Note: This information is from 2022 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

Hockey's hat trick tradition is perhaps the most unique tradition in all of professional sports. For those of you that may not follow the National Hockey League as closely as other sports, a hat trick is when one player scores three goals in one game. To honor the player's performance, the hockey fans in the stands will then throw their hats onto the ice.

The stock market’s version of hockey’s hat trick is the double-digit performance of the S&P 500 over the past three years: 2021 = 28.70% | 2020 = 18.40% | 2019 = 31.49%. Read more of our analysis of 4Q2021 and a look ahead to 2022.

Part 1: Looking back at 2021

Part 2: What actions did we take in McKinley Carter portfolios in Q4?

Part 3: A look ahead - our outlook for 2022

Looking back at 2021

Hockey's hat trick tradition is perhaps the most unique tradition in all of professional sports. For those of you that may not follow the National Hockey League as closely as other sports, a hat trick is when one player scores three goals in one game. To honor the player's performance, the hockey fans in the stands will then throw their hats onto the ice.

The stock market’s version of hockey’s hat trick is the double-digit performance of the S&P 500 over the past three years:

- 2021 = 28.70%

- 2020 = 18.40%

- 2019 = 31.49%

In the final quarter of 2021, stocks overcame numerous headwinds including a resurgence in COVID cases, a lack of additional stimulus from Washington, and the Federal Reserve moving aggressively to end the current Quantitative Easing (QE) bond buying program due to spiking inflation, to hit new all-time highs and produce the strong returns for all of 2021 that completed the “hat trick.”

