"Elvis has left the building" is a phrase that was often used by public address announcers at the conclusion of Elvis Presley concerts in order to disperse audiences who lingered in hopes of an encore.

With that in mind, we believe that Federal Reserve Chair Jerome

Powell has strongly hinted that when it comes to the Fed’s rate-hiking

cycle that began in March of 2022, Elvis (future rate hikes) has now

“left the building.”

Read more about Senior Investment Strategist Dave Nolan's 4Q2023 market review and what may be ahead for 2024.

Part 1: Looking back at Q4 2023

Part 2: What actions did we take in McKinley Carter portfolios last quarter?

Part 3: A look ahead - our outlook for 2024

Looking back at Q4 2023

"Elvis has left the building" is a phrase that was often used by public address announcers at the conclusion of Elvis Presley concerts in order to disperse audiences who lingered in hopes of an encore.

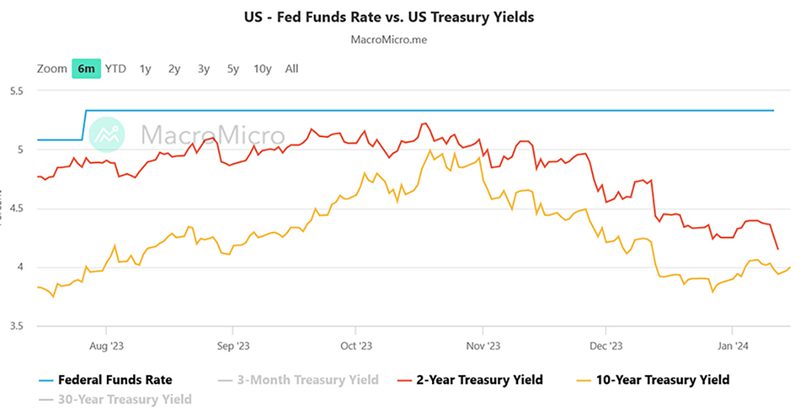

With that in mind, we believe that Federal Reserve Chair Jerome Powell has strongly hinted that when it comes to the Fed’s rate-hiking cycle that began in March of 2022, Elvis (future rate hikes) has now “left the building.” Following the December 13th meeting of the Federal Reserve, Chair Powell stated that “the median FOMC participant projects that the appropriate level of the federal funds rate will be 4.6 percent at the end of 2024, 3.6 percent at the end of 2025, and 2.9 percent at the end of 2026.” This implies that the members of the Federal Reserve believe that the current Fed Funds rate of 5.375% is too high and will need to be lowered this year. Additionally, Chair Powell said in his post-meeting press conference that, “we believe that we are likely at or near the peak rate for this cycle.”

The CME FedWatch Tool, which measures market sentiment on future Fed Funds rate levels, currently projects the first rate cut in March and a year-end target of between 3.75% and 4.00%. This indicates that interest rate traders believe that the Fed will be much more aggressive with their rate cuts in 2024 than Fed members currently project.

Historically, markets tend to perform well when the Fed cuts interest rates, assuming the cuts are not in response to rapidly deteriorating economic data. With inflation continuing to abate, longer term interest rates declining, GDP estimates for 2024 showing modest growth, and the stock market having enjoyed a robust year-end rally, the groundwork for a productive investment environment in 2024 has been laid. Famed investor and market forecaster, Marty Zweig, coined the phrase, “Don't fight the Fed,” in 1970, explaining that Federal Reserve policy has a strong correlation in determining the stock market's direction. However, Marty’s #1 rule for investing was “the trend is your friend, don’t fight the tape.” Both rules are currently pointing to a positive outcome for 2024.

