Note: This information is from 2022 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

We all invest money for one primary reason—to make money. No doubt, your financial plan outcome hinges on achieving some amount of return on your money you’ve accumulated. While the whole point of investing is to get a positive return on those resources over your holding period, your success does not rise nor fall on the consistency of price increases. Well-formed financial plans consider not only reasonably anticipated rates of return but also the variability of outcomes. In short, your financial plan should not experience shock from short-term fluctuations in the markets. Learn how to get ahead with capital losses.

We all invest money for one primary reason—to make money. No doubt, your financial plan outcome hinges on achieving some amount of return on your money you’ve accumulated. While the whole point of investing is to get a positive return on those resources over your holding period, your success does not rise nor fall on the consistency of price increases. Well-formed financial plans consider not only reasonably anticipated rates of return but also the variability of outcomes. In short, your financial plan should not experience shock from short-term fluctuations in the markets.

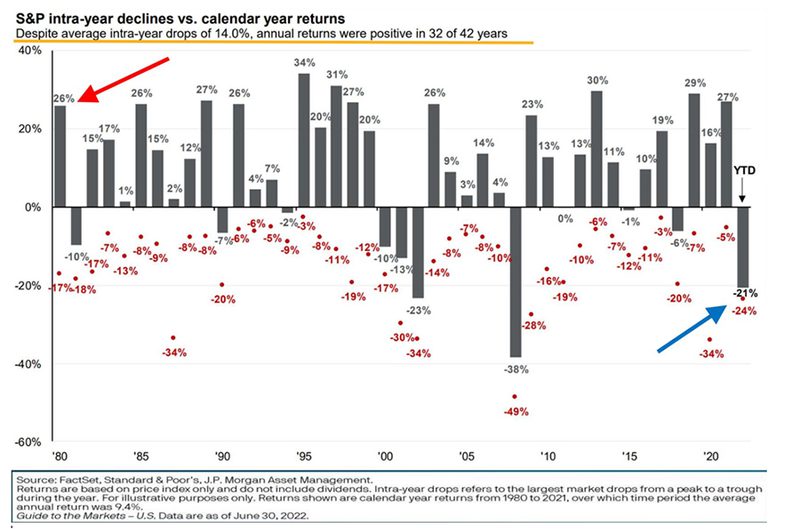

The reality is that financial markets fluctuate which means, of course, your portfolio will contract in value from time to time, sometimes substantially. A favorite chart of ours at McKinley Carter recognizes the intra-year drops over the past 40+ years. The average largest intra-year drop in the S&P 500 Index since 1980 is about -14%, with outliers being much worse than that, historically.

When dealt a lemon, make lemonade! There is a strategy to manage through every financial problem we face. This includes, if not more so, those times when your portfolio return for a period of time begins with a negative sign. Here is one such strategy that your financial planning team at McKinley Carter employs for the benefit of our clients who hold taxable investment accounts when it is raining lemons.

[Enter Tax-Loss Harvesting stage-right.] Tax-Loss Harvesting is an investment management strategy whereby an investment that drops in value is sold to generate the benefit of a tax “write-off.” The proceeds from the sale are then reinvested into another similar investment to avoid selling low.

Making Lemonade

To implement the Tax-Loss Harvesting strategy, you’ll need:

- A Pitcher: A taxable investment account, such as an Individual or Joint Account, a Living Trust, or the like. (This strategy does not apply to tax-deferred vehicles like Traditional IRAs nor tax-free vehicles like Roth IRAs.)

- A Lemon: An investment that has dropped in value since it was purchased, having an unrealized (not yet sold) capital loss.

- Thirst: Your intent is not to make the temporary loss in economic value into a permanent loss by pulling out to cash. The presumption here is your continued intent to make a return on the money!

- Water and Sugar: A well-educated and proactive planning team who knows how to recognize the opportunity to take capital losses and reinvest the proceeds.

- A Spoon: More than knowledge and wherewithal, your team must enact the strategy by actually selling the position at a loss and reinvesting the proceeds.

How It Works

Here are some definitions that are necessary to understand what it means to employ a Tax-Loss Harvesting strategy. (These definitions are oversimplified intentionally for educational purposes; like the English language, tax law is a labyrinth of rules, exceptions to the rules, and exceptions to the exceptions to the rules. Also, there may be other important considerations in individual circumstances.)

- Capital Gains, In General: Capital gains (i.e., investment price increases) are taxed on your tax return only when they are realized. If you hold an investment in a taxable account but do not sell it, the gain is unrealized (and therefore is not taxable in most cases). As soon as you sell the position, you will owe tax on any gain in price you have realized since purchasing the position.

- The Netting Process: Each year, you will only owe taxes on net positive capital gains. If you have any capital losses, they will be used to offset your capital gains. If that number is still positive, you only owe taxes on the net positive gain. If that number is a net loss, you do not owe any taxes on capital gains for that year.

- Tax Treatment of Net Losses: More than not owing taxes on capital gains that are offset by capital losses, if you generate a net capital loss in a tax year, you can effectively “write off” up to $3,000 in losses against your ordinary income. Because ordinary income is taxed at higher rates (much higher for some taxpayers), this can be an invaluable tool in your tax planning strategy!

- Capital Loss Carryforward: If you have greater than the (up to) $3,000 in capital losses available to “write off,” you can carry the remaining loss forward to future tax years to offset any future capital gains, or even to offset ordinary income, if applicable. Any remaining loss can be used up to $3,000/year until fully used.

A further benefit of harvesting capital losses is that it can provide more flexibility in making trade decisions to help drive performance within a taxable account. Absent realized capital losses, it can be difficult to lock in gains by reducing exposures to top performers in a taxable account due to the tax implications of those trades. Long-term performance can be helped and tax implications minimized whenever capital losses are realized and available to offset other capital gains that may be to your advantage to take.

Caveat: Avoid a Wash Sale

As noted above under the heading “Thirst,” the presumption here is your continued intent to make a return on the money! Therefore, when employing the Tax-Loss Harvesting strategy, your sale of a position that has a capital loss is only the first half of the implementation. You must then reinvest the proceeds in such a way that you attempt to replicate upside potential for those dollars for going forward.

That said, it is considered an abuse of the tax “write-off” if you sell a position to realize a capital loss, only to buy the position right back again. The Wash Sale Rule prevents this sort of action. There are specific rules as to how similar the purchased position can be in comparison to the sold position, and additional rules regarding the timing of the trades. You cannot use the capital loss on your taxes if your purchase fails these tests. While this starts to become very technical in nature, rest assured that your team at McKinley Carter takes this into consideration when implementing the strategy to ensure you get the tax benefit of the strategy.

Driving Optimal Outcomes

Don’t lose sight of the big picture when thinking through tax-loss harvesting. You’ve not lost money in implementing the strategy even though it may seem to be so in a vacuum. The strategy simply uses the tax law to your advantage in times when the variableness of your range of returns happens to be in a trough.

We’re all rooting for good days ahead, but I’ve found that bad days are made just a little better with a glass of fresh-squeezed lemonade. Also, saving on my tax bill helps.