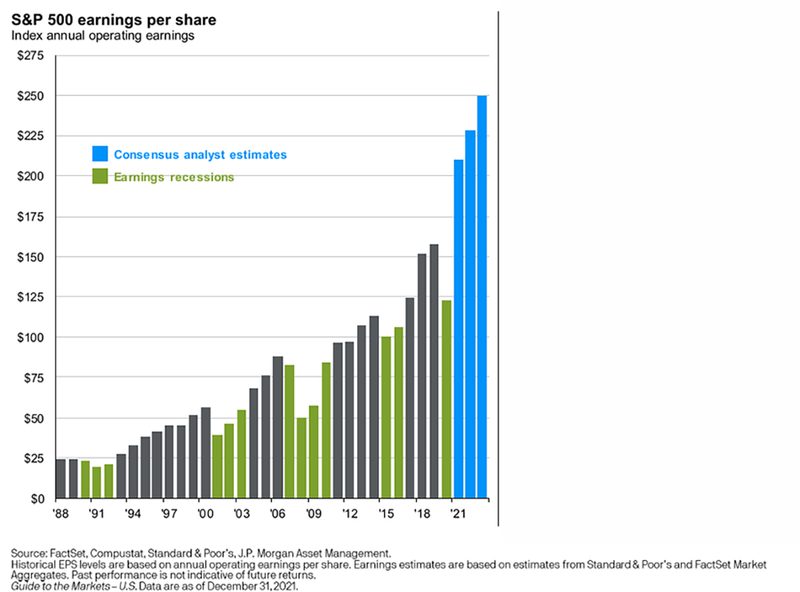

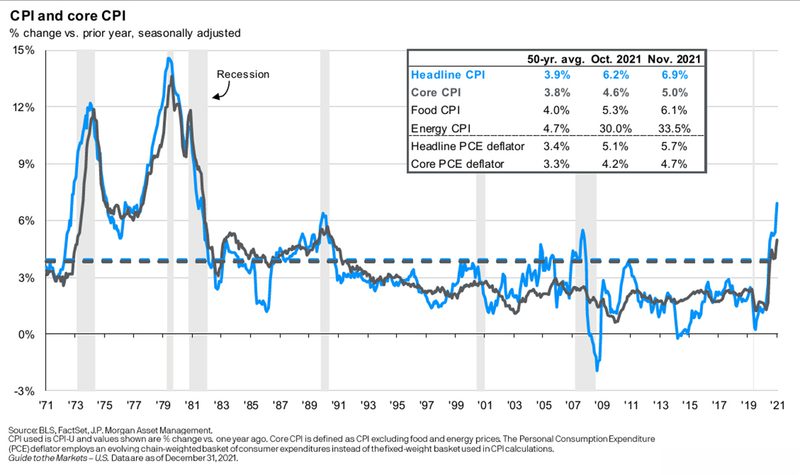

In terms of the economy, The Conference Board estimates fourth quarter real GDP growth to be a robust 6.5%, and 5.6% for all of 2021. Additionally, the U.S. unemployment rate dropped steadily during the quarter and recent unemployment insurance claims hit their lowest levels since 1969. However, inflation became a much more critical concern in the fourth quarter as the Consumer Price Index reached a year-over-year gain of 6.8%, the highest in nearly 40 years. Despite the sharp increase, long-term interest rates did not reflect that concern as they were virtually unchanged for the quarter. Finally, corporate earnings estimates climbed sharply in the period as S&P 500 earnings estimates for the fourth quarter are forecast to grow by 19%, capping off a great comeback year for S&P 500 companies’ earnings (+45%).

October

The fourth quarter started with a continuation of the volatility that we saw at the end of the third quarter, as in early October there was still little progress in Washington on extending the debt ceiling, avoiding a government shutdown, or providing investors clarity on future tax changes contained in the Build Back Better bill. That political uncertainty combined with concerns over third-quarter corporate earnings results to send stocks lower to start the fourth quarter. But by the middle of October, Republicans and Democrats had extended the debt ceiling and avoided a government shutdown, while many of the tax increases proposed in the Build Back Better bill were removed from the bill, which eased investor anxiety about future tax increases. Additionally, the third-quarter earnings season proved to be better than feared as corporate America again proved resilient. Most companies posted better-than-expected results and 2022 S&P 500 earnings expectations rose yet again. Each of those positive developments helped send the S&P 500 sharply higher in October as the S&P 500 recouped all the September losses and hit a new all-time high late in the month.

November

The positive momentum continued in early November, as the S&P 500 drifted steadily higher given the tailwinds of 1) Clarity from Washington, 2) Strong earnings, and 3) Declining COVID cases. Additionally, while the Federal Reserve announced it would begin to reduce, or taper, its Quantitative Easing (QE) bond buying program starting in November, the pace of the reductions met investor expectations and markets continued to rally and hit new all-time highs in mid-November.

But on Thanksgiving Day, the World Health Organization declared the Omicron variant of COVID-19, which had just been discovered in South Africa, a “variant of concern” and that designation caused a sharp selloff in stocks, partially thanks to very low liquidity, as governments once again closed borders to international travel, and the world wearily braced for another increase in cases.

Additionally, at Congressional testimony in late November, Federal Reserve Chairman Jerome Powell surprised markets by stating that due to persistently high inflation, the Fed would likely need to accelerate the just-announced tapering of QE and endorsed doubling the pace of reduction. That acceleration came less than a month after the Fed’s initial tapering announcement, and it caused markets to price in sooner-than-expected interest rate hikes in 2022. Concerns about future Fed policy combined with Omicron uncertainty led to declines in stocks late in November and the S&P 500 finished the month with a small loss.

December

Markets rebounded in December thanks to less aggressive messaging on rate hikes from the Fed combined with governments not imposing economically crippling lockdowns in response to the surging Omicron outbreak. First, at its December meeting, the Fed announced it will accelerate the tapering of QE in 2022, and that QE would end in mid-March, about three months earlier than expected. The Fed also signaled it expected to raise interest rates three times in 2022 to combat rising inflation. But both of those announcements largely met the latest market expectations, and some reassuring commentary by Chair Powell that the Fed would remain supportive of the economy helped ease investors’ concerns that interest rates would rise too quickly in 2022.

