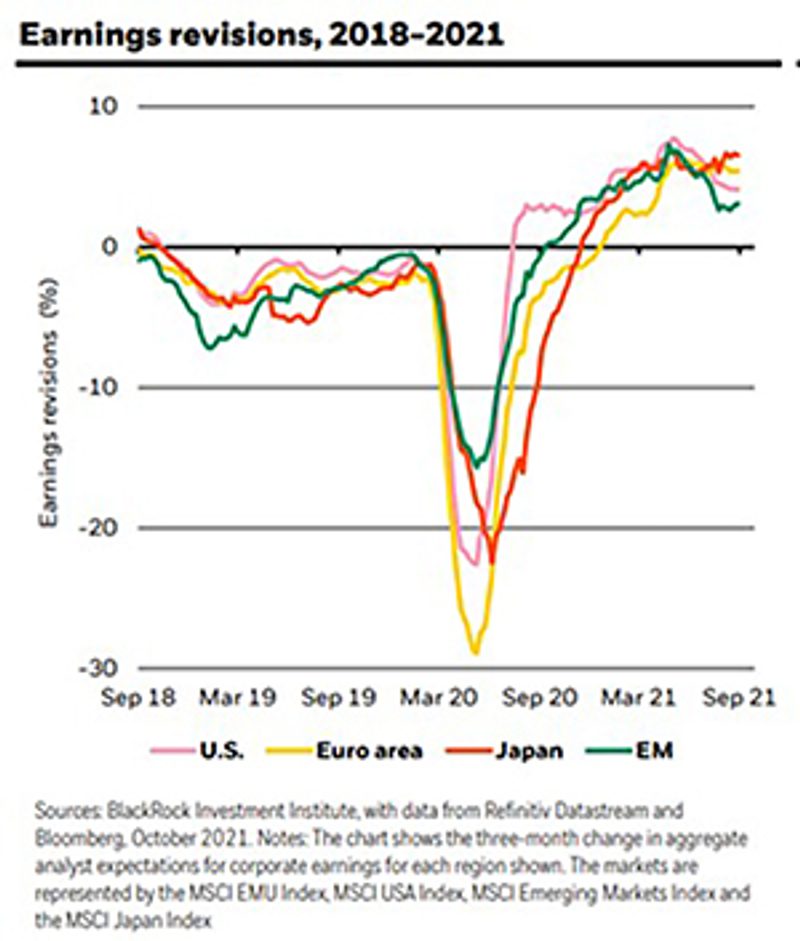

Stocks moved steadily higher to start the third quarter as the U.S. economy continued to return to pre-pandemic levels of activity while corporate earnings remained solid. To that point, second quarter earnings results, which were released in mid-to-late July, were stronger than expected and broadly did not show signs of the margin compression that some analysts feared might hurt corporate profitability. Additionally, at the July FOMC meeting, Fed Chair Powell reiterated that, despite economic progress, it was not yet time for the Fed to begin to reduce Quantitative Easing (QE), thereby ensuring the economy and markets would continue to enjoy full Fed support until late 2021. Those factors helped investors look past an increase in COVID-19 cases, especially across the Sunbelt, as the S&P 500 hit a new all-time high in late July.

That positive momentum for markets continued in August, powered by similar factors: Positive corporate commentary, solid economic activity, and continued supportive Fed rhetoric. Those forces again combined to help markets look past a further increase in COVID-19 cases. Unlike during the COVID-19 waves of 2020 and early 2021, government authorities did not re-impose economic restrictions or lockdowns in response to rising case counts. Instead, most policy responses centered around mask mandates, and as such, the economic headwinds from rising COVID-19 cases were mild compared to previous episodes. Meanwhile, politics once again became a focus of the markets in August. The Senate passed a $1.2 trillion bipartisan “hard” infrastructure package that included funding for roads, bridges, electric vehicle, broadband, cybersecurity, water infrastructure, and grid resilience. But what passed in August merely set the stage for the looming policy battle over the larger $3.5 trillion “human” infrastructure bill. Given that, stocks were able to look past future policy risks and climb steadily higher throughout the month with the S&P 500 ending August essentially at all-time highs.

A September Swoon

The market tone changed in September, however, as many of the positive factors that supported stocks earlier in the quarter began to fade. First, corporate commentary turned more cautious last month. Profit warnings that cited supply chain constraints and margin compression came from multiple industries, and that caused investors to become more concerned about the outlook for corporate earnings. Then, economic data from August showed that the rise in COVID-19 cases had weighed slightly on the economic recovery. Finally, after investors ignored the looming policy battle in August, politics once again became an influence on markets as Democrats unveiled new details on the $3.5 trillion spending and tax plan that included increases to the corporate tax, personal income taxes for high earners, and changes to capital gains and inheritance taxes.

