In the Terminator movie franchise, the third installment was titled Terminator 3: Rise of the Machines

and continued the original movie’s theme of how the growth of

Artificial Intelligence (AI) would ultimately lead to the end of

civilization, as AI would discover that it no longer had need of humans.

Fortunately, as AI is still in its infancy, the stock market is pricing

in only the positive aspects of the technology. While graphic chips

provider Nvidia (up 82% in Q1) has served as the poster child for

Artificial Intelligence investments, many other technology companies

(such as Super Micro Computer – up 255% in Q1) with some connection, or

perceived connection, to AI rallied strongly in the first quarter. This

led to an overall positive market sentiment throughout the period that

lifted the S&P 500 and the NASDAQ 100 higher.

Ultimately, we believe the most powerful trend in AI will be the

productivity enhancements experienced by many companies across a wide

swath of industries. Read more about our thoughts on market trends and our look ahead to the remainder of 2024.

Part 1: Looking back at Q1 2024

Part 2: What actions did we take in McKinley Carter portfolios last quarter?

Part 3: A look ahead - our outlook for the rest of 2024

Looking back at Q1 2024

In the Terminator movie franchise, the third installment was titled Terminator 3: Rise of the Machines and continued the original movie’s theme of how the growth of Artificial Intelligence (AI) would ultimately lead to the end of civilization, as AI would discover that it no longer had need of humans. Fortunately, as AI is still in its infancy, the stock market is pricing in only the positive aspects of the technology. While graphic chips provider Nvidia (up 82% in Q1) has served as the poster child for Artificial Intelligence investments, many other technology companies (such as Super Micro Computer – up 255% in Q1) with some connection, or perceived connection, to AI rallied strongly in the first quarter. This led to an overall positive market sentiment throughout the period that lifted the S&P 500 and the NASDAQ 100 higher.

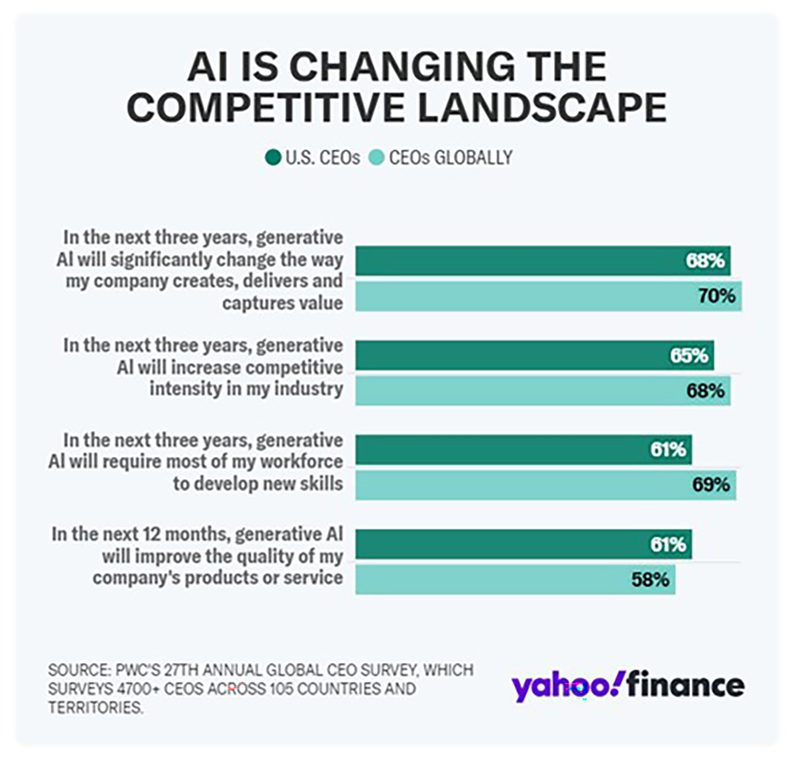

Ultimately, we believe the most powerful trend in AI will be the productivity enhancements experienced by many companies across a wide swath of industries. Generative AI (like the well-known Chat GPT), a type of AI that can create new content and ideas, including conversations, stories, images, videos, and music, will undoubtedly have a huge impact on how we work and play in the future. Many Artificial Intelligence-related investment opportunities will present themselves going forward and our focus will be on the ones that best monetize the potential ahead.

