Note: This information is from 2023 but much has changed since then. Please be sure to discuss your unique financial situation with your McKinley Carter Advisor or another trusted professional.

Easing inflation pressures and a resolution of the fiscal turmoil in the United Kingdom fueled a strong rally in stocks and bonds early in the fourth quarter, but hawkish Fed guidance, disappointing economic data, and rising global bond yields weighed on markets in December and the S&P 500 finished the fourth quarter with only modest gains that capped the worst year for the index since 2008. Learn more about 2022, what actions we took on McKinley Carter portfolios, and our outlook for 2023.

Part 1: Looking back at 2022

Part 2: What actions did we take in McKinley Carter portfolios last year?

Part 3: A look ahead - our outlook for 2023

Looking back at 2022

Easing inflation pressures and a resolution of the fiscal turmoil in the United Kingdom fueled a strong rally in stocks and bonds early in the fourth quarter, but hawkish Fed guidance, disappointing economic data, and rising global bond yields weighed on markets in December and the S&P 500 finished the fourth quarter with only modest gains that capped the worst year for the index since 2008. Roughly 45% of stocks in the Russell 1,000 fell 20% or more on a total return basis in 2022. 30% of the index fell 30%+, just under 20% fell 40%+, and 11% fell 50%+.

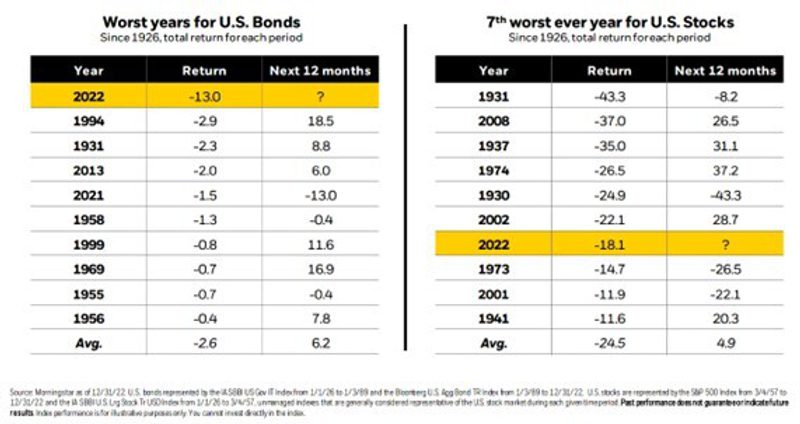

In sum, 2022 was the most difficult year for investors from a return and volatility standpoint since the Global Financial Crisis. Multi-decade highs in inflation combined with historically aggressive Fed rate hikes and growing concerns about economic and earnings recessions to pressure both stocks and bonds. Major benchmarks for both stocks and bonds declined together for the first time since the 1960s, punctuating just how disappointing the year was for investors.

The beginning of the fourth quarter was volatile as global bond yields spiked in response to the spending and tax cut package proposed by former U.K. Prime Minister Liz Truss, and that volatility led to the S&P 500 hitting a new low for the year on October 13th. However, that market turmoil ultimately resulted in political change in the U.K. as PM Truss resigned on October 20th and was replaced by former Chancellor of the Exchequer Rishi Sunak, who immediately took steps to disavow Truss’ plan and restore market confidence in U.K. finances. In part due to a very short-term oversold condition and following a no-worse-than-feared third-quarter earnings season, stocks and bonds staged large rallies in mid and late October and the S&P 500 finished the month with a substantial gain, rising 8.1%.

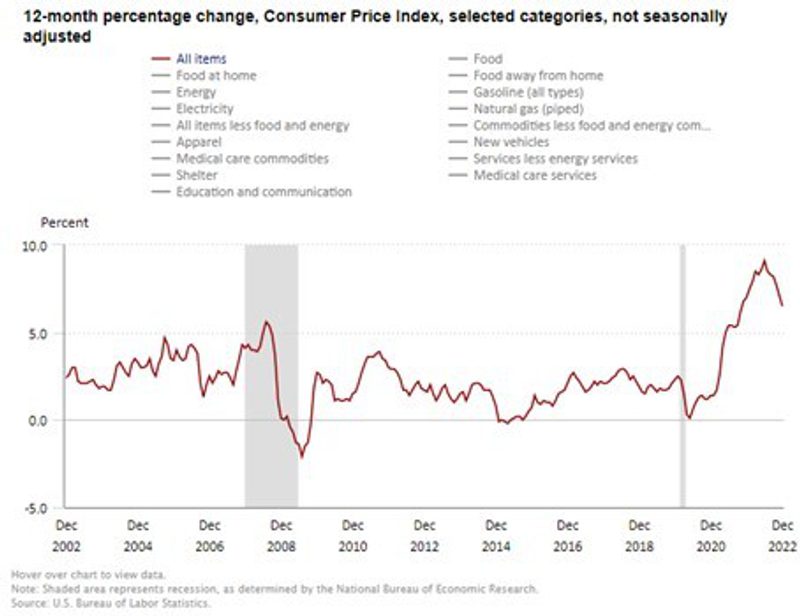

The positive momentum for stocks and bonds continued in early November thanks to a growing number of price indicators that implied inflation pressures had finally peaked. The October CPI report (released November 10th) showed the first solid decline in consumer price data for the year and that was echoed by price indices contained in national and regional manufacturing reports, as well as other official inflation statistics. Both stocks and bonds enjoyed solid gains in response to the data because while inflation remained far too high on an absolute level, markets hoped these declines would result in the Federal Reserve not raising interest rates as high as previously feared. Those hopes were boosted after the Thanksgiving holiday when Fed Chair Powell stated that interest rates would only need to rise “somewhat” higher than previous projections. Investors took that “somewhat” remark as a sign that previous estimates for rate hikes were too aggressive and that extended the rally into early December. The S&P 500 ended November at multi-month highs with another solid monthly gain of 5.6%.

However, investor optimism faded in December as global central banks signaled that they were still committed to aggressively hiking rates, economic data showed clear signs of slowing growth, and several negative earnings announcements raised concerns of an earnings recession in 2023. First, at the December meeting, the Fed revealed that they expected rate hikes to take the fed funds rate above 5% (from the current 4.375%), which was higher than market expectations. Then, economic data released in mid-December, including regional manufacturing indices and the November retail sales report, showed economic activity was slowing. Finally, both the European Central Bank and the Bank of Japan surprised markets with hawkish policy decisions, providing yet another reminder to investors that rates will continue to rise in 2023 despite clearly slowing global economic growth and the increasing threat of recession. Stocks dropped from mid-December on, and the S&P 500 ended the month of December with a loss of 5.90%.

Q4 and Full Year 2022 Performance Review

Unlike the first three quarters of 2022, when all four major indices saw quarterly declines, performance was mixed during the fourth quarter as the Dow Jones Industrial Average rose sharply, while the S&P 500 and Russell 2000 were solidly higher. Like most of 2022, however, the Nasdaq lagged and fell slightly in the fourth quarter. Expectations for higher rates, slowing economic growth and underwhelming earnings weighed on the tech sector in the fourth quarter, which was the case for much of 2022. Conversely, less economically sensitive companies that trade at lower valuations than tech stocks outperformed again as investors continued to shift towards defensive sectors amid growing recession fears.

On a full-year basis, all four major indices posted negative returns, with the Dow Jones Industrial Average relatively outperforming while the Nasdaq badly lagged the other major indices.

- By market capitalization, large-caps slightly outperformed small-caps in the fourth quarter, but modestly outperformed throughout 2022. Concerns about future economic growth and higher interest rates (which can impact small-caps disproportionately due to funding needs) were the main drivers of large-cap outperformance and small-cap underperformance throughout 2022. Small-cap stocks did show some resilience in the fourth quarter with the Russell 2000 index registering a solid gain as investors’ hopes for a peak in inflation and ultimately interest rates, led to some dip buying in the segment.

- From an investment style standpoint, value massively outperformed growth all year and that trend continued in the fourth quarter. Underwhelming earnings weighed on tech stocks in the final three months of the year, while concerns about slowing economic growth combined with rising bond yields hit richly valued tech stocks throughout 2022. Value stocks, meanwhile, were viewed as more attractive in the market environment of 2022 due to lower valuations and exposure to business sectors that are considered more resilient than high-growth parts of the market.

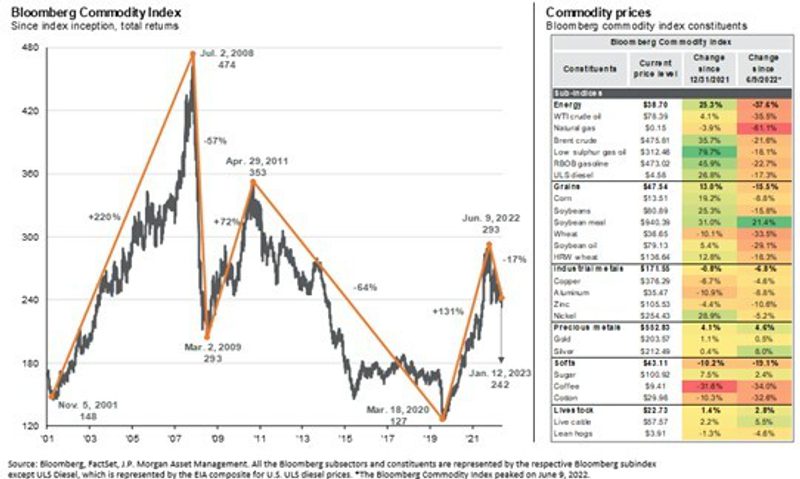

- On a sector level, 10 of the 11 S&P 500 sectors finished the fourth quarter with a positive return, although only two of the 11 ended 2022 with gains. Energy outperformed other sectors not just in the fourth quarter but for all of 2022. In the fourth quarter, energy stocks were helped by progress on the post-Covid economic reopening in China which increased energy demand expectations, while a falling dollar was an added tailwind for commodities including oil and gas. More to that point, the other strong sector performers in the fourth quarter were industrials and materials, which also benefitted from an improving Chinese demand outlook and a weaker U.S. dollar. For the full year, energy was, by far, the best-performing sector in the market as an early-year surge in oil and natural gas prices in response to increased geopolitical risks and reduced Russian supply helped push energy stocks sharply higher. Defensive sectors, specifically utilities and consumer staples, were the next best-performing sectors finishing the year with small gains and losses, respectively, again as investors rotated towards less economically sensitive corners of the market amid rising recession risks.

- The tech sector and those sectors with overweight exposure to high-growth companies badly lagged in the fourth quarter and over the course of 2022. In the fourth quarter, communication services were only fractionally positive while the consumer discretionary sector posted a negative return on weakness in high-growth internet and consumer stocks. For the full year, those same two sectors posted the worst returns in the S&P 500, as investors shunned richly valued, growth-oriented tech companies.

- Internationally, foreign markets handily outperformed the S&P 500 in the fourth quarter thanks to a large bounce in Chinese stocks as Beijing ended its “Zero-Covid” policy and commenced an economic reopening, while a falling dollar boosted global economic sentiment. Foreign developed markets outperformed emerging markets in the fourth quarter thanks in part to a large bounce in U.K. shares following the resignation of Prime Minister Truss and the abandonment of her fiscal spending and tax cut plan. For the full-year 2022, foreign developed markets registered solidly negative returns, but thanks to the fourth-quarter rally, relatively outperformed the S&P 500.

- Commodities saw gains in the fourth quarter as both oil and gold logged positive returns. A falling dollar paired with an improving outlook for Chinese demand as the government moved towards reopening their economy pushed oil higher throughout the quarter. Gold, meanwhile, saw steady gains in the final three months of the year thanks primarily to the decline in the U.S. dollar. For 2022, commodities posted a large, positive return due to the significant gains in oil futures and other energy commodities that came in response to geopolitically driven supply concerns following Russia’s invasion of Ukraine. Gold, however, saw only a slightly positive return for 2022 as sharp rises in the U.S. dollar and Treasury yields midyear weighed on the yellow metal, limiting gains.

- Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the fourth quarter but declined sharply for the full year of 2022, as more-aggressive-than-expected Fed rate hikes combined with decades-high inflation pressured most bond classes.

- Looking deeper into the fixed income markets, longer-duration bonds outperformed those with shorter durations in the fourth quarter, as bond investors became more concerned with economic growth than inflation. For the full year, shorter-term bonds handily outperformed longer-duration bonds as they were less impacted by Fed rate hikes and spiking inflation.

- Turning to the corporate bond market, both higher-yielding, lower-quality corporate bonds and investment grade bonds posted similarly positive returns for the fourth quarter, as investors reacted to the possible peak in inflation. Lower-yielding and safer investment-grade corporate debt underperformed for the full year, however, as investors shunned those bonds for shorter-duration debt and corporate debt with higher yields.

S&P 500 Total Returns by Month in 2022

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -5.17% | -2.99% | 3.71% | -8.72% | 0.18% | -8.25% | 9.22% | -4.08% | -9.21% | 8.10% | 5.59% | -5.90% |

Source: Morningstar

| U.S. Equity Indexes | Q4 Return | 2022 Return | |

|---|---|---|---|

| S&P 500 | 7.56% | -18.11% | |

| DJ Industrial Average | 16.01% | -6.86% | |

| NASDAQ 100 | -0.04% | -32.38% | |

| S&P MidCap 400 | 10.78% | -13.06% | |

| Russell 2000 | 6.23% | -20.44% |

Source: YCharts

| International Equity Indexes | Q4 Return | 2022 Return |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 17.40% | -14.01% |

| MSCI EM TR USD (Emerging Markets) | 9.79% | -19.74% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 14.37% | -15.57% |

Source: YCharts

| Commodity Indexes | Q4 Return | 2022 Return |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | 3.44% | 25.99% |

| S&P GSCI Crude Oil | 1.20% | 5.06% |

| GLD Gold Price | 9.85% | 0.42% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q4 Return | 2022 Return |

|---|---|---|

| BBgBarc US Agg Bond | 1.87% | -13.01% |

| BBgBarc US T-Bill 1-3 Mon | 0.89% | 1.52% |

| ICE US T-Bond 7-10 Year | 0.98% | -14.90% |

| BBgBarc US MBS (Mortgage-backed) | 2.14% | -11.81% |

| BBgBarc Municipal | 4.10% | -8.53% |

| BBgBarc US Corporate Invest Grade | 3.63% | -15.76% |

| BBgBarc US Corporate High Yield | 4.17% | -11.19% |

Source: YCharts

What actions did we take in McKinley Carter portfolios last year?

- We maintained a defensive posture in our bond portfolios keeping an emphasis on shorter maturities in a rising interest rate environment

- We added large-cap companies with high free cash flow yields to provide portfolio stability