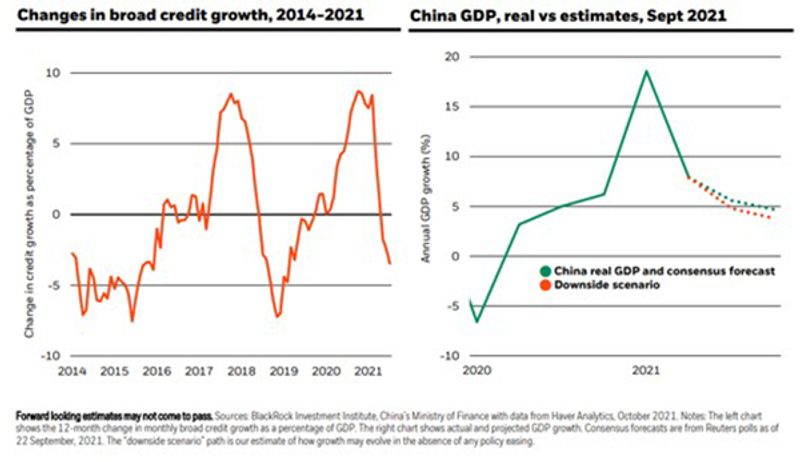

Those factors weighed on markets initially in September, but the volatility was compounded by the news that the second-largest property developer in China, Evergrande, was possibly going to default on debt payments. Fear of potential financial market contagion hit stocks in late September and the S&P 500 suffered its first 5% pullback in a year.

Markets remained volatile into the end of the quarter as the Federal Reserve confirmed market expectations that it will begin to reduce Quantitative Easing before year-end, while Washington approached the looming deadline of a government shutdown with no extension in sight, although that was avoided in the last few days of the quarter. The S&P 500 finished September with moderate losses although the index still logged a positive return for the third quarter.

In sum, the market remained resilient in the third quarter, but the final few weeks of September served as a reminder to investors that markets will face the resolution of numerous macroeconomic unknowns in the fourth quarter, and while fundamentals remain decidedly positive, an increase in market volatility should be expected.

Third Quarter Performance Review

The last few days of the third quarter had a substantial impact on quarterly index returns. For the majority of the third quarter, the Nasdaq had solidly outperformed both the S&P 500 and the Dow Jones Industrial Average as investors continued a trend from the second quarter by moving to less economically sensitive large-cap tech shares. However, during the last week of the quarter, as global bond yields rose, there was heavy selling in tech shares as investors rotated into other market sectors. The Nasdaq still slightly outperformed the S&P 500 while the Dow Jones Industrial Average produced a negative return for the third quarter thanks to the late September sell-off.

Highlights:

- Large-cap stocks outperformed small-cap stocks as COVID fears disproportionately impacted smaller, more economically sensitive stocks.

- Growth outperformed value in the third quarter, thanks to tech sector gains.

- On a sector level, financials led the way higher. Industrials and materials stocks underperformed.

- International stocks dropped in the quarter with Emerging Markets stocks falling sharply due to China concerns.

- Commodities posted strong gains for the fourth quarter in a row and again outperformed the S&P 500 over the past three months. Major commodity indices were led higher by a late-quarter rally in oil prices. Gold posted a small loss in the third quarter as a firming dollar and rising interest rates helped offset elevated inflation metrics.

- Bonds were little changed in the third quarter. Most bond indices were solidly higher through mid-September as investors rotated to safety following the rise in COVID-19 cases in July and August. But in late September, the Federal Reserve confirmed tapering of Quantitative Easing will begin this year. That, combined with high inflation statistics, weighed on fixed income markets during the final few days of the third quarter which erased most of the quarter-to-date returns for many bond indices.

