The S&P 500 ended the first quarter of 2023 with a solid gain as hopes for an economic “soft landing” gave confidence to investors that enough damage had been done to stock prices in 2022 and that the Federal Reserve would soon stop moving the interest rate “goal posts.” However, stock and bond markets were volatile during the period as investors wrestled with the Fed’s ongoing proclamations regarding the timing and magnitude of further interest rate hikes. Despite the biggest bank failures since the financial crisis taking place during the quarter, Fed Chair Jerome Powell maintained his hawkish position regarding inflation and the need to further tighten financial conditions to curb consumer demand for goods and services. Read more from Senior Investment Strategist Dave Nolan on his 1Q2023 market recap and what may lie ahead in the remainder of 2023.

Part 1: Looking back at Q1 2023

Part 2: What actions did we take in McKinley Carter portfolios last quarter?

Part 3: A look ahead - our outlook for the rest of 2023

Looking back at Q1 2023

The S&P 500 ended the first quarter of 2023 with a solid gain as hopes for an economic “soft landing” gave confidence to investors that enough damage had been done to stock prices in 2022 and that the Federal Reserve would soon stop moving the interest rate “goal posts.” However, stock and bond markets were volatile during the period as investors wrestled with the Fed’s ongoing proclamations regarding the timing and magnitude of further interest rate hikes. Despite the biggest bank failures since the financial crisis taking place during the quarter, Fed Chair Jerome Powell maintained his hawkish position regarding inflation and the need to further tighten financial conditions to curb consumer demand for goods and services.

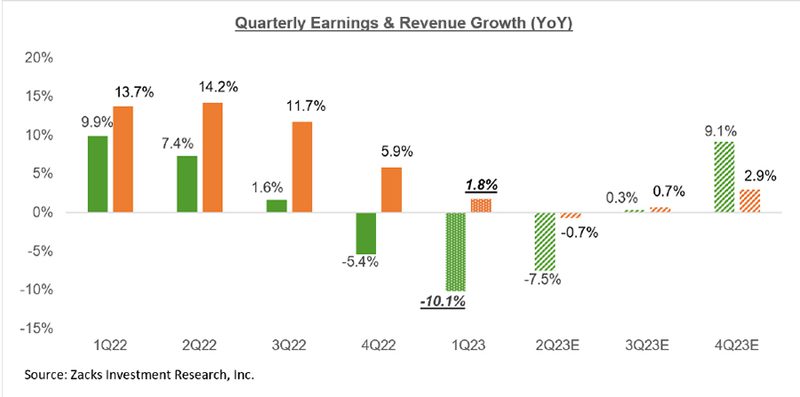

Markets started 2023 with strong gains in January, which were primarily driven by a continued decline in widely followed inflation indicators. That decline in price pressures was coupled with surprisingly resilient economic data, especially in the labor market. Those forces combined to increase investors’ hopes that the Fed could deliver an economic soft landing, whereby the economy slows but avoids a painful recession while inflation moves close to the Fed’s target. Additionally, corporate earnings for the fourth quarter of 2022, which were reported in January, were “better than feared” and the resilient nature of corporate America contributed to the growing hope that both an economic and earnings recession could be avoided. The S&P 500 posted strong gains in the month of January, rising more than 6%.

In February, growing optimism for an economic soft landing was delivered a setback, however, as economic data implied a still very tight labor market while the decline in inflation stalled. The January jobs report, released in early February, showed a massive gain in jobs, implying that the labor market will remain extremely tight (something the Fed believes is contributing to inflation). Later in the month, widely followed inflation metrics such as CPI and the Core PCE Price Index showed minimal further price declines, implying that the drop in inflation that had powered the gains in stocks was ending. The strong economic data and a leveling off of inflation metrics led investors to price in substantially higher interest rates in the coming months, and that weighed on both stocks and bonds in February. The S&P 500 finished with a modest loss on the month, falling just over 2%.