Then, late in December, multiple studies implied that the Omicron variant, while more contagious than previous strains, resulted in substantially fewer severe COVID cases. So, while there would likely be new records in daily cases due to Omicron, the risk of hospitalizations and deaths remained low, and as such governments could avoid lockdowns such as those seen in March 2020. That news, along with the report of strong holiday retail sales (up 8.5% from 2020 and 10.7% from pre-pandemic 2019 levels) helped stocks extend the rally late in December, and the S&P 500 finished the month with a four percent gain.

Q4 and Full Year 2021 Performance Review

Highlights:

- Large-cap stocks (S&P 500 Index) outperformed mid and small-cap stocks in the quarter and for the year. Concerns about economic headwinds from the Omicron variant and the Fed’s more aggressive Quantitative Easing tapering and rate hike schedule weighed on small-cap companies as investors sought relative safety in large-cap tech amidst the rising possibility of slower economic growth in 2022.

- From an investment style standpoint, a late-year rally in large-cap tech helped growth outperform value both in the fourth quarter and for the full year. That outperformance reflected the deceleration in economic growth during the second half of 2021 due to the Delta and Omicron variants.

- On a sector level, 10 of the 11 S&P 500 sectors finished the fourth quarter with positive returns, with the tech and real estate sectors leading the way higher. For 2021, however, energy was by far the best-performing sector in the market as a surge in oil and natural gas prices helped energy handily outperform all other market sectors. The only S&P 500 sector to post a negative return for the fourth quarter was communication services, as investors rotated out of internet-focused tech stocks and into more diversified technology companies such as Microsoft, Apple, and others. Utilities and consumer staples were the worst performing sectors for the full year, as investors focused on companies with more positive exposure to higher inflation and economic growth.

- Internationally, Developed Markets posted a positive return for the fourth quarter although they badly underperformed the S&P 500. Emerging Markets dropped in the fourth quarter in reaction to a stronger U.S. dollar while the Omicron variant also weighed on global economic growth estimates.

- Commodities saw gains in the fourth quarter as both oil and gold logged positive returns. For 2021, commodities posted a large, positive return due to the significant gains in oil futures and other energy commodities which surged as the global economy reopened and demand increased. Gold, however, saw a modestly negative return for 2021 as the increasing attractiveness of alternative investments, such as Bitcoin and other cryptocurrencies, combined with a stronger dollar to weigh on precious metals.

- Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays U.S. Aggregate Bond Index) finished flat for the fourth quarter but declined for the full-year 2021, as the potential for sooner-than-expected Fed rate hikes combined with still-high inflation weighed on most bond classes. Higher-yielding, but lower-quality corporate bonds posted a positive return and outperformed on a full-year basis, as investors flocked to riskier debt amidst low rates, elevated inflation, and strong economic growth.

S&P 500 Total Returns by Month in 2021

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|

| -1.01% | 2.76% | 4.38% | 5.34% | 0.70% | 2.33% | 2.38% | 3.04% | -4.65% | 7.01% | -0.69% | 4.48% |

Source: Morningstar

| U.S. Equity Indexes | Q4 Return | 2021 Return |

|---|---|---|

| S&P 500 | 11.03% | 28.71% |

| DJ Industrial Average | 7.87% | 20.95% |

| NASDAQ 100 | 11.28% | 27.51% |

| S&P MidCap 400 | 8.00% | 24.76% |

| Russell 2000 | 2.14% | 14.82% |

Source: YCharts

| International Equity Indexes | Q4 Return | 2021 Return |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 2.74% | 11.78% |

| MSCI EM TR USD (Emerging Markets) | -1.24% | -2.22% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 1.88% | 8.29% |