- Higher-yielding, lower-quality bonds outperformed investment-grade bonds thanks to a late September drop in investment-grade following the rise in global bond yields, as investors rotated out of lower-yielding, yet higher-credit quality corporate debt as global yields rose.

| U.S. Equity Indexes | Q3 Return | YTD |

|---|---|---|

| S&P 500 | 0.58% | 15.92% |

| DJ Industrial Average | -1.46% | 12.12% |

| NASDAQ 100 | 1.09% | 14.58% |

| S&P MidCap 400 | -1.85% | 15.21% |

| Russell 2000 | -4.36% | 12.41% |

Source: YCharts

| International Equity Indexes | Q3 Return | YTD |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | -0.35% | 8.79% |

| MSCI EM TR USD (Emerging Markets) | -7.97% | -0.99% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | -2.88% | 6.29% |

Source: YCharts

| Commodity Indexes | Q3 Return | YTD |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | 5.22% | 38.27% |

| WTI Crude Oil | 1.21% | 55.18% |

| Gold Price | -0.39% | -7.73% |

Source: YCharts/Koyfin.com/Marketwatch.com

| U.S. Bond Indexes | Q3 Return | YTD | |

|---|---|---|---|

| BBgBarc US Agg Bond | 0.05% | -1.55% | |

| BBgBarc US T-Bill 1-3 Mon | 0.01% | 0.03% | |

| ICE US T-Bond 7-10 Year | -0.21% | 3.50% | |

| BBgBarc US MBS (Mortgage-backed) | 0.10% | -0.67% | |

| BBgBarc Municipal | -0.27% | 0.79% | |

| BBgBarc US Corporate Invest Grade | 0.00% | -1.27% | |

| BBgBarc US Corporate High Yield | 0.89% | 4.53% |

Source: YCharts

What actions did we take in McKinley Carter portfolios in Q3?

August:

- In ActiveTrack, Earnings Focus, Hybrid, and Dividend Focus programs, we eliminated the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and added to the iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB) to lessen interest rate sensitivity in our bond portfolios as rising inflation impacts longer-term interest rates.

- In ActiveTrack, Earnings Focus, and Hybrid programs, we eliminated the iShares Core MSCI Emerging Markets ETF (IEMG) and added to the Vanguard FTSE Developed Markets Index Fund ETF Shares (VEA) and added a new ETF, the iShares MSCI Emerging Markets ex China ETF (EMXC). These changes were made to reduce Emerging Markets and China exposure to equal-weight because of our concerns over Chinese regulatory crackdowns on some of their most successful companies combined with growing problems in the Chinese real estate market (29% of China’s GDP).

September:

In Earnings Focus and Hybrid programs, we eliminated RPM International Inc. (RPM) due to Zacks Research underperform rating and earnings downgrade, and added Broadcom Inc. (AVGO).

A look ahead - our outlook for the rest of 2021

As we assess the fourth quarter, three significant issues face the economy and the stock and bond markets.

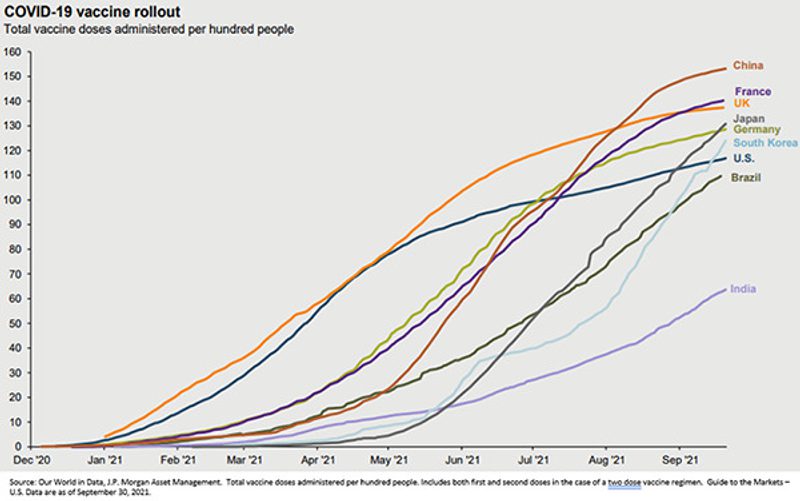

First:

COVID cases may be peaking in some parts of the U.S. and the world, but variants still represent a threat to economies as colder weather drives more inside activity. However, we are heartened by the continued rollout of vaccines across the country and globally. As more people are vaccinated and/or infected, we move closer to the “herd immunity” levels needed to dramatically slow the progress of the disease. In addition, several therapeutics have been shown to be quite effective in treating many COVID patients.

As COVID becomes less of a worry for individuals and businesses, as it did during the early days of summer before the Delta variant was so pronounced, economic activity will likely pick up and corporate earnings and the stock market should reflect the positive change.