The final month of the first quarter began with investors still focused on inflation and potential interest rate hikes, but the sudden failure of Silicon Valley Bank, at the time the 16th largest bank in the United States, shifted investor focus to a potentially growing banking crisis. Signature Bank of New York failed just days later, and concerns about a regional banking crisis surged. In response, the Federal Reserve and the Treasury Department created new lending programs aimed at shoring up regional banks and preventing bank runs but concerns about the health of the financial system persisted and those fears weighed on markets through the middle of March. However, while the Federal Reserve hiked interest rates again at the March meeting, policy makers signaled that they are very close to ending the current rate hike campaign. That admission, combined with no additional large bank failures, eased concerns about a growing banking crisis, and the S&P 500 was able to rally during the final two weeks of March to finish the month with a small gain.

In sum, markets were impressively resilient in the first quarter as a looming end to rate hikes, further declines in inflation and quick and effective actions by government officials in response to regional bank failures helped shore up confidence in the banking system. Stocks and bonds both logged modest gains in Q1, despite the threat of a regional banking crisis and still-elevated market volatility.

First Quarter Performance Review

The first quarter of 2023 saw a sharp reversal in index and sector performance compared to 2022. On an index level, the Nasdaq (which badly underperformed in 2022) handily outperformed in the first quarter and finished with very impressive returns. That outperformance was driven by a decline in bond yields (which makes growth-oriented tech and consumer companies more attractive to investors) and as well-capitalized mega-cap tech companies such as Apple, Alphabet, Amazon and others were viewed as “safe havens” amidst the late-quarter banking stress. The S&P 500, with its heavy weighting to tech, finished the quarter with a solidly positive return while the Dow Industrials and Russell 2000 logged more modest, but still positive returns through the first three months of the year.

- By market capitalization, large caps outperformed small caps, as they did throughout 2022. Concerns about funding sources, should the banking crisis worsen, and higher interest rates weighed on small caps as smaller companies are historically more dependent on financing to maintain operations and fuel growth.

- From an investment style standpoint, growth handily outperformed value which is a sharp reversal from 2022. Tech-heavy growth funds benefited from the aforementioned decline in bond yields and a late-quarter “flight to safety” amidst the regional banking crisis. Value funds, which have larger weightings towards financials, were weighed down by concerns about a potential broader banking crisis.

- On a sector level, seven of the 11 S&P 500 sectors finished the first quarter with a positive return. Notably, the three top performers from the first quarter were the three worst performing sectors in 2022. Communication services was one of the best performing sectors in the first quarter thanks to strong gains from internet-focused tech stocks, as lower rates and the rotation to mega-cap tech companies pushed the sector higher. The technology sector also clearly benefitted from those two trends, as it rose slightly more than the communications sector in Q1. Finally, consumer discretionary, which has larger weightings towards tech-based consumer companies such as Amazon and others, also logged a solidly positive gain thanks to the same general tech stock outperformance and as the labor market remained more resilient than expected, improving the prospects for consumer spending in the months ahead.

- Turning to the laggards, the financial sector was the worst performer in the first quarter as the regional banking crisis weighed on bank stocks and financials more broadly. Energy also logged solid declines through the first quarter as growing concerns about global economic growth and subsequent weakness in consumer demand weighed on energy stocks. More broadly, the remaining S&P 500 sectors saw small quarterly gains or losses, as there remains a lot of uncertainty about future economic growth and earnings and the banking stresses that emerged in March will only add an additional headwind on economic growth.

- Internationally, foreign markets largely traded in line with the S&P 500 in the first quarter and realized positive returns. Foreign developed markets outperformed the S&P 500 through the first three months of the year as economic data in Europe was better than expected and European banks were viewed as mostly insulated from the U.S. regional bank crisis.

- Emerging markets logged slightly positive returns through March but underperformed the S&P 500 thanks to still-elevated geopolitical stress, as U.S.-China tensions rose following the Chinese spy balloon affair.

- Commodities saw sharp declines in the first quarter thanks mostly to the notable weakness in oil prices, which hit fresh 52-week lows. Oil fell during the first quarter on rising global recession worries and subsequent reductions in demand expectations, while geopolitical risks didn’t rise enough to offset those demand concerns. Gold, however, posted a solidly positive return as investors moved to the yellow metal as a store of value amidst the regional banking stress.

- Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays U.S. Aggregate Bond Index) realized a positive return for the first quarter of 2023, although bonds were volatile to start the year. The Fed signaling an imminent end to rate hikes combined with concerns that the regional banking crisis would raise the odds of a recession, fueled a broad bond market rally in the first quarter.

- Looking deeper into the fixed income markets, longer-duration bonds outperformed those with shorter durations in the first quarter, as bond investors welcomed further declines in inflation and reached for long-term yield amidst an uncertain outlook for future economic growth.

- Turning to the corporate bond market, higher-quality investment grade bonds and higher-yielding, “junk” rated corporate debt registered similarly positive returns in the first quarter. Investors moved to both types of corporate debt following declines in inflation and as corporate earnings results were largely better than feared.

| U.S. Equity Indexes | Q1 Return |

|---|---|

| S&P 500 | 7.50% |

| DJ Industrial Average | 0.93% |

| NASDAQ 100 | 20.77% |

| S&P MidCap 400 | 3.81% |

| Russell 2000 | 2.74% |

Source: YCharts

| International Equity Indexes | Q1 Return |

|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 8.62% |

| MSCI EM TR USD (Emerging Markets) | 4.02% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 7.00% |

Source: YCharts

| Commodity Indexes | Q1 Return |

|---|---|

| S&P GSCI (Broad-Based Commodities) | -4.94% |

| S&P GSCI Crude Oil | -6.15% |

| GLD Gold Price | 8.00% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q1 Return |

|---|---|

| BBgBarc US Agg Bond | 2.96% |

| BBgBarc US T-Bill 1-3 Mon | 1.09% |

| ICE US T-Bond 7-10 Year | 3.55% |

| BBgBarc US MBS (Mortgage-backed) | 2.53% |

| BBgBarc Municipal | 2.78% |

| BBgBarc US Corporate Invest Grade | 3.50% |

| BBgBarc US Corporate High Yield | 3.57% |

Source: YCharts

What actions did we take in McKinley Carter portfolios last quarter?

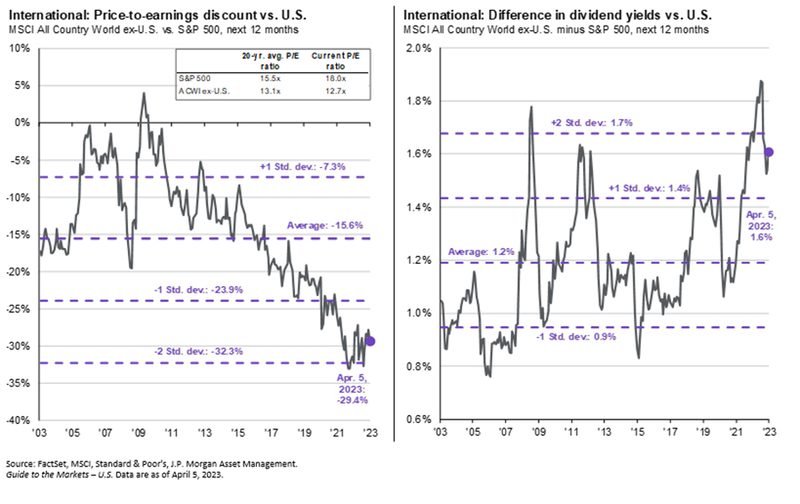

- Increased international allocation by 10% to take advantage of a weakening U.S. dollar in light of the Federal Reserve nearing the end of its rate-hiking cycle.

- Reduced high yield bond exposure in our MarketTrack portfolios in favor of better opportunities found in the mortgage-backed bond area.

- Renamed the MarketTrack program to Strategic Focus to better align with the program’s long term strategic investment objective.

- Made changes to our Dividend Focus portfolio stocks to align with updated quality and dividend growth screening.

A look ahead - our outlook for the rest of 2023

Markets begin the new quarter facing multiple sources of uncertainty including the path of inflation, future economic growth, the number of remaining Fed rate hikes, and whether the regional banking crisis is truly contained. Yet despite all this uncertainty, markets have proven resilient over the past six months since hitting their lows in October of 2022. So, while headwinds remain in place and markets will likely stay volatile, there remains a path for future positive returns.

