Note: This information is from 2021 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

Looking back, the S&P 500 had a strong second quarter thanks to numerous positive developments that led to a “Goldilocks” economic environment. We dig deeper into performance and outline the actions we took in McKinley Carter portfolios, plus provide an outlook for the remainder of 2021.

For your convenience, we have provided a brief 3-minute video version of this quarterly investment update. To watch the video, please click on the link below, or scroll down to continue reading the blog version.

Part 1: Looking back at the second quarter of 2021

Part 2: What actions did we take in McKinley Carter portfolios in Q2?

Part 3: A look ahead - our outlook for the rest of 2021

Looking back at the second quarter of 2021

The S&P 500 had a strong second quarter thanks to numerous positive developments that led to a “Goldilocks” economic environment. As highlighted by a recent Bank of America survey, markets are currently dominated by a consensus based on three core hypotheses: durable high global growth; transitory inflation; and ever-friendly central banks.

By embracing this positive view of the world, investors have pushed stocks and corporate bonds ever higher, stabilized government bond markets, and sidelined short sellers who bet on falling stock prices.

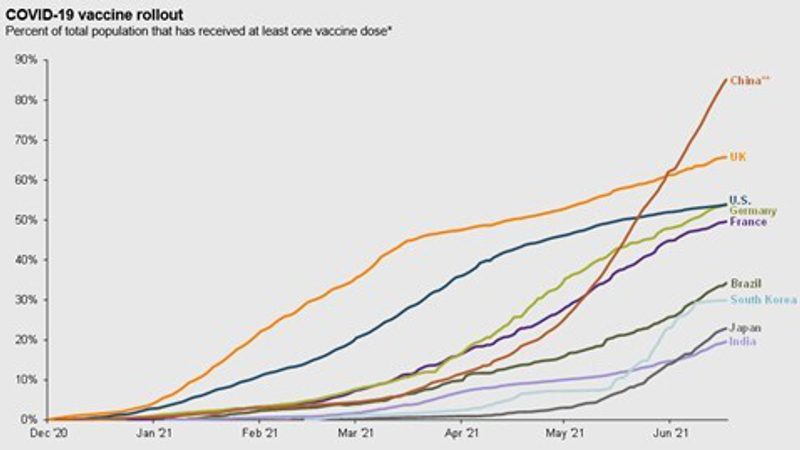

Early in the quarter, the pace of vaccinations in the U.S. accelerated meaningfully with daily vaccinations hitting a peak of more than three million per day by the middle of the month. At the same time, the number of new COVID-19 infections fell from approximately 77,000 daily new cases at the beginning of April to less than 60,000 daily new cases during the last week of the month. The increased pace of vaccinations combined with a decline in COVID-19 cases helped numerous states more fully reopen their economies or prompted the announcement of plans to do so soon. That served as a positive signal to investors that a return to pre-pandemic normal was now likely just a matter of time.

Meanwhile, the Federal Reserve reiterated its support for the economy and promised not to remove any accommodation in the near term. That continued “safety net” gave investors confidence in the future economic outlook and the sustainability of the economic recovery. Finally, first-quarter corporate earnings were very strong, as most U.S. companies beat earnings estimates. These positive factors helped stocks rally throughout the month, as the S&P 500 hit a new record above 4,200 during the final days of April.