Second:

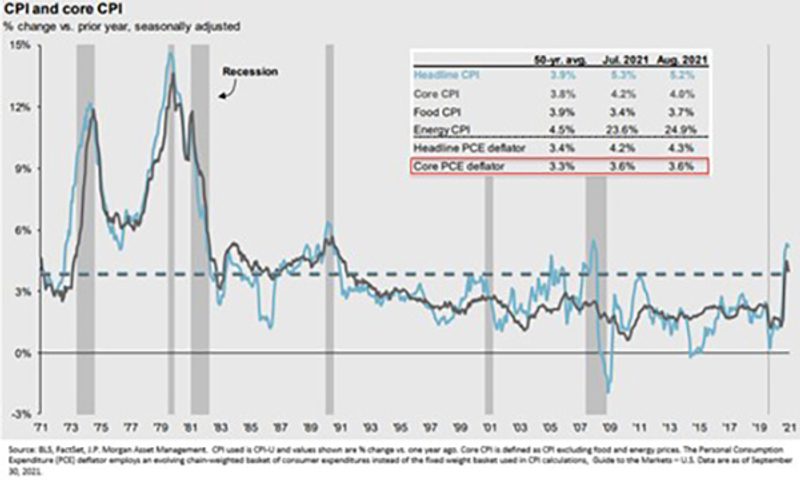

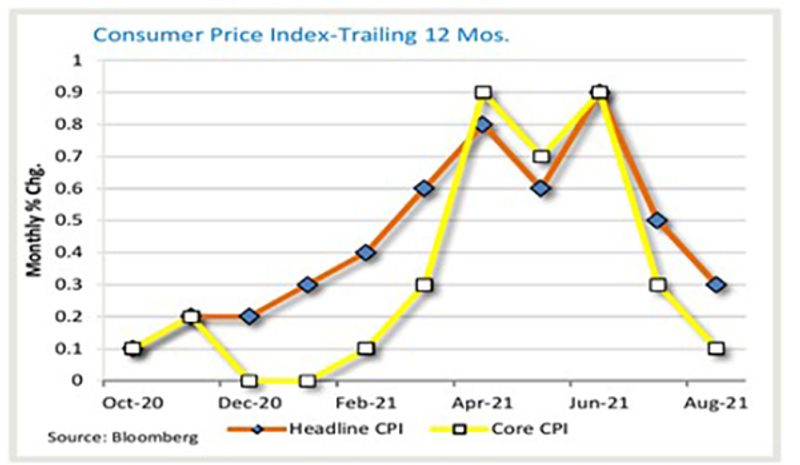

On a year-over-year basis, inflation data (+3.6%) is running well above the Federal Reserve’s 2% long-term target and, if left unchecked, could lead to ongoing higher costs for goods and services. While the Fed believes many of these costs are temporary spikes reflecting the year-over-year comparisons with pandemic lows and the associated short-term supply chain bottlenecks, any further indications of rising inflation would likely lead to higher interest rates and roil both the stock and bond markets.

However, if inflationary pressures ease next year due to supply chain bottlenecks abating and the ongoing deflationary benefits of cost-saving technologies, long-term interest rates may remain range-bound, and the Fed may delay any increases in short-term rates. These would be positive developments for the stock market.

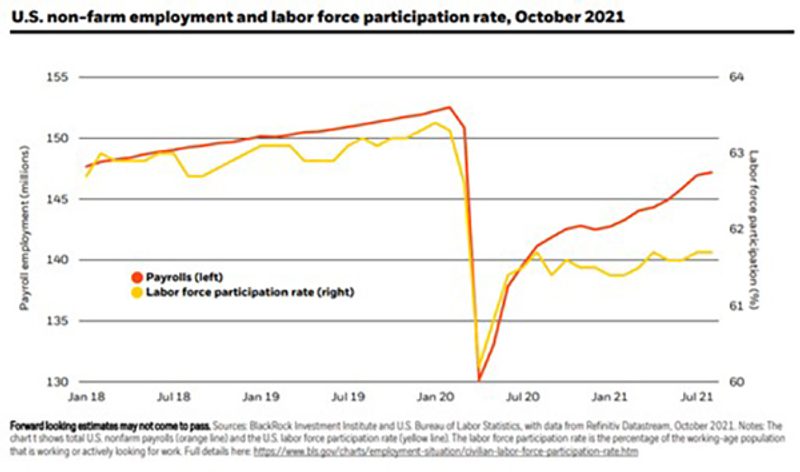

The Fed is also very focused on the pace of recovery in employment and plans to be steadfast with their position of waiting for employment numbers to return to pre-pandemic levels before raising rates.

Recently, long-term rates have moved up a bit as investors process the Fed’s communications regarding their intentions to begin tapering their monthly bond purchases later this year due to an improving employment picture. Markets do not yet know when exactly the Fed will start to scale back those asset purchases or the pace at which they will be reduced. If the Fed starts to taper sooner than expected, or the pace of reductions is faster than the market has currently priced in, it will likely cause additional volatility.