Starting with the regional banking crisis, despite consistent comparisons in the financial media between what happened in March and the 2007-2008 financial crisis, banks are far better capitalized today than during the previous period and regulators have already demonstrated their commitment to ensuring we do not experience a repeat of those difficult days. As we begin the new quarter, there is reason for hope this crisis has been contained. But regardless of whether that’s true, regulators and government officials have proven they are ready to use current tools (or create new ones) to prevent a broader spread of the regional banking crisis, and that’s an important, and positive, difference from 2008.

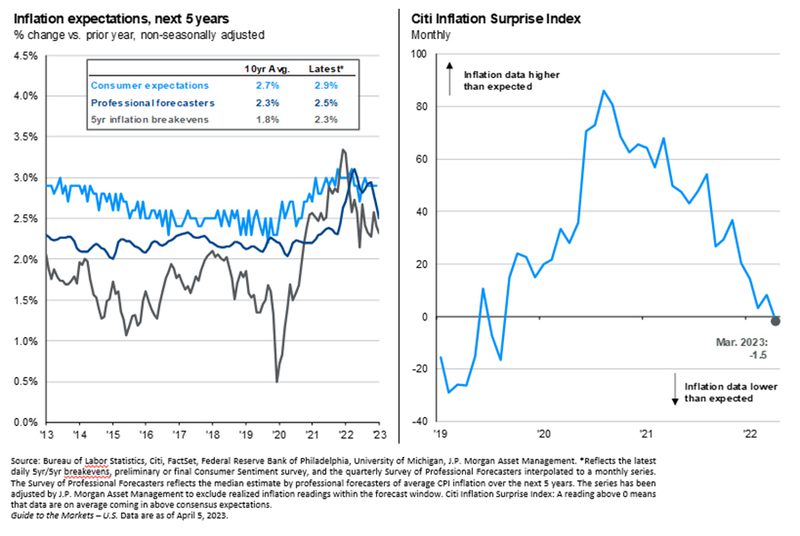

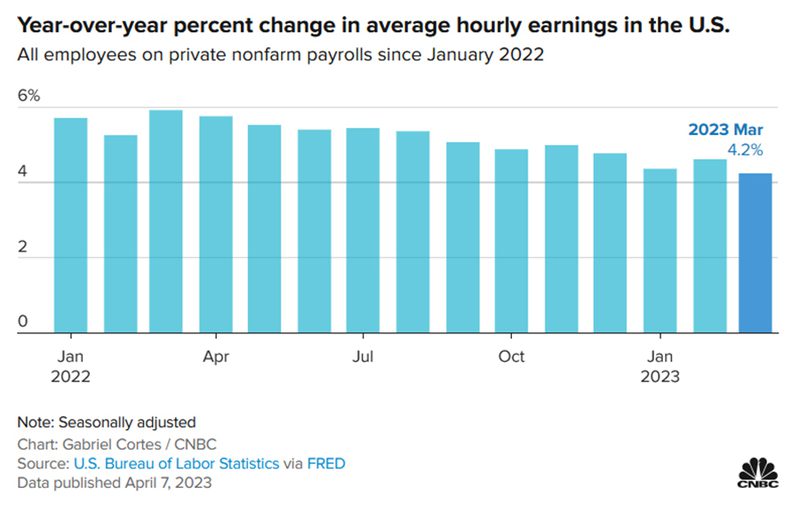

Looking past the regional bank crisis, inflation remains a major longer-term influence on the markets and the economy, and whether inflation resumes its decline this quarter will be very important for investors and the markets. More specifically, the decline in inflation somewhat stalled in February and March but if the decline in inflation resumes in the second quarter that will provide a powerful tailwind for both stocks and bonds. We believe the overall trend in inflation (including wage increases) is downward and that additional evidence of easing pricing pressures will allow the Federal Reserve to pause their interest rate hikes.