The Key Events of the Quarter

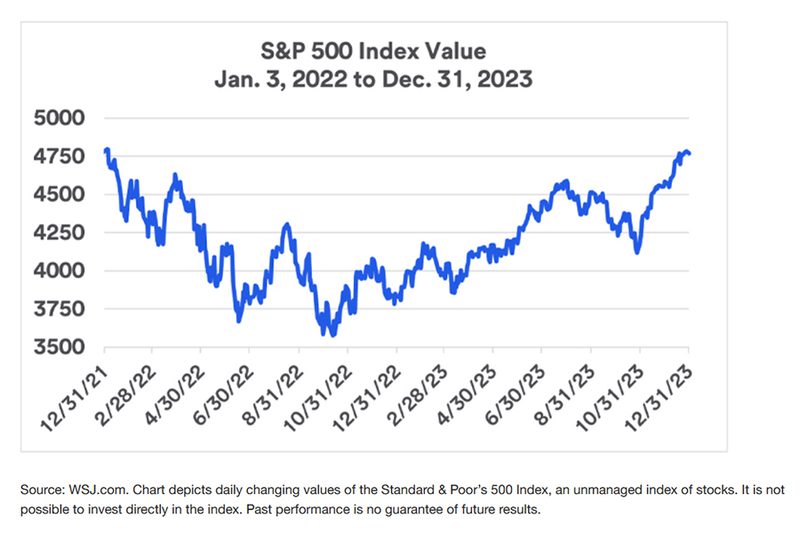

Markets staged an impressive reversal in the fourth quarter thanks to a surprise dovish pivot by the Federal Reserve, which combined with solid economic activity and declining inflation to push stocks sharply higher and send the S&P 500 to two-plus-year highs, resulting in the best annual return since 2021.

The strong fourth quarter performance somewhat obscures the fact that stocks and bonds started the fourth quarter under significant pressure. First, Treasury yields continued to move higher in early October which weighed on stocks and bonds, just like in the third quarter. Then on October 7th, Hamas soldiers infiltrated settlements in Israel, killing and kidnapping more than 1,200 Israelis in the worst attack on Israel in decades. The market fallout was immediate, as oil prices spiked on fears a broader regional war would ensue between Israel, Hamas, Lebanon and, potentially, Iran. Higher oil prices fueled a further increase in Treasury yields as investors priced in a possible oil-driven bounce back in inflation. Those factors, combined with a lackluster earnings season, resulted in the S&P 500 falling to the lowest levels since mid-May while the 10-year Treasury yield touched 5.00% for the first time since the mid-2000s. However, markets reversed when Fed Governor Chris Waller made comments that implied rate hikes were over and rate cuts may be coming in 2024. The market reaction was immediately positive as bond yields fell sharply and stocks rallied hard into month-end to finish well off the lows and with just a 2% decline.

That positive momentum continued in November as the S&P 500 posted its best monthly return of 2023, rising more than 9%. There were several factors that fueled this rally. First, numerous Fed officials echoed Waller’s commentary and investors priced in rate cuts as early as May, substantially earlier than previously expected. Additionally, the Israel/Hamas conflict did not spread and remained contained between Israel and Hamas and oil prices declined as a result, easing inflation concerns. Finally, inflation metrics continued to decline. The year-over-year increase in the Consumer Price Index dropped to 3.14% and that further fueled investor expectations that rate cuts would come in the first half of 2024. Those factors combined with favorable seasonality to fuel an early “Santa Claus Rally.”

The Santa rally continued and accelerated in December courtesy of the Fed. At the December 13th FOMC meeting, Fed officials clearly signaled that rate hikes were over and forecasted three rate cuts in 2024, one more than previously forecasted. Additionally, Fed Chair Powell did little to push back against the markets’ expectations for rate cuts. Put plainly, the Fed surprisingly pivoted to a more dovish policy stance and that fueled a continuation of the rally that started in late October. The S&P 500 rose to the highest level since January 2022 while the Dow Industrials hit a new all-time high.