Source: YCharts

| Commodity Indexes | Q4 Return | 2021 Return |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | 1.51% | 40.35% |

| S&P GSCI Crude Oil | 0.24% | 55.01% |

| GLD Gold Price | 4.09% | -3.75% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q4 Return | 2021 Return |

|---|---|---|

| BBgBarc US Agg Bond | 0.01% | -1.54% |

| BBgBarc US T-Bill 1-3 Mon | 0.01% | 0.04% |

| ICE US T-Bond 7-10 Year | 0.44% | -3.07% |

| BBgBarc US MBS (Mortgage-backed) | -0.37% | -1.04% |

| BBgBarc Municipal | 0.72% | 1.52% |

| BBgBarc US Corporate Invest Grade | 0.23% | -1.04% |

| BBgBarc US Corporate High Yield | 0.71% | 5.28% |

Source: YCharts

What actions did we take in McKinley Carter portfolios in Q4?

December:

In the ActiveTrack, Earnings Focus, and Hybrid programs, we reduced our exposure in the Vanguard International Growth Fund (VWILX) in order to move our overall international stock exposure (relative to total equity exposure) to 36% from 38%. This was done to reflect a more challenging economic environment for global supply chains and the resulting impact on a diverse group of international companies.

In the ActiveTrack program, the proceeds from the reduction in VWILX were added to our iShares Russell 1000 ETF (IWB) position.

In the Earnings Focus and Hybrid programs, we allocated the proceeds from the VWILX reduction to the iShares Core S&P Small-Cap ETF (IJR). We also eliminated our Activision (ATVI) position due to earnings uncertainty and ongoing litigation and added Linde (LIN - Linde is an industrial gas and engineering company). Linde was formerly known as Praxair Inc.

In the Dividend Focus program, we eliminated the Orion Office REIT Inc. (ONL) position, a spinoff from Realty Income Corporation (O).

In all TAS (tax sensitive) models, we replaced the BMO Intermediate Tax-Free Fund (MIITX) with the Vanguard Tax-Exempt Bond Index Fund ETF (VTEB) due to BMO’s decision to exit the U.S. asset management business.

A look ahead - our outlook for 2022

The S&P 500’s three-year average annual return of 26% naturally leads to the question of what’s next for the stock market. Are the outsized gains in this large cap stock index over the past three years an anomaly that needs to be unwound or are there reasons to believe that the fundamentals of the market can support further gains?

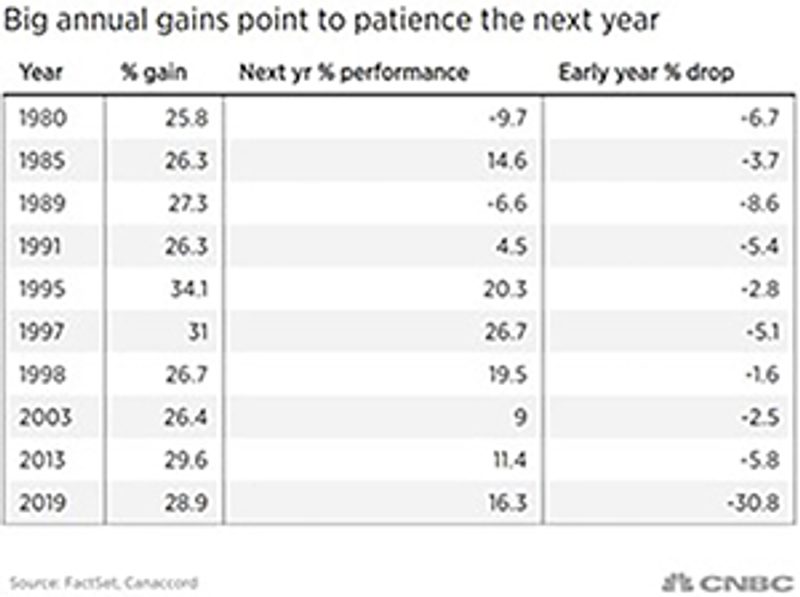

Historical data compiled by DataTrek Research shows the S&P 500’s performance in January following a strong year can be lackluster.