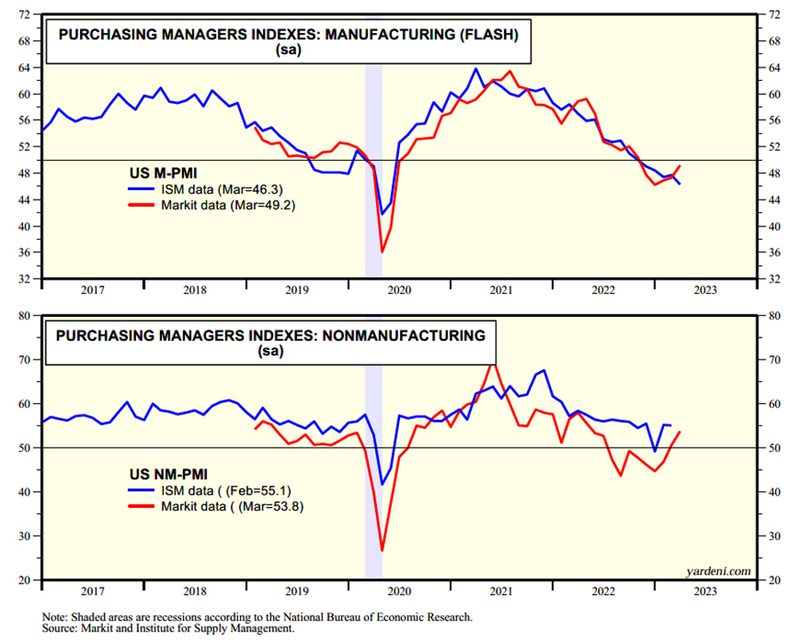

Regarding economic growth, markets rallied on the hope of an economic soft landing earlier in the first quarter, and while the regional banking crisis complicates that optimistic outlook as banks will likely tighten lending standards and regulators may enact stricter supervisory standards, it is still possible. While manufacturing data indicate sluggishness (<50) in the economy, services (nonmanufacturing) continue to be strong (>50) as consumers are still going to restaurants and taking trips. Accumulated savings during COVID and a still healthy jobs market (3.5% unemployment rate as of the March report from the Labor Department) are allowing folks to spend more on experiences but less so on goods. In total, GDP estimates for the first quarter of the year still forecast modest growth for the U.S. economy. While we should expect slowing in the economy this quarter, a recession, while growing more likely due to the delayed impact of previous Fed rate hikes on employment, is by no means guaranteed. If the economy does indeed achieve a soft landing, that will be a material positive for risk assets like stocks.

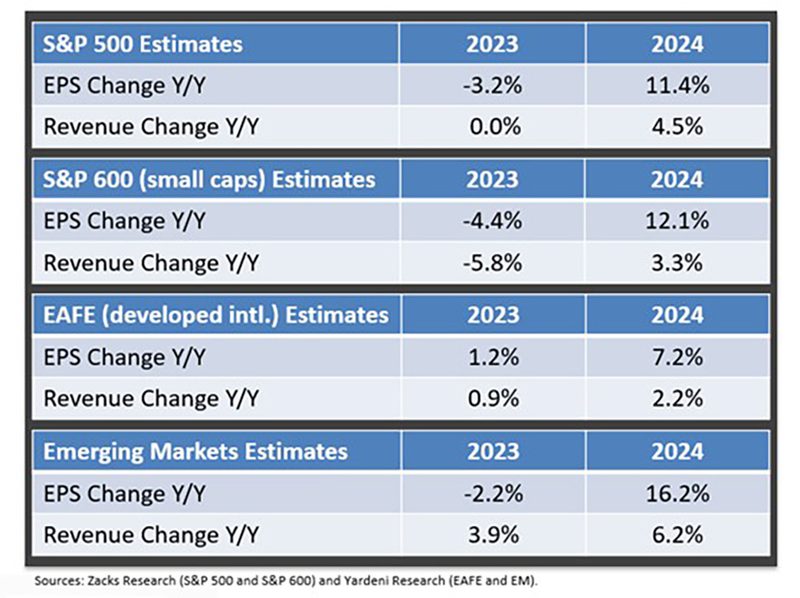

Corporate earnings estimates, the primary driver of stock prices, have steadily eroded over the past year. However, despite this, stock prices have rallied over the last six months as investors “look through” the current earnings forecasts to better days ahead later this year (S&P 500 projected earnings in green, revenues in orange) and into 2024.