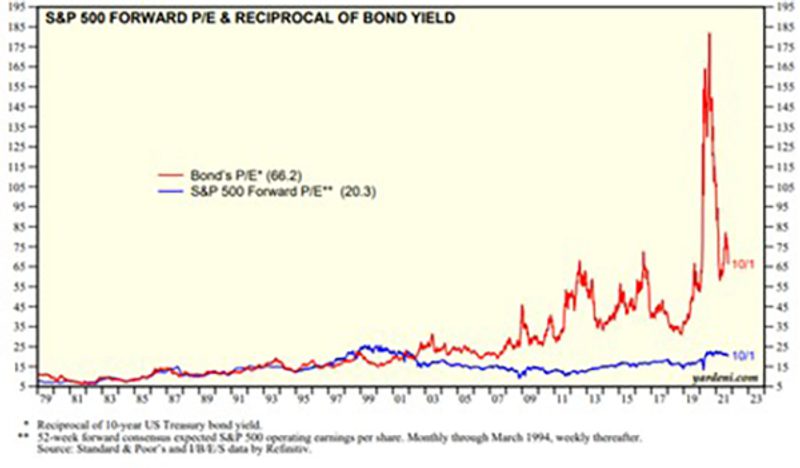

We favor a slight overweight to stocks and an underweight to bonds, as even a gradual increase in long-term rates will negatively impact bond prices. This is why we lowered the interest rate sensitivity of our bond portfolios in mid-August by selling longer duration bonds.

In addition, bonds are more expensive than stocks when considering their low yields compared to current stock valuations that are supported by robust corporate earnings and positive seasonal trends for the equity markets.

Also, despite the ongoing economic issues in China, we have confidence in the opportunities found in international stock markets as they currently trade at historically low valuations to the U.S. markets and should rebound as countries receive more vaccinations and move to fully reopen their economies.

Third:

The last issue relates to the ongoing debate in Congress over the two infrastructure bills and the legislation needed to raise the federal debt ceiling.

The infrastructure bills have far-reaching implications for the economy, the markets, and tax policy. Should the bipartisan traditional infrastructure bill pass, it would be stimulative to the economy, as we could begin the long overdue work to repair roads, bridges, and other hard infrastructure.

The other infrastructure bill, covering a wide variety of issues including Medicare expansion, universal pre-K, and climate change measures, comes with a potential cost of $3.5 trillion and would likely result in higher taxes for more affluent Americans as well as corporations.

In sum, though passage of the bills in their current form is far from assured, it’s important to review the lessons of history regarding market reactions to tax increases. Fortunately, history shows us that the stock market has mostly risen during periods of higher taxes on individuals and corporations as well as higher capital gains taxes.

Final thoughts

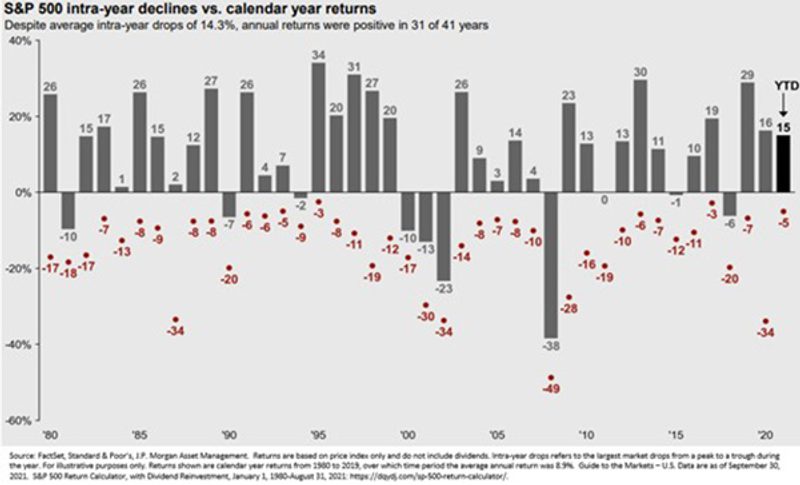

Despite the economic and medical progress achieved so far in 2021, we remain vigilant towards risks to portfolios and the economy. While multiple risks remain, macroeconomic fundamentals (GDP growth, corporate earnings, interest rates) are still decidedly positive and it is important to remember that a well-executed and diversified, long-term financial plan can overcome bouts of even intense volatility (red dots in the chart below) such as we’ve seen in the past and especially over the last two years.