Since 1980, the S&P 500’s return in January is flat on average after returning more than 20% in the prior year, DataTrek found. The firm added that while the S&P 500 typically rises in the first five trading days of the new year — the tail-end of the “Santa Claus rally” period — that positive momentum fades through the end of January.

However, in those years, pullbacks tended to be excellent buying opportunities.

Our base case for markets

In our base case scenario, we foresee 2022 as another positive year for stocks, but caution investors that overall returns for stocks are likely to be lower than in the last 12 months, and volatility is likely to be higher coming off three consecutive years of above-average returns. We feel bond performance will be challenged again this year by a strong economy and a less accommodative Federal Reserve policy. We favor an underweight to bonds as any increase in interest rates will negatively impact bond prices.

We believe there are several key market drivers for 2022:

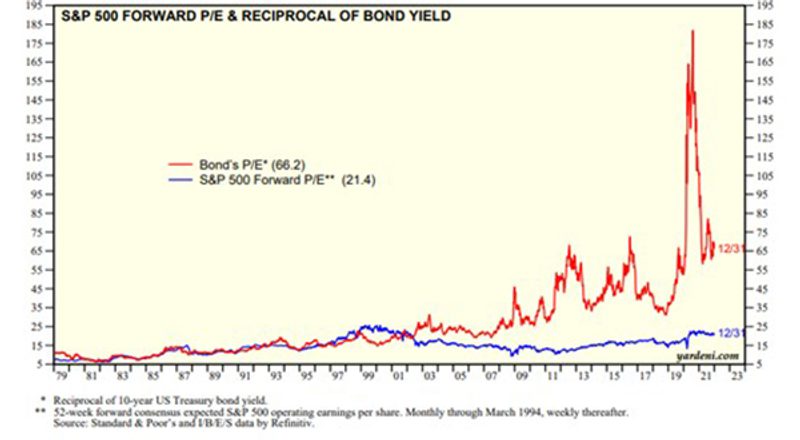

FIRST: While stocks are still expensive relative to their history, they are reasonably valued relative to low interest rate bonds.

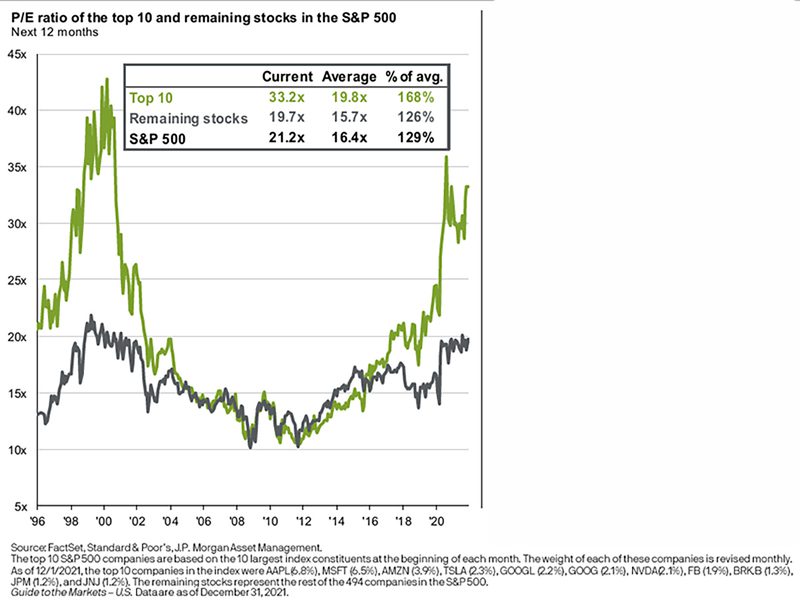

Also, while the S&P 500 is expensive today, the high valuation is significantly influenced by the ten largest stocks. Excluding those, the rest of the index is not as richly priced.