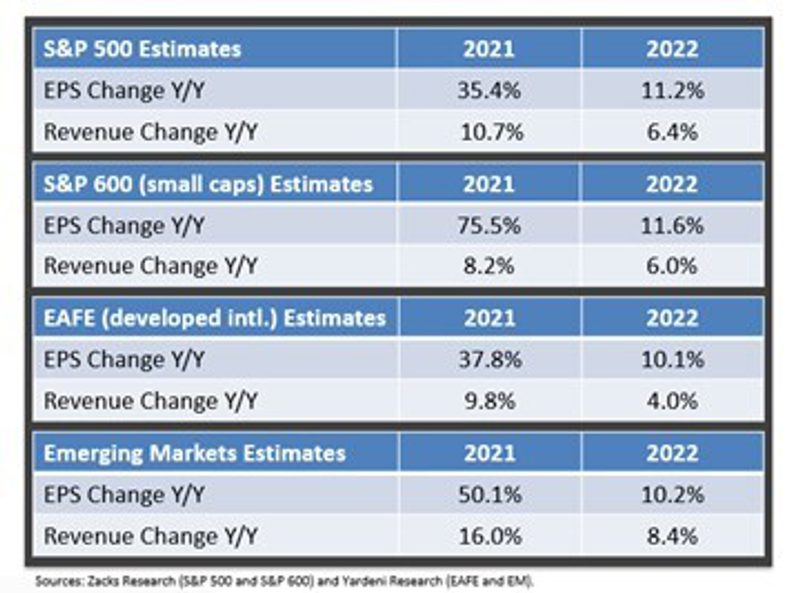

The rally paused in May, however, thanks to uncertainty regarding inflation, the labor market and when the Federal Reserve would begin to reduce, or taper, its quantitative easing (QE) program. A disappointing jobs number in early May implied the labor market might not be recovering as quickly as expected. That, combined with inflation metrics hitting multi-decade highs, elicited some concern the economic recovery might not be as strong as forecasted, and that a return of inflation might make the Federal Reserve begin to reduce accommodation earlier than previously expected. But after some volatility early in the month, it became apparent that the lackluster job growth was more a function of a labor supply issue rather than there not being enough jobs available, and investors came to believe that issue will resolve itself as the economy and society continues to return to pre-pandemic “normal.”

Meanwhile, Federal Reserve officials reiterated their long-held position that any increase in inflation would be temporary and due to pandemic-related supply chain disruptions and not the return of 1970’s style inflation problems. Investors were comforted enough for stocks to rebound in mid-May and close the month with a small gain.

Stocks resumed the rally in early June as more state economies returned to pre-pandemic normal, measures of economic activity remained strong, and certain inflation statistics (such as falling lumber prices) implied that inflation pressures were starting to ease, possibly validating the Fed’s belief that surging inflation is just temporary. The June Fed meeting provided a small surprise to markets, as it revealed that Federal Reserve officials began discussions about when to reduce the current quantitative easing program, while Federal Reserve forecasts showed interest rates could start to rise late in 2022, sooner than previously expected. Those two surprises caused some mild market volatility late in June, although ultimately investors remained confident that the Federal Reserve will not remove economic support too quickly and the S&P 500 hit another record high during the last few days of the quarter.

In sum, the strong gains of the second quarter and the first half of 2021 reflected continued government support for the economy combined with a material improvement in the pandemic in the U.S., and as we start the second half of 2021, we are happy to say the world looks a lot more like it did pre-pandemic than it did for most of 2020, and that sentiment is supportive of risk assets going forward.

2nd Quarter Performance Review

Highlights:

- The tech-driven Nasdaq 100 outperformed both the S&P 500 and Dow Jones Industrial Average thanks to a June rally in technology shares, as investors began to consider that the intensity of the economic recovery had possibly peaked as virtually all state economies had fully reopened.

- By market capitalization, large-cap stocks outperformed small-cap stocks, (which was a reversal from the previous two quarters) as investors rotated back into large caps as the outlook for future economic growth became slightly less certain.

- Growth handily outperformed value thanks to the tech sector rally, as again investors positioned for the possibility that the intensity of the economic recovery may wane in the coming months.

- Despite solid returns due to further declines in COVID-19 cases, rising vaccination rates, and more widespread economic reopenings, foreign markets again lagged the S&P 500.

- Commodity prices were up sharply in the quarter as supply constraints and rising demand fueled the rally. Commodities posted strong gains for the third quarter in a row and once again outperformed the S&P 500 over the past three months.

- Bonds prices, led by corporate bonds, rose modestly in the quarter as interest rates declined.

| U.S. Equity Indexes | Q2 Return | YTD |

|---|---|---|

| S&P 500 | 8.95% | 15.25% |

| DJ Industrial Average | 4.81% | 13.79% |

| NASDAQ 100 | 13.07% | 13.34% |

| S&P MidCap 400 | 3.57% | 17.38% |

| Russell 2000 | 5.47% | 17.54% |

Source: YCharts

| International Equity Indexes | Q2 Return | YTD |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 5.03% | 9.17% |

| MSCI EM TR USD (Emerging Markets) | 4.88% | 7.58% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 5.38% | 9.45% |

Source: YCharts

| Commodity Indexes | Q2 Return | YTD |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | 15.34% | 31.40% |

| WTI Crude Oil | 27.29% | 51.53% |

| Gold Price | 3.41% | -6.74% |

Source: YCharts/Koyfin.com

| US Bond Indexes | Q2 Return | YTD |

|---|---|---|

| BBgBarc US Agg Bond | 1.82% | -1.60% |

| BBgBarc US T-Bill 1-3 Mon | 0.00% | 0.02% |

| ICE US T-Bond 7-10 Year | 2.50% | -3.30% |

| BBgBarc US MBS (Mortgage-backed) | 0.36% | -0.77% |

| BBgBarc Municipal | 1.40% | 1.06% |

| BBgBarc US Corporate Invest Grade | 3.70% | -1.27% |

| BBgBarc US Corporate High Yield | 2.96% | 3.62% |

Source: YCharts

What actions did we take in McKinley Carter portfolios in Q2?