The Key Events of the Quarter

The 2023 rally continued in the first quarter of 2024 as a positive combination of stable economic growth, falling inflation, impending Fed rate cuts and ever-growing enthusiasm towards AI propelled stocks higher, as the S&P 500 rose above 5,000 for the first time and hit new all-time highs.

The year began with a modest uptick in volatility, as traders and investors initially booked profits following the strong 2023 gains. However, those initially small declines intensified shortly after the start of the year when the December Consumer Price Index, an important inflation indicator, declined less than expected. That reading challenged the idea that inflation was quickly falling towards the Fed’s 2.0% target and caused investors to delay the expected date of the first Fed rate cut, as expectations for that first cut moved from March to June. Fears of potentially higher-than-expected rates pushed stocks temporarily into negative territory early in January. However, the declines didn’t last. First, fourth-quarter corporate earnings were again better than feared and that helped stocks recover from those early declines. Then, in late January, the Federal Reserve clearly signaled that rate hikes were over and strongly hinted that rate cuts would occur in the coming months. Investors seized on that positive message and the S&P 500 hit a new all-time high late in the month and finished with a modest gain, up 1.59%.

The rally continued and accelerated in February as fears of a potential rebound in inflation subsided. Inflation metrics released in February largely met expectations and importantly did not imply that inflation was reaccelerating. As such, investor expectations for a June rate cut were strengthened and that helped stocks extend the year-to-date gains. Then, on February 21st, Nvidia, the semiconductor company at the heart of the AI boom, posted much-stronger-than-expected earnings and guidance. Those results further fueled investors’ AI enthusiasm and large-cap tech stocks powered the S&P 500 higher into month-end as the index hit a new record high above 5,000. The benchmark domestic index gained 5.34% in February.

March saw even more gains, aided by familiar factors such as solid economic growth (manufacturing data joined services data in indicating expansion), generally as-expected inflation data, AI enthusiasm, and bullish Fed guidance. Broadly speaking, economic and inflation data largely met expectations in March and continued to point towards stable growth and (slowly) falling inflation. Then, in mid-March, updated Federal Reserve interest rate projections still pointed towards three rate cuts in 2024, further reinforcing investor expectations for a June rate cut. Those positive factors combined with additional strong AI-related earnings reports (this time from Micron) to push markets broadly higher as the S&P 500 crossed 5,200 for the first time late in the month and ended March with strong gains.

In sum, the 2023 rally continued and accelerated in the first quarter of 2024 thanks to positive news flow that implied stable growth (no recession), still falling inflation, looming Fed rate cuts and continued AI enthusiasm and those factors propelled the S&P 500 to new all-time highs.

Q1 Performance Review

The first quarter of 2024 reflected a much more evenly distributed rally compared to the fourth quarter of 2023, where tech and tech-aligned sectors handily outperformed the rest of the markets. Over the past three months markets saw broad gains distributed more equitably amongst various sectors and industries.

- While the rally in stocks did broaden out in the first quarter, that did not benefit small caps as they were some of the notable laggards over the past three months. Small caps registered a positive return for the first quarter but lagged large caps as concerns about stubbornly high interest rates weighed on small caps, as they are more sensitive to higher funding costs and slowing growth.

- From an investment style standpoint, growth once again outperformed value in the first quarter, but the margin was much closer than last year, as both investment styles logged strong quarterly returns. Continued heightened AI enthusiasm was the main reason for the modest growth outperformance over the past three months, as large-cap tech stocks again saw strong rallies in Q1.

- On a sector level, as mentioned, gains were broad as 10 of the 11 S&P 500 sectors finished the first quarter with a positive return. Unlike 2023, however, tech and tech-aligned sectors didn’t substantially outperform. To that point, the best-performing sectors in the market in the first quarter were communication services, financials, energy, and industrials. That sector mix reflected the influences of AI enthusiasm, strong financial stock guidance, solid U.S. economic data and rising optimism towards a rebound in Chinese economic growth. The diversified gains demonstrated that the Q1 rally was driven by a more varied set of influences beyond just AI enthusiasm.