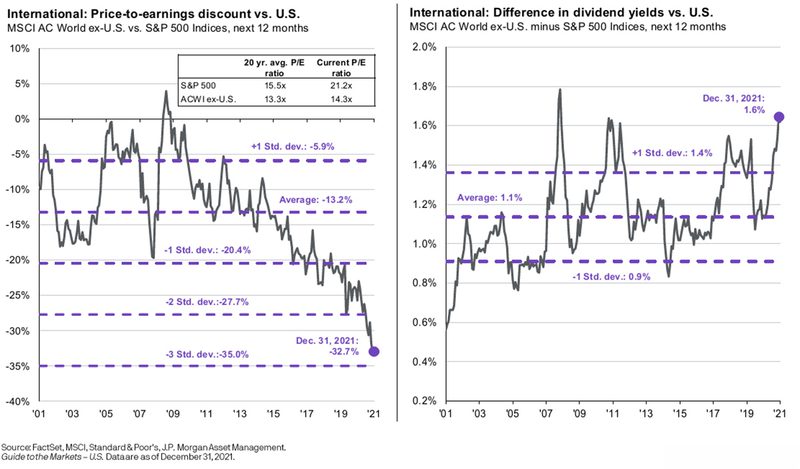

Within the stock market, we favor a combination of secular growth and economically sensitive U.S. value stocks along with an allocation to historically inexpensive international stocks. Higher valuation growth stocks, the big winners of the past few years, may underperform less expensive stocks as the Fed begins to lessen their bond buying program and moves to raise rates in 2022.

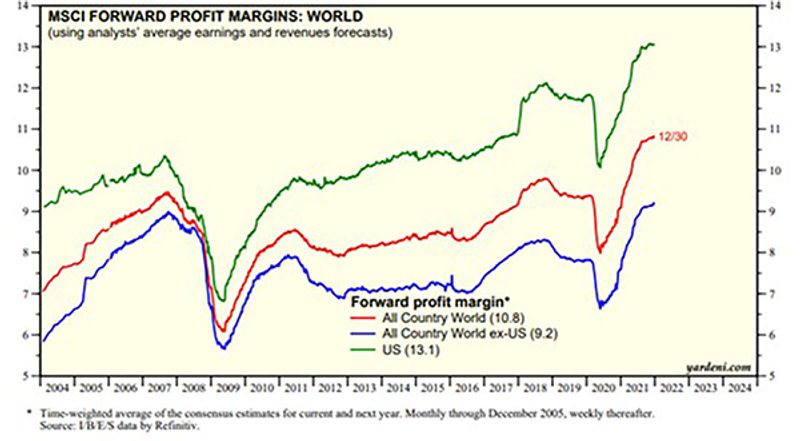

SECONDLY: Technological productivity and a more financially secure U.S. consumer continue to power the U.S. economy and corporate earnings despite COVID-related headwinds.

Companies have become more efficient during COVID and have, in general, been able to maintain their profit margins.