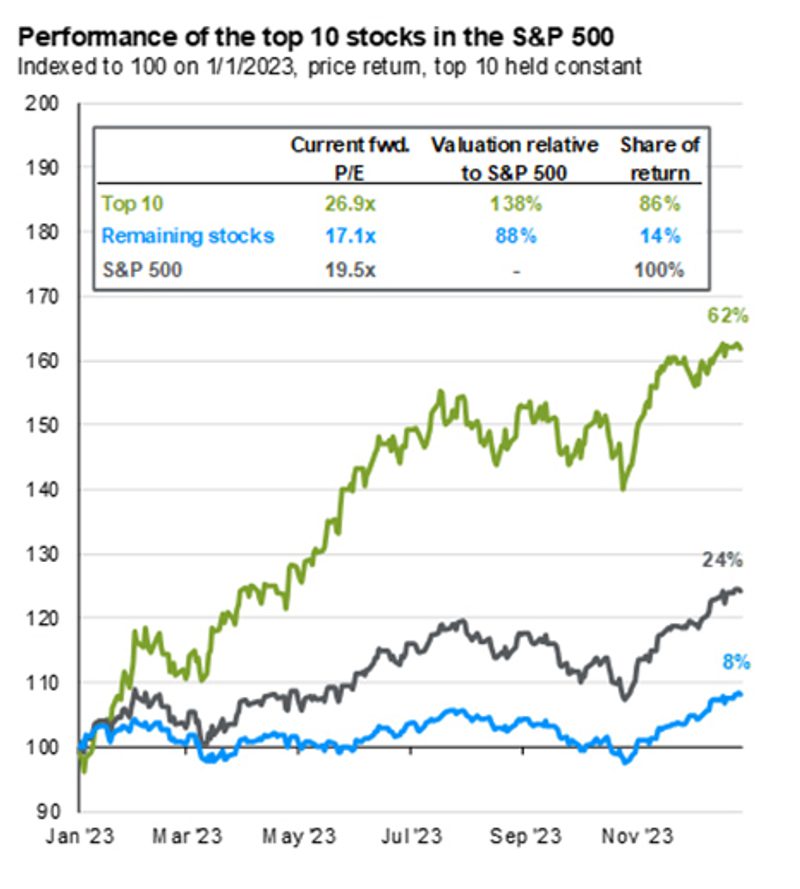

In sum, 2023 was a year of surprises for the markets as the expectations for a recession never materialized, inflation fell faster than forecasts, corporate earnings proved resilient and the Fed surprised markets by pivoting to a more dovish future policy. The result was substantial gains for the major averages. However, the gains in the S&P 500 were concentrated in just ten large companies (up 62%), while the rest of the index rose just 8% for the year.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. The top 10 companies used for this analysis are held constant and represent the S&P 500’s 10 largest index constituents at the start of 2023. The top 10 stocks are: AAPL, MSFT, AMZN, NVDA, GOOGL, BRK.B, GOOG, META, XOM, UNH, and TSLA. The remaining stocks represent the rest of the 494 companies in the S&P 500.

Q4 and Full Year 2023 Performance Review

Stocks enjoyed a broad and powerful rally in the fourth quarter as all four major U.S. stock indices posted strong quarterly gains. Investor expectations for rate cuts in 2024 were a major influence on markets in the fourth quarter as the Russell 2000 and Nasdaq 100 outperformed the S&P 500 over the past three months, as companies in those two indices are expected to benefit most from a sustainable decline in interest rates. For the full year, however, the dual influences of 1) Artificial Intelligence (AI) enthusiasm and 2) Rate cut expectations drove performance as the tech-heavy Nasdaq 100 massively outperformed the other major stock indices, surging more than 50%.

The S&P 500 also logged a substantial gain of over 20% thanks mostly to the large weighting of technology stocks in the index. The less-tech-stock-sensitive Dow Industrials and Russell 2000 also enjoyed strong returns in 2023 but underperformed the Nasdaq and S&P 500. Notably, the index performance for the full year 2023 was the opposite of 2022, where we saw the Nasdaq and small caps decline substantially more than the S&P 500 and Dow Jones Industrial Average.

- By market capitalization, small caps outperformed large caps in the fourth quarter thanks to those surging rate cut expectations, as lower rates are typically most beneficial for smaller companies. For the full year, however, large caps handily outperformed small caps thanks to the strength in large-cap tech stocks and as the higher rates in the first three quarters of 2023 weighed on small cap performance earlier in the year.

- From an investment-style standpoint, growth significantly outperformed value both in the fourth quarter and for the full year. The reasons were familiar ones: Artificial intelligence enthusiasm powered tech-heavy growth funds early in 2023 while in the fourth quarter expectations for rate cuts were seen as positive for growth stocks. Growth outperforming value is also the opposite of 2022, where higher rates and recession fears resulted in value outperforming growth.

- On a sector level, 10 of the 11 S&P 500 sectors finished the fourth quarter with a positive return, while eight of the 11 sectors ended 2023 with gains. Not surprisingly, the dual influences of artificial intelligence enthusiasm and expectations for rate cuts drove sector trading in the fourth quarter and throughout the year. In the fourth quarter, the influence of expected lower rates was dominant as REITs were the best performing sector, followed by tech. Both stand to benefit from falling interest rates. Cyclical sectors also outperformed over the past three months as expectations for stable economic growth rose as the Fed telegraphed future rate cuts. For the full year, however, the influence of AI enthusiasm was clearly the dominant influence on sector trading, as the three most “AI sensitive” sectors (tech, consumer discretionary and communications services) massively outperformed the remaining eight S&P 500 sectors.

- Looking at sector laggards for the fourth quarter and for the full year, defensive sectors including consumer staples and utilities lagged as economic growth was more resilient than expected while higher rates (for most of 2023) reduced the demand for high dividend yielding sectors. Consumer staples and utilities posted negative returns for 2023 after being the best relative performers in 2022.