The primary competition for stocks continues to be short-term Treasuries, CDs, money market funds and fixed annuities. With these products yielding above 4.5% and corporate earnings estimates in doubt, many investors are moving their dollars to guaranteed investments to reduce portfolio risk. Until the Federal Reserve clearly indicates their intention to stop raising interest rates, investors will likely continue to allocate significant assets to these categories.

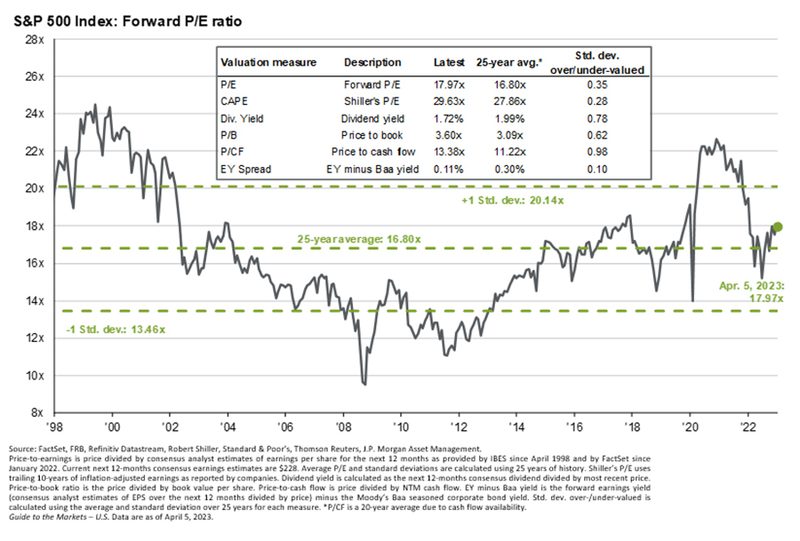

While stock valuations are certainly not cheap in the current environment, declining inflation data should lead to lower interest rates which, in turn, should likely lead to expanding price/earnings (PE) multiples. Despite some near-term earnings and valuation headwinds for U.S. stocks, we believe that over the next year we will see stocks outperform bonds as the stock market anticipates an economic recovery in 2024.

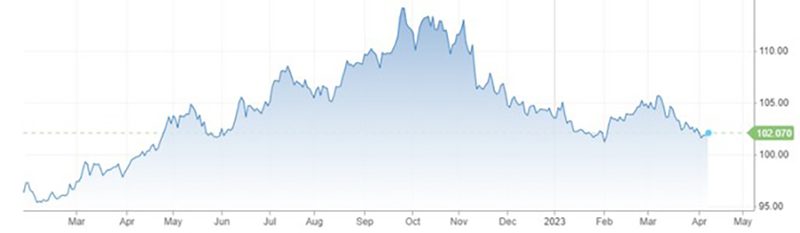

International stocks, which had been previously hurt by a strong U.S. dollar, have already seen a recovery this year as investors are taking advantage of a weakening dollar and more attractive valuations found overseas.

U.S. Dollar Index

Source: CNBC

After one of the most intense interest rate hike campaigns in history, the Fed has signaled that it is close to being done with rate increases, and that will remove a material headwind on the economy. As long as that expectation for a looming end to rate hikes does not change and the Fed stops moving the interest rate “goal posts,” it will increase the chances that the economy can achieve the desired soft landing. Also, the banking turmoil may convince the Fed to stop tightening soon and could also prod Congress and the Administration into a less eventful raising of the debt ceiling, all of which could reduce recession risks.

To be sure, this remains a tumultuous time in the markets. Investors are facing the highest interest rates in decades, the worst geopolitical tensions in years, and a very uncertain economic outlook that deteriorated in the wake of recent bank failures. But while concerning, it’s important to realize that underlying U.S. economic fundamentals and U.S. corporate earnings proved incredibly resilient through the first quarter. And those two factors, steady economic growth and strong earnings, are the real long-term drivers of market performance, not the latest disconcerting geopolitical or financial headlines.