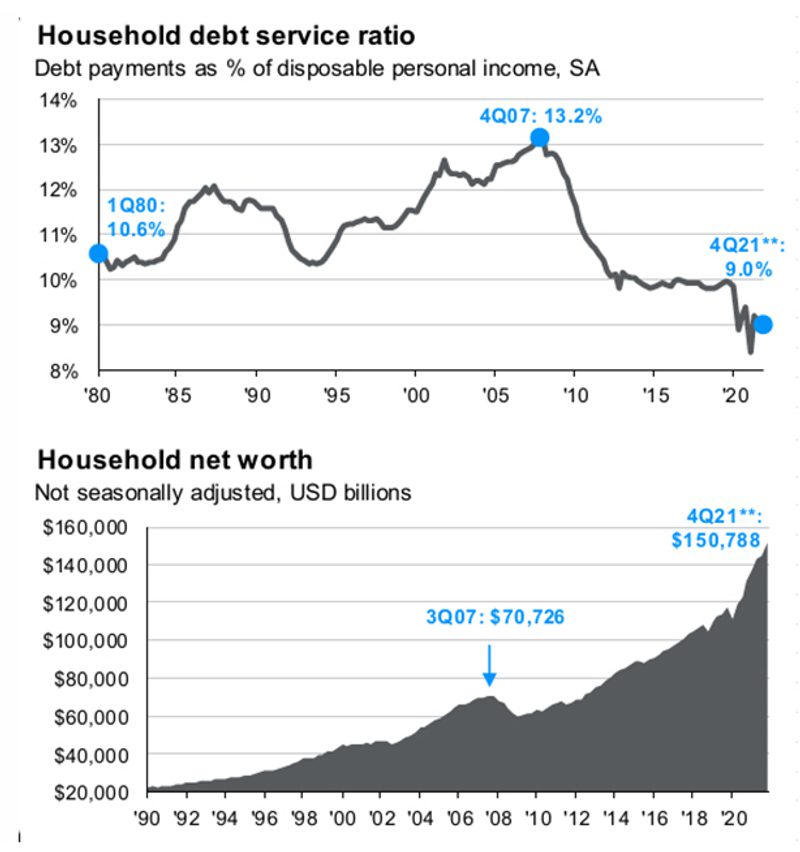

Also, consumer balance sheets are in much better shape than in the recent past as household debt service to disposable income ratios are low and consumer savings balances and net worth are still high as a result of the stimulus payments and rising stock market during the past two years.

AND LASTLY: Inflation is likely to peak in 2022 as supply chain shocks ease

We believe that much of the current inflation surge will prove temporary, including the energy and supply chain issues. While peaking inflation does not necessarily mean low inflation, any deceleration in the current uptrend will likely be welcomed by markets.

The three biggest risks to our forecasts are:

- #1: COVID variants may continue to stall the global economic recovery.

While COVID death rates in the U.S. and globally have likely peaked, variants still represent a threat to economies as cases of the Omicron variant are spiking.

However, as more people are vaccinated and/or infected, we move closer to the “herd immunity” levels needed to dramatically slow the progress of the disease. In addition, new therapeutics have been shown to be quite effective in treating many COVID patients. As 2022 progresses and the weather warms, COVID cases, and the severity of outcomes, will likely decline. Economic activity will likely pick up and corporate earnings and the stock market should reflect the positive change.

- #2: High inflation may be more persistent than we expect

Inflation data is running well above the Federal Reserve’s 2% long-term target (Core PCE) and if COVID restrictions persist through the first quarter, this could lead to ongoing higher costs for goods and services. While we agree with the Federal Reserve’s position that many of these costs are temporary spikes reflecting the year-over-year comparisons with pandemic lows, any further indications of rising inflation would likely lead to higher interest rates and could pressure both the stock and bond markets. The impacts of higher wage growth, rising rents and generally higher inflation expectations may linger and would imply inflation that is well above 2% for the remainder of this economic expansion.

However, if inflationary pressures ease next year due to supply chain bottlenecks abating and the ongoing deflationary benefits of cost-saving technologies, long-term interest rates may remain range-bound, and the Fed may delay increases in short-term rates. These would be positive developments for the stock market.

- #3: Earnings growth could be more than offset by valuation contraction if interest rates rise more than expected

S&P 500 earnings projections for 2022 are for a 9% increase. This is a marked deceleration from the 45% projected growth in 2021 and may not be robust enough to offset a potential PE contraction from today’s elevated levels should the Fed take more aggressive action to constrain inflationary pressures. Also, as the Fed has taken the position that they will halt their monthly bond purchases by the spring and then move to raise short-term interest rates beginning as early as the summer, they will no longer be supportive of the bond market and the current near-zero short-term lending rates.