- Internationally, foreign markets lagged the S&P 500 in the fourth quarter thanks mostly to muted gains in the emerging markets following increased geopolitical tensions in the Middle East and on continued lackluster Chinese economic growth. Foreign developed markets outperformed emerging markets in Q4 on better-than-expected inflation readings and rising expectations other major central banks will follow the Fed’s lead and cut rates in 2024. For the full-year 2023, foreign developed markets registered solidly positive returns but underperformed the S&P 500 thanks primarily to the large gains in U.S. tech stocks.

- Commodities declined broadly in the fourth quarter as weakness in oil, which was driven by reduced geopolitical fears and rising global economic growth worries, offset a solid gain in gold. Gold rallied on a falling U.S. dollar and hit a new all-time high in early December. For 2023, commodities saw modestly negative returns as concerns about economic growth, especially from China and parts of Europe, weighed on commodity demand expectations. Gold, however, did finish the year with a solidly positive return thanks to the fourth quarter dollar decline.

- Switching to fixed income markets, the leading benchmark for bonds (Bloomberg U.S. Aggregate Bond Index) realized a positive return for the fourth quarter and for the full year as falling inflation and expectations for rate cuts in 2024 pushed bonds higher.

- Looking deeper into the fixed income markets, longer-duration bonds outperformed those with shorter durations in the fourth quarter as bond investors reacted to lower-than-expected inflation and priced in future Fed rate cuts. For the full year, however, shorter-duration debt outperformed longer-term bonds as high inflation readings through the first three quarters of 2024 weighed on the long end of the yield curve.

- Turning to the corporate bond market, both high yield and investment grade bonds posted sharply positive returns for the fourth quarter as investors embraced the idea of lower interest rates and reduced recession chances. For the full year, high yield corporate bonds posted a strong return and outperformed investment grade corporate debt as the resilient economy pushed investors to embrace more risk in return for a higher yield.

S&P 500 Total Returns by Month in 2023

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 6.28% | -2.44% | 3.67% | 1.56% | 0.43% | 6.61% | 3.21% | -1.59% | -4.77% | -2.10% | 9.13% | 4.54% |

Source: Morningstar

| U.S. Equity Indexes | Q4 Return | 2023 Return |

|---|---|---|

| S&P 500 | 11.69% | 26.29% |

| DJ Industrial Average | 13.09% | 16.18% |

| NASDAQ 100 | 14.60% | 55.13% |

| S&P MidCap 400 | 11.67% | 16.44% |

| Russell 2000 | 14.03% | 16.93% |

Source: YCharts

| International Equity Indexes | Q4 Return | 2023 Return |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 10.47% | 18.85% |

| MSCI EM TR USD (Emerging Markets) | 7.93% | 10.27% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 9.82% | 16.21% |

Source: YCharts

| Commodity Indexes | Q4 Return | 2023 Return |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | -10.73% | -4.27% |

| S&P GSCI Crude Oil | -21.29% | -11.17% |

| GLD Gold Price | 11.55% | 13.11% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q4 Return | 2023 Return |

|---|---|---|

| BBg US Agg Bond | 6.82% | 5.53% |

| BBg US T-Bill 1-3 Mon | 1.38% | 5.14% |

| ICE US T-Bond 7-10 Year | 6.42% | 3.38% |

| BBg US MBS (Mortgage-backed) | 7.48% | 5.05% |

| BBg Municipal | 7.89% | 6.40% |

| BBg US Corporate Invest Grade | 8.50% | 8.52% |

| BBg US Corporate High Yield | 7.16% | 13.44% |

Source: YCharts

What actions did we take in McKinley Carter portfolios last quarter?

- We reduced our small cap exposure in December in ActiveTrack, Earnings Focus, and Hybrid models. This was due to the significant runup in price of our two small cap holdings, Dimensional U.S. Targeted Value ETF (DFAT) and iShares Core S&P Small-Cap ETF (IJR), despite ongoing negative earnings revisions for the small cap index. With the proceeds, we added to the iShares S&P 500 Value ETF (IVE) in ActiveTrack models and the iShares Russell Top 200 ETF (IWL) in Earnings Focus and Hybrid models.