Changes – May 2021

In the Earnings Focus program, we eliminated our Netflix position and added Stanley Black & Decker to add economic sensitivity to the portfolio.

Changes – April 2021

In all programs and strategies except for MarketTrack, the Strategy Committee elected to reduce interest rate risk in our fixed income portfolios by eliminating the iShares U.S. Treasury Bond ETF – GOVT (pure Treasury bond exposure with a greater than target duration). GOVT’s duration (price sensitivity to interest rates) is 7% vs. the Committee’s target of 5.75%. The proceeds from the sale of GOVT were allocated to our BlackRock-managed core bond fund MAHQX.

With the Committee’s expectation of expanding GDP growth in 2021 and 2022 and the associated rise in interest rates, a greater allocation to MAHQX was warranted to better exploit ongoing tactical opportunities in the fixed income market. BlackRock’s worldwide credit expertise also allows for a more global approach to bond investing than U.S.-centric investing only.

A look ahead - our outlook for the rest of 2021

As we stated earlier, markets are currently dominated by a consensus based on three core hypotheses: durable high global growth; transitory inflation; and ever-friendly central banks. While agreeing with the consensus opinion is sometimes an ill-advised position, we find the rationales compelling.

Durable high global growth

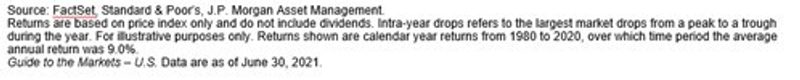

Global GDP growth remains robust and should continue that trend into 2022 as the effects from the pandemic wane due to accelerating vaccine rollouts.

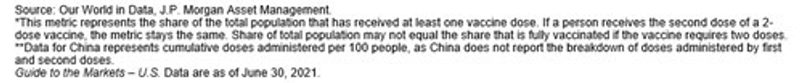

High GDP growth is leading to rising earnings estimates which are propelling stock prices higher:

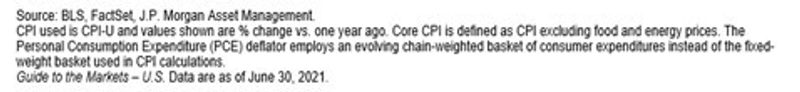

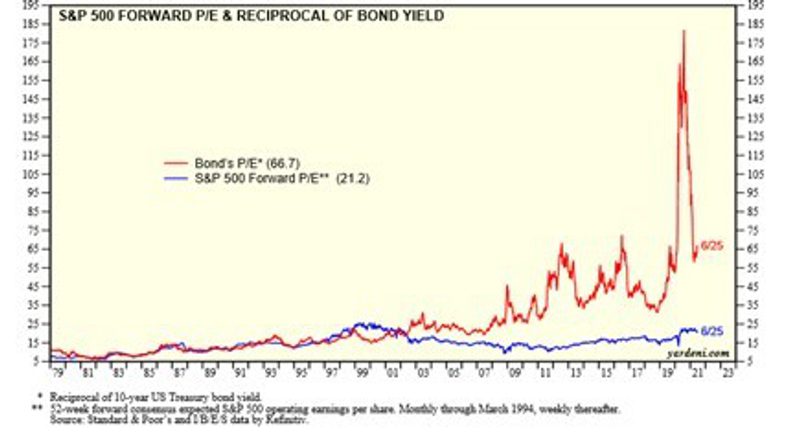

Transitory inflation

Rapidly increasing inflation data is being dismissed by the markets as transitory due to the Federal Reserve’s (FOMC) adamant position that these data points will reverse course over the next year as supply chains are reconciled and more people return to the workforce. Also, the orientation of spending towards experiences and away from durable goods may lead to an easing of inflationary pressures. While fuel prices may remain high for some time due to strong demand and tight supplies (thanks to our friends at OPEC), we have seen some encouraging signs of easing commodity price pressures such as the 50% drop in lumber prices over the past six weeks. Additionally, as was dramatically demonstrated during the height of the pandemic, the ongoing trend towards digitization in the workplace is very deflationary.