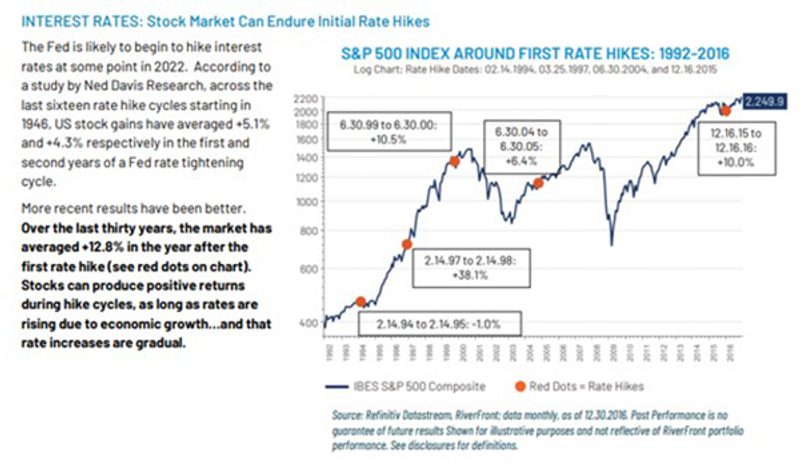

However, a silver lining in a likely rate-hiking environment is the stock market’s positive historical performance as long the Fed begins to raise the Federal Funds rate at a gradual pace and the economy is growing.

Final thoughts

Politics will also be a source of potential volatility in the first quarter of 2022 and beyond. Democrats failed to pass the Build Back Better social spending bill in 2021, but the process is not over, and none of us should be surprised if some version of that legislation passes in early 2022. From a market standpoint, investors will be most focused on any potential tax increases that might reduce corporate profits or consumer spending. Given the current version of the bill, market-negative tax increases look unlikely, but the legislative process is unpredictable, and we’ll continue to monitor the situation for any negative tax implications. Additionally, there will be midterm elections in November, and as is usually the case, we can expect the run-up towards the midterms to cause at least temporary market volatility.

Global tensions may also be a factor in 2022 as the Russian government builds a military presence on the border of Ukraine and the possibility exists that China takes more aggressive actions toward Taiwan.

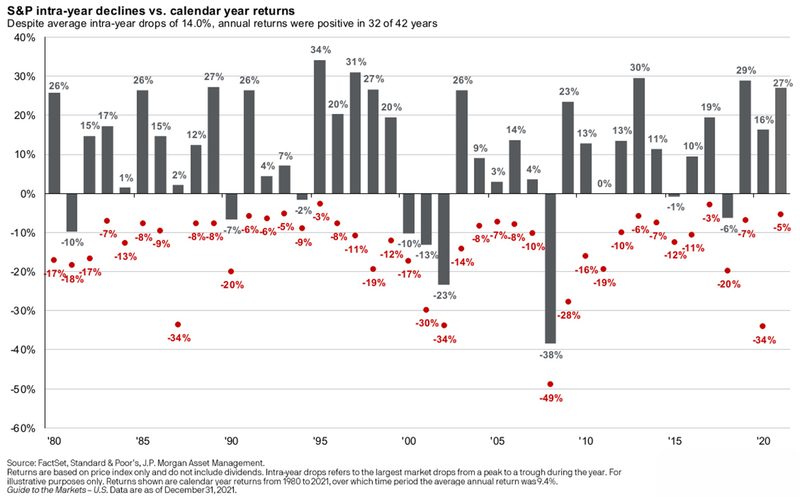

Despite the economic and medical progress achieved in 2021, we remain vigilant towards risks to portfolios and the economy. While geopolitical and U.S. political uncertainty present a threat to markets, and risks of persistent inflation and a less friendly Federal Reserve exist, macroeconomic fundamentals (GDP growth, corporate earnings, still low interest rates) are still decidedly positive. It is important to remember that a well-executed and diversified, long-term financial plan can overcome bouts of even intense volatility (red dots in the chart below) such as we’ve seen in the past and will likely see again.

* Banner Image Source: Click HERE