Interest rates (and interest income) are significantly higher than we've seen in many years. And many taxpayers may be surprised when they see their next tax bill due from interest income earned in their taxable accounts—whether from their investment portfolio, or their bank or credit union. Be prepared.

In this world, nothing can be said to be certain, except death and taxes.

Benjamin Franklin

If you are an individual or family who prefers to keep a significant balance of your liquid net worth in a bank account, I’d like to congratulate you for all the interest you should now be making on your deposits! After experiencing historically low interest rates for the better part of the last decade and a half, the boost in interest on your safety net is welcomed, no doubt.

While it is true that the trend started in 2022, your interest collected in the 2023 tax year on similar deposit amounts should be substantially higher in dollar terms vs. last year, or any year going back 15+ years, for that matter.

Eluding a Tax Surprise

As an average taxpayer’s tax memory is confined to last year’s tax return, many taxpayers may be surprised when they see the tax bill due from interest income earned in their taxable accounts—whether from their investment portfolio, or their bank or credit union.

As an example, a depositor of $100,000 in a taxable Money Market may have hypothetically earned:

- An average of 0.05% interest in 2021, or $50 for the year.

- An average of 1.00% interest in 2022, or $1,000 for the year.

- An average of 4.50% interest in 2023, or $4,500 for the year.

Since interest income generally has no taxes automatically withheld, many taxpayers who are accustomed to receiving a tax refund may see it

reduced substantially or may end up owing. Others who try to estimate their

taxes closely may be surprised by a significantly larger tax bill upon

filing. Better to know ahead of time and make adjustments accordingly!

How Interest Gets Taxed in Taxable Money Markets Held in Taxable Registrations

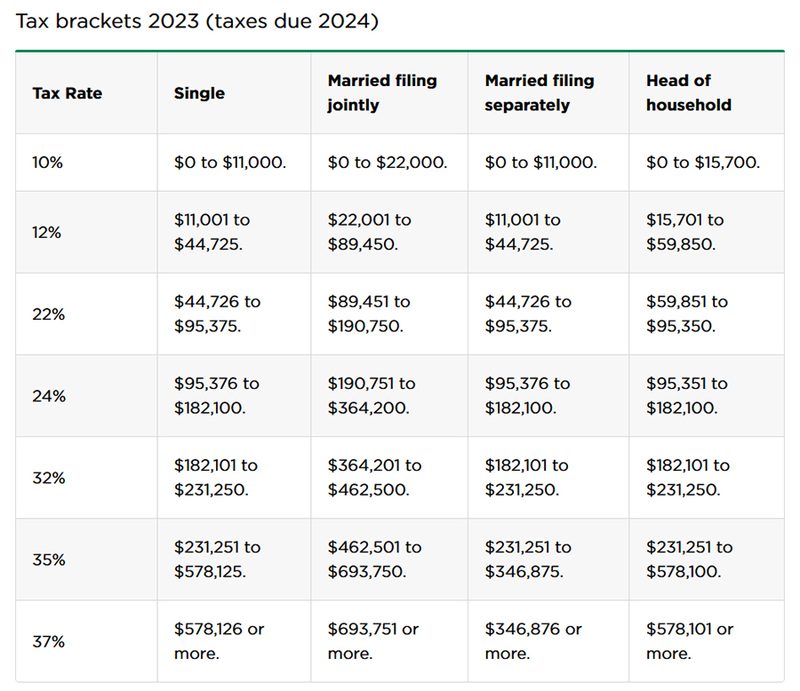

While there are tax-free Money Markets available to investors, chances are high that your Money Market at your bank or credit union is taxable. In that case, the interest will likely be taxed as ordinary income.

Source: www.nerdwallet.com

Returning to our previous example of a taxpayer holding $100,000 in a taxable Money Market, if you are in the 24% tax bracket for your Federal taxes for each year, your tax bill on interest could have been/be:

- In 2021, $12 on $50 interest income.

- In 2022, $240 on $1,000 interest income, an increase of $228 over the prior year.

- In 2023, $1,125 on $4,500 interest income, an increase of $897 over the prior year.

Of course, the higher your balance and/or interest earned, the greater impact this will have for you.

There may be additional tax impacts to your state and/or local taxes not considered above.

Strategies to Consider

You had to make money to owe the tax, so this is not all bad. However, if you find this factor may have a material impact on the taxes you may owe for 2023, consider taking the following steps:

- Raise the issue with your qualified tax professional sooner rather than later. That professional may recommend increasing withholdings or making tax estimates to stay in front of this potential concern.

- Consider moving some or all of your Money Market into a tax-free solution. Making use of municipal securities can alleviate the tax burden on your Federal taxes going forward.

- Consider which tax bucket makes the most sense to hold income-producing assets. As an example, interest earned in your IRA is not taxed until distributed, so if some of your safety net isn’t immediately needed for spending, it may make sense to shift which tax bucket holds that much income-production.

At McKinley Carter, we incorporate these and many more strategies to ensure your financial assets and strategies are working together to drive successful outcomes. Reach out to a McKinley Carter advisor for any additional insights specific to your circumstances. We’re always happy to help!