Ever-friendly central banks

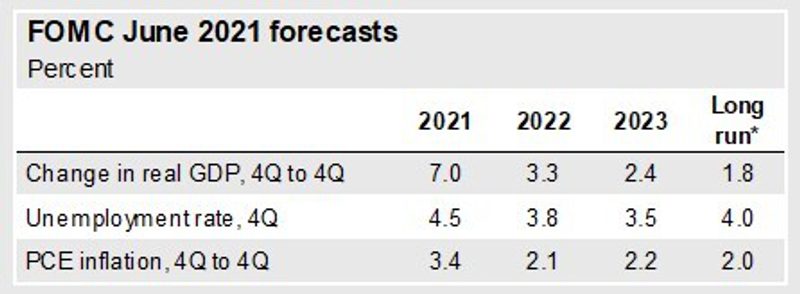

Federal Reserve Bank Chairman Jerome Powell has stated on many occasions that the central bank will not be raising rates any time soon despite higher inflation data. He is focused on getting the unemployment rate down to under 4.0% from its current level of 5.9%. More than 22.3 million Americans were laid off in March and April of 2020 amid government-imposed business restrictions, and the total employment level remains 7.13 million below where it was in February 2020. While the Fed may cut back on the $120 billion in monthly bond purchases later this year as the economy strengthens, they are unlikely to raise short-term interest rates until late 2022. Supporting this decision is the reaction of the 10-yr. Treasury bond recently as its yield has dropped from 1.75% to 1.31%.

U.S. 10 Year Treasury

The MCWS position on the investment markets:

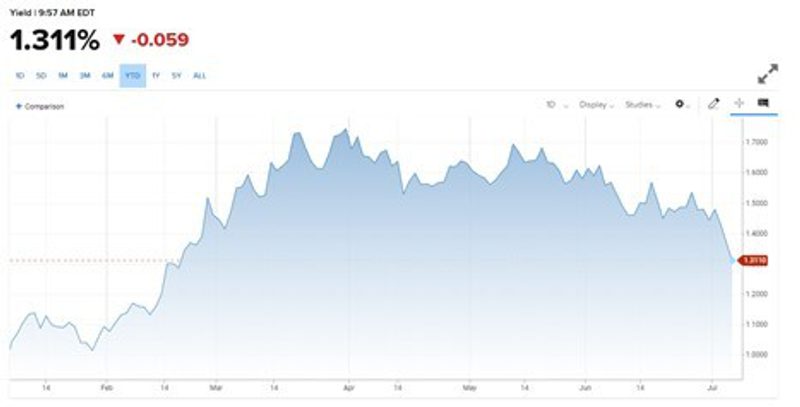

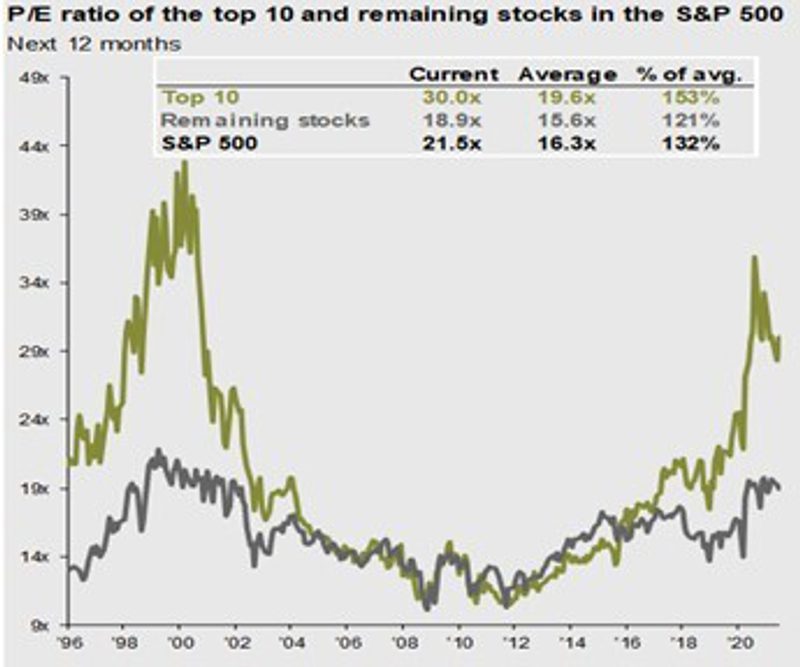

- Despite the strong YTD performance, equity markets will likely generate better returns than the bond market for the remainder of 2021 as powerful economic and earnings trends propel stock prices. Stock valuations, while stretched relative to their historic averages, are still less expensive than the bond market, especially considering the recent drop in interest rates. When one removes the valuations seen in the largest ten stocks (PE = 30.0X) in the S&P 500, the remaining index members are trading at a more reasonable level (PE = 18.9X).