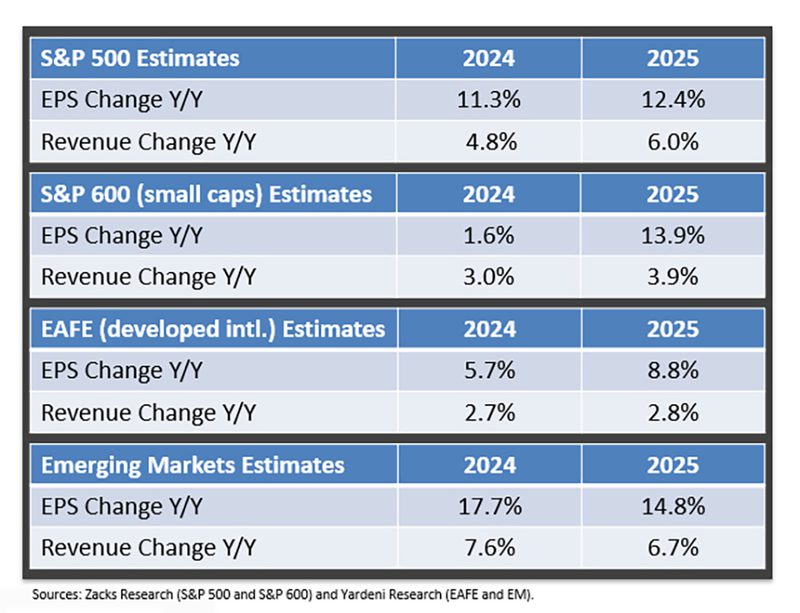

- Also in December, we sharply increased our allocation to the iShares MSCI Emerging Markets ex China ETF (EMXC) in ActiveTrack, Earnings Focus, and Hybrid models. With Emerging Markets’ projected earnings for 2024 being far superior to Developed Intl. Markets, we reduced our exposure to the Vanguard Developed Markets Index Fund (VEA). Falling interest rates should provide support for Emerging Markets as those markets are particularly sensitive to moves in the U.S. dollar index which is influenced by U.S. Treasury rates.

A look ahead - our outlook for 2024

What a difference a year makes.

At this time last year, the S&P 500 had just logged its worst annual performance since the financial crisis, the Fed was in the midst of the most aggressive rate hike campaign in decades, inflation was above 6% and concerns about an imminent recession were pervasive across Wall Street.

Now, as we begin 2024, the market outlook couldn’t be much more positive. The Fed is likely done with rate hikes and cuts are on the way this year. Economic growth has proven more resilient than most expected and fears of a recession are all but dead. Inflation dropped substantially in 2023 and corporate earnings growth is expected to resume in the coming year.

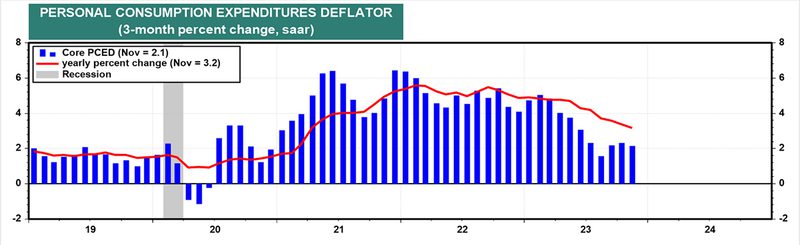

Inflation, the key factor in the decision-making process of the Fed, has declined to a level that no longer calls for additional Fed tightening. The favorite inflation index used by the Federal Reserve is the core Personal Consumption Expenditures, or PCE, index that removes the volatile impacts of Food and Energy prices. While the most recent data show a 3.2% year-over-year increase in inflation, the recent trend of monthly data shows a reading of only slightly above 2%. This is important because the Federal Reserve has declared that 2% inflation is their long-term goal. Based on commentary at their last meeting, we believe the Fed has likely finished their rate-hiking cycle that began in March of 2022 and led to eleven increases totaling 5%.

Source: LSEG Datastream and Yardeni Research

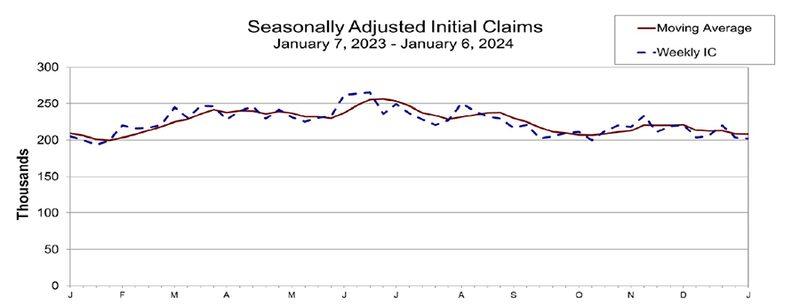

The jobs picture continues to be a positive for the markets as unemployment remains at only 3.7% and unemployment claims remain at modest levels. As long as employment remains strong, we can reasonably assume that consumer spending, which makes up two thirds of our economy, will be supportive of sustainable economic growth. However, after a period of strong consumer spending on services due to excess savings from pandemic relief funds, a slowdown in 2024 would not be a surprise. Rising credit card and subprime auto loans’ delinquency rates, while not yet at levels that warrant real concern, are worth watching to assess the overall health of the consumer.