- Turning to the laggards, the only S&P 500 sector to log a negative return for the first quarter was the real estate sector, as it continues to be weighed down by concerns about the health of the commercial real estate market. Specifically, terrible quarterly earnings from New York Community Bank reminded investors of the sustained weakness in the commercial real estate market and that weighed on the real estate space. Consumer discretionary also lagged and registered only a slightly positive return as numerous retailers warned about a potential slowing of consumer spending during the first quarter (this is something to monitor as we begin the second quarter).

- Internationally, foreign markets posted solid quarterly gains but still underperformed the S&P 500. Looking deeper, foreign developed markets outperformed emerging markets in Q1 thanks to better-than-expected economic data and as expectations rose for early summer rate cuts from the European Central Bank and Bank of England. Emerging markets, meanwhile, logged only slightly positive returns in Q1 and solidly underperformed the S&P 500 thanks to mixed Chinese economic data and a lack of substantial Chinese economic stimulus early in the quarter.

- Commodities saw strong gains in the first quarter thanks to still-elevated geopolitical tensions, a weaker U.S. dollar and smaller-than-expected declines in inflation. Oil rallied sharply in Q1 thanks to late-quarter optimism for an acceleration in Chinese economic growth, combined with an increase in geopolitical tensions following the continued attacks on commercial ships in the Red Sea, along with an increase in Russian attacks on Ukrainian energy infrastructure. Gold hit a new all-time high in the first quarter, meanwhile, and logged solidly positive returns thanks to the buoyant inflation data and a weaker U.S. dollar.

- Switching to fixed income markets, the leading benchmark for bonds (Bloomberg U.S. Aggregate Bond Index) realized a slightly negative return for the first quarter of 2024. Disappointing inflation readings were the primary reason for the weakness in bonds as they delayed the expected start of Fed rate cuts from March until June and caused bond investors to consider that rates may be higher than previously expected over the medium and longer term.

- Looking deeper into the fixed income markets, longer-duration bonds underperformed those with shorter durations. That performance gap was due to the slower-than-expected decline in inflation, because while it won’t materially delay the start of Fed rate cuts, it does threaten to keep rates “higher for longer,” which is a bigger negative for longer-dated debt.

- Turning to the corporate bond market, higher-yielding but lower-quality “junk” bonds outperformed investment grade debt as looming Fed rate cuts and buoyant inflation, amidst stable economic growth, led bond investors to “reach” for more yield in the riskier parts of the credit spectrum.

| U.S. Equity Indexes | Q1 Return |

|---|---|

| S&P 500 | 10.56% |

| DJ Industrial Average | 6.14% |

| NASDAQ 100 | 8.72% |

| S&P MidCap 400 | 9.95% |

| Russell 2000 | 5.18% |

Source: YCharts

| International Equity Indexes | Q1 Return |

|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 5.81% |

| MSCI EM TR USD (Emerging Markets) | 2.16% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 4.66% |

Source: YCharts

| Commodity Indexes | Q1 Return |

|---|---|

| S&P GSCI (Broad-Based Commodities) | 10.36% |

| S&P GSCI Crude Oil | 15.93% |

| GLD Gold Price | 7.93% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q1 Return |

|---|---|

| BBg US Agg Bond | -0.78% |

| BBg US T-Bill 1-3 Mon | 1.32% |

| ICE US T-Bond 7-10 Year | -1.35% |

| BBg US MBS (Mortgage-backed) | -1.04% |

| BBg Municipal | -0.39% |

| BBg US Corporate Invest Grade | -0.40% |

| BBg US Corporate High Yield | 1.47% |

Source: YCharts

What actions did we take in McKinley Carter portfolios last quarter?