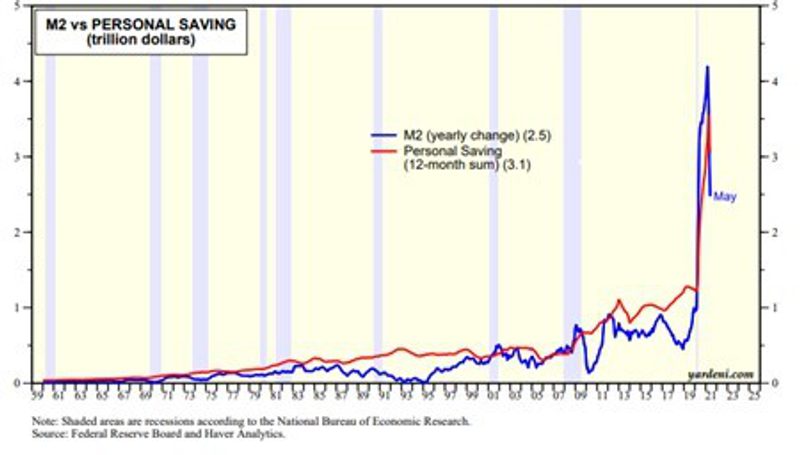

Additionally, the massive increase in the U.S. money supply (M2) plus elevated personal savings by consumers is supportive of higher stock prices.

- International markets, though lagging U.S. markets YTD, should narrow the performance gap as they experience improving vaccination rates as the year progresses and investors seek out less expensive investment opportunities.

- After the recent pull back in interest rates, Treasury bonds will likely be under pressure later this year as the Federal Reserve begins to taper bond purchases. We believe that better fixed income opportunities lie in non-Treasuries and international bonds.

Final thoughts

Despite the “Goldilocks” environment found in the second quarter, we are cognizant of the second-half risks that are posed by the “three bears.” These are:

- COVID – despite significant progress against COVID-19 here in the U.S., the pandemic is not over. Vaccination rates for most countries are well behind that of the United States, and the second quarter saw an explosion of COVID-19 cases in India, and an outbreak in China. Meanwhile, England delayed its planned economic reopening over concerns about the spread of the “Delta” COVID-19 variant that was behind the surge in cases in India. Then, late in the month, both Australia and South Africa reimplemented local lockdowns due to rising cases of the Delta variant. Point being, there remains a possibility that a new COVID-19 variant appears and renders the vaccines less effective. If that happens, markets will become concerned that progress towards a return to economic “normal” will be reversed, and that will cause volatility.

- Profit margin pressures – will rising costs pinch earnings estimates?

- Inflation and interest rates – some metrics in June implied that the spike in inflation during the second quarter is starting to reverse, but that debate is far from settled. To that point, no one knows what the trillions in pandemic stimulus combined with 0% interest rates and the Fed’s ongoing QE program will do to inflation over the longer term. If this sudden surge in inflation is indeed just temporary, we should see more conclusive evidence of that during the third quarter.

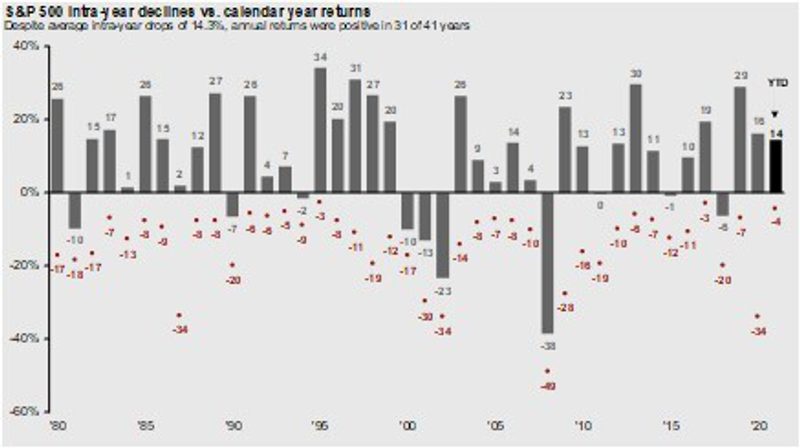

Importantly though, the start of 2021 again clearly demonstrated that a well-executed and diversified, long-term focused financial plan can overcome temporary bouts of volatility (red dots in the chart below), just like it did in 2020 and preceding years.