Source: U.S. Department of Labor

The Conference Board, the global, nonprofit think tank, forecasts that real GDP grew by 2.4% in 2023, but expects it to slow to 0.9% in 2024. However, following this downturn the U.S. economy should begin to normalize. They forecast 2025 GDP growth to come in near potential at 1.7%.

In an environment where inflation is decelerating, interest rates have peaked, and the economy is growing at a modest pace, global corporate earnings can rebound this year from 2023’s tepid levels. Spurred on by earnings growth from large U.S. companies, technology, industrials, communications services, consumer discretionary, and heath care sectors are expected to generate double digit earnings growth in 2024.

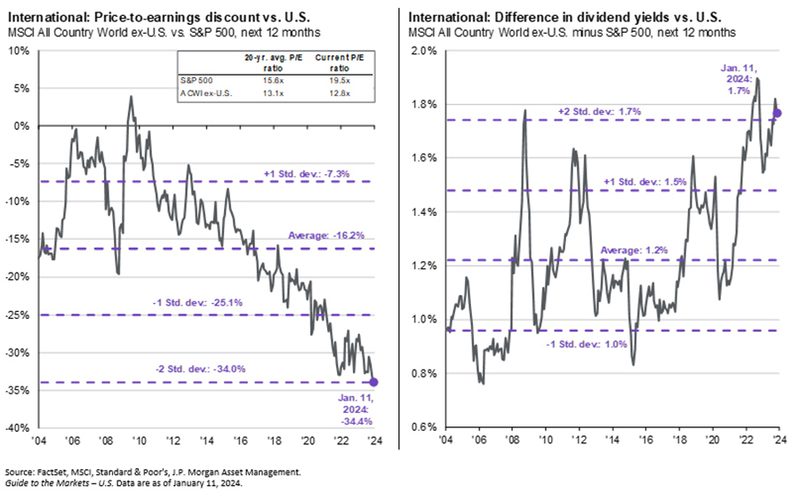

Though the current valuation of the S&P 500 is above its historic average, excluding the ten largest stocks in the index, valuations remain much more modest. In contrast to somewhat elevated valuations for U.S. stocks, international stocks remain quite reasonably valued. We continue to recommend an allocation to international stocks to supplement domestic equity positions.

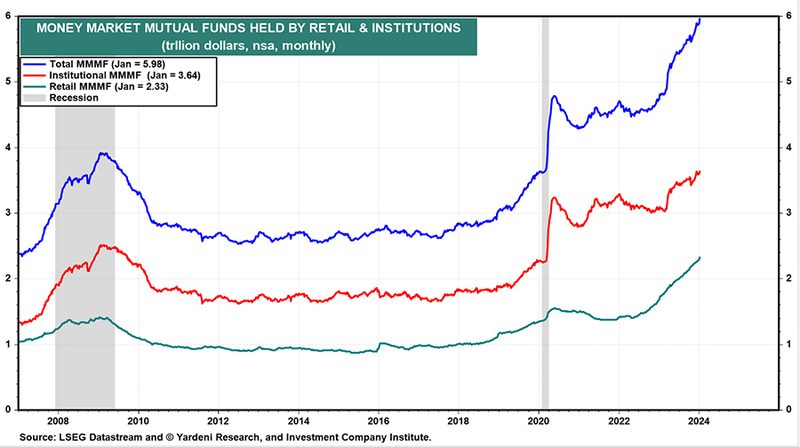

In addition, as we have previously pointed out, the massive $6 billion currently held in money market fund accounts can be a source of fuel for both the stock and bond markets as the Federal Reserve is likely to cut interest rates later this year.

While the U. S. stock market may spend some time in the first quarter digesting the impressive gains experienced in the fourth quarter of 2023, as long as we continue to get positive news regarding our three “pillars” of the investment landscape, inflation, interest rates, and corporate earnings, we believe that both the stock and bond markets can deliver modest growth in the first quarter of the year.