- In January we added two new stock names to our Earnings Focus models: Amazon (AMZN), the large e-commerce provider and Hubbell Inc. (HUBB), an infrastructure beneficiary which is engaged in the design, manufacture, and sale of electrical and electronic products to commercial, industrial, utility, and telecommunications markets. Stocks that were eliminated from the portfolio were Tractor Supply (TSCO) and Thermo Fisher Scientific (TMO).

- In our annual rebalance of Strategic Focus models in February, we left the equities allocation unchanged from 2023. However, due to changing dynamics in the bond markets, we added the BlackRock Flexible Income ETF (BINC), a managed fixed income fund that takes a multisector approach to maximize income. We funded the new position by reducing the iShares MBS ETF (MBB) allocation as well as the iShares Broad USD Investment Grade Corp Bd ETF (USIG) allocation. Also, in our tax-free bond Strategic Focus models, we added the BlackRock High Yield Muni Income Bd ETF (HYMU) and eliminated the iShares Broad USD High Yield Corp Bd ETF (USHY) in order to replace a taxable high yield investment with tax-free high yield option.

- In the quarter, due to our positive outlook for stocks vs. bonds, we maintained our overweight position in stocks and also maintained our shorter-than-index bond duration to mitigate any upward move in longer-term bond yields that might arise from concerns over the large supply of Treasuries that the government would need to issue to fund current deficits.

A look ahead - our outlook for the rest of 2024

As we look at our three investment pillars, inflation, interest rates, and corporate earnings, for clues about future market returns, we find that, while S&P earnings continue to beat expectations due to the influence of tech companies, inflation and interest rate data have become less of a tailwind for stocks of late.

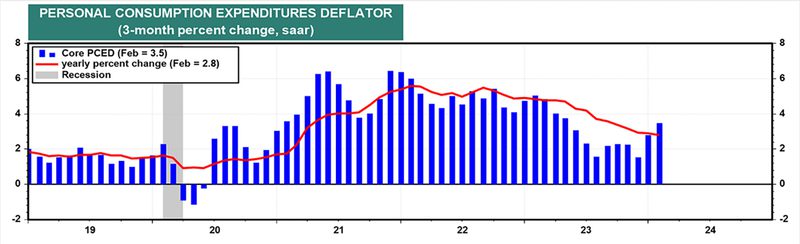

Regarding inflation trends in the first quarter, both CPI and the Federal Reserve’s favorite inflation gauge, the core Personal Consumption Expenditures, or PCE index, reported mix results. Recent data have shown that the “last mile” of declining inflation reaching the Federal Reserve’s ultimate target of 2%, may be a challenging one. Encouragingly, despite the recent rise in the three-month rate of core PCE which excludes volatile food and energy prices, the year-over-year rate declined to a multiyear low of 2.8%. We continue to monitor inflation very closely as market expectations have been for a persistent easing in inflation trends which then contributes to moderating interest rates and ongoing support for stock prices.

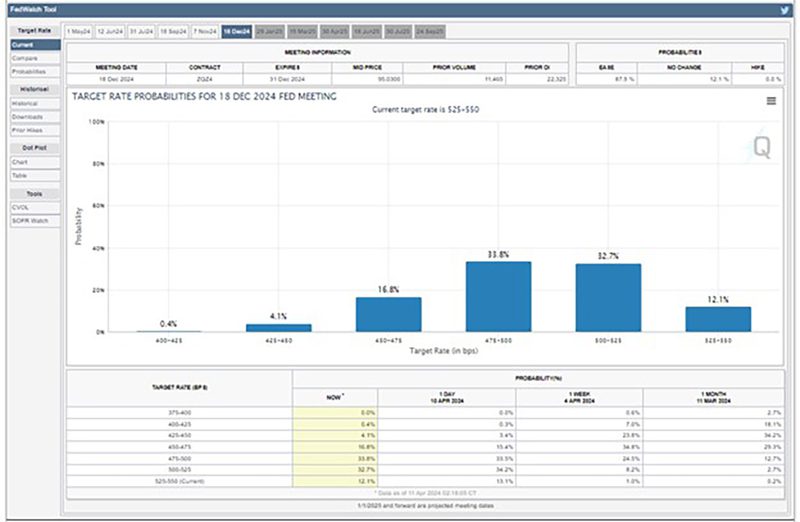

We expect the short-term interest rates controlled by the Fed to fall in the second half of 2024. The CME FedWatch Tool that tracks the probability of the Fed Funds rate being within specific ranges on specific dates, currently forecasts a 12% chance that the current high level of rates will still be in place at the end of the year. Recently though, less positive inflation data combined with strong economic trends, have brought into question how soon the Fed will announce the first rate cut and how many cuts will take place this year.

To that point, markets fully expected a June rate cut from the Fed and three rate cuts in 2024 and that assumption was central to the first-quarter rally. However, with the higher-than-expected inflation data reported in the first quarter, these rates cuts are not guaranteed, and if the Fed does not cut as aggressively as markets expect, that will likely result in disappointment and a potential decline in stocks and bonds.

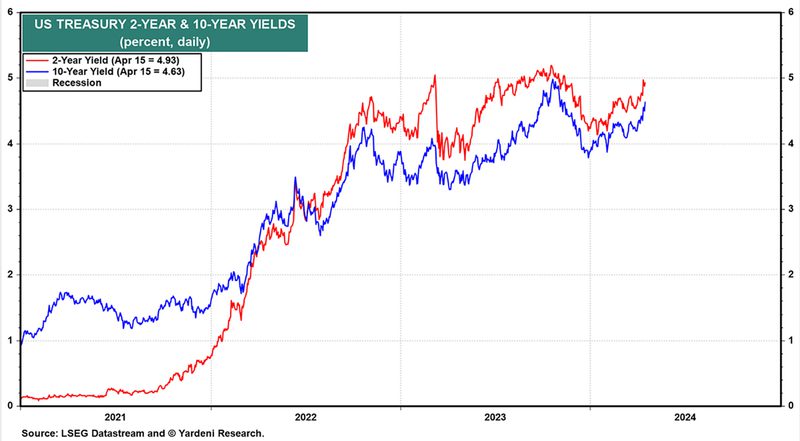

This year, bond investors have demanded higher rates on their new bond purchases due to the economic impact of stubborn inflation and continued low unemployment. This can be seen in the increase in the yield on the 10-yr. Treasury bond which recently moved back above the 4.5% level, well beyond the 3.9% rate seen at the end of 2023. This increase in rates has led to negative fixed income returns year-to-date and may serve as a short-term obstacle to higher stock prices, especially growth stocks which tend to perform better in a lower rate environment. At McKinley Carter, we have consistently maintained a shorter duration (risk measure) in our bond portfolios to guard against the threat of higher longer-term interest rates and their negative impact on bond prices.

On the earnings front, consensus S&P 500 earnings for the first quarter of 2024 are expected to be up 2.5% from the same period last year on 3.5% higher revenues. This follows the 6.7% earnings growth on 3.9% higher revenues in the fourth quarter of 2023.

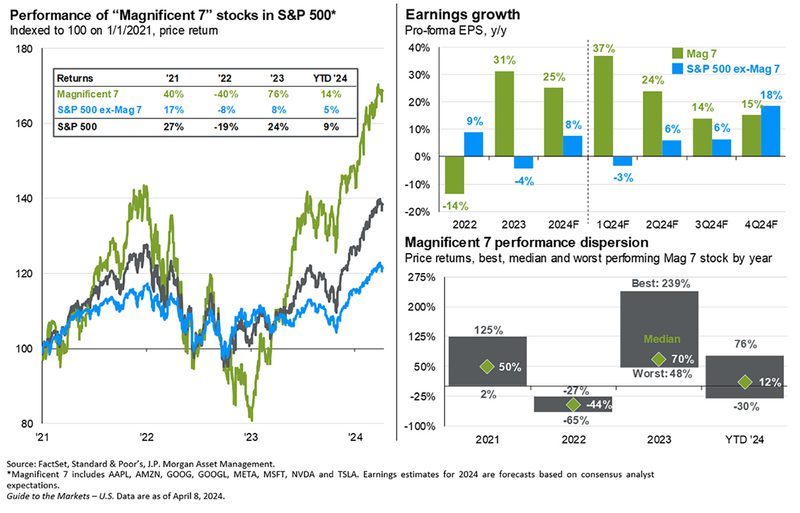

As was the case in the preceding two quarters, “The Magnificent 7” and the Tech sector remains a key growth driver for overall earnings. Had it not been for the robust Tech sector growth, total earnings for the rest of the index would be modestly in negative territory. Despite this negative outlook for the non-tech part of the market, the good news is that future quarters are expected (blue bars) to reverse this trend with earnings leadership broadening out to other sectors.

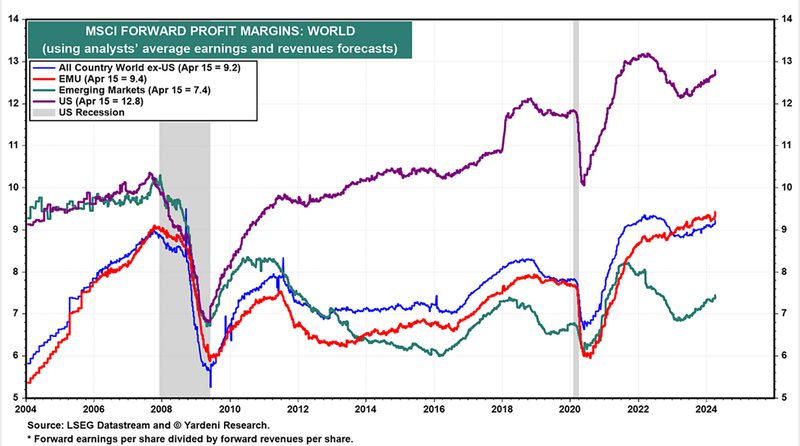

We expect a big part of this year’s earnings growth to come from profit margins reversing last year’s declines and starting to expand again. Our expectation is that profit margins this year get back toward the 2022 level, with the Tech sector driving most of the gains. In addition, margin expansion should help international markets as well.

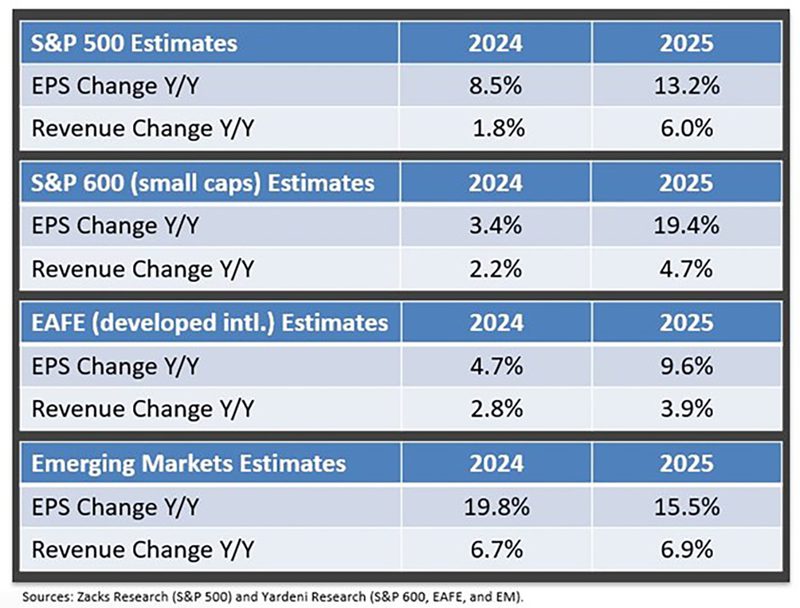

Looking at the calendar year picture, consensus S&P 500 earnings are expected to grow by 8.5% this year after last year’s modest decline. 2025 is projected to be an even better year for earnings growth with large cap, small cap, and international estimates all quite strong.

Despite some near-term challenges, namely “sticky” inflation data, and rising longer-term interest rates, our three pillars are expected to provide support for markets over the course of 2024. We remain overweighted in stocks vs. bonds.

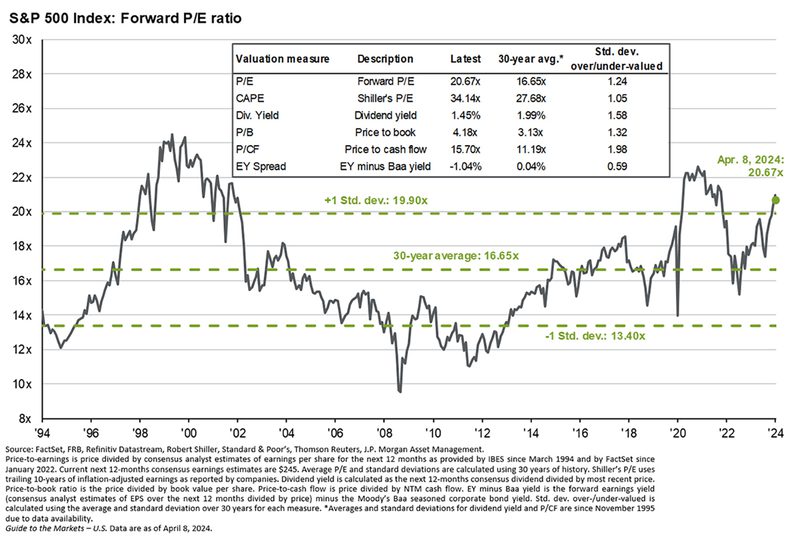

While stock market valuations are historically not effective timing tools for investors, it is important to recognize that stocks have come a long way since October of last year and valuations are a bit stretched at 21x the next 12-months earnings estimates.

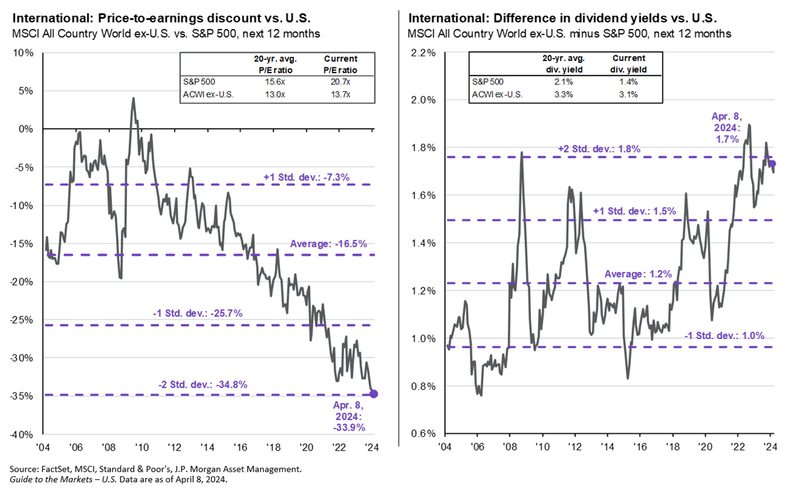

Despite this above average valuation, other indices show more modest P/E multiples. The S&P 500 equal-weighted index has a current P/E of only 17.9x and, excluding the ten largest companies in the S&P 500 index, the P/E on the remaining 490 stocks is just 18x. Additionally, foreign stocks are dramatically cheaper than U.S. stocks and do provide good value vs. U.S. stocks at these levels.

Bottom line, this historic rally is currently supported by positive fundamentals. But we cannot let the currently positive set up blind us to risks, and that’s why we are also focused on managing both reward and risk in portfolios, because despite the strong performance, this market remains vulnerable to negative news.

Finally, investor enthusiasm towards the potential for Artificial Intelligence remains a critical part of the bull market and strong earnings from Nvidia in February furthered investors’ hopes that AI integration will lead to a profitability and earnings boom, not just for tech companies, but for the entire market. However, that’s also not guaranteed and so far, AI integration has produced a lot of flashy headlines but not a lot of profit maximization for non-tech industries. If AI fails to broadly boost profits and demand declines, that will be a significant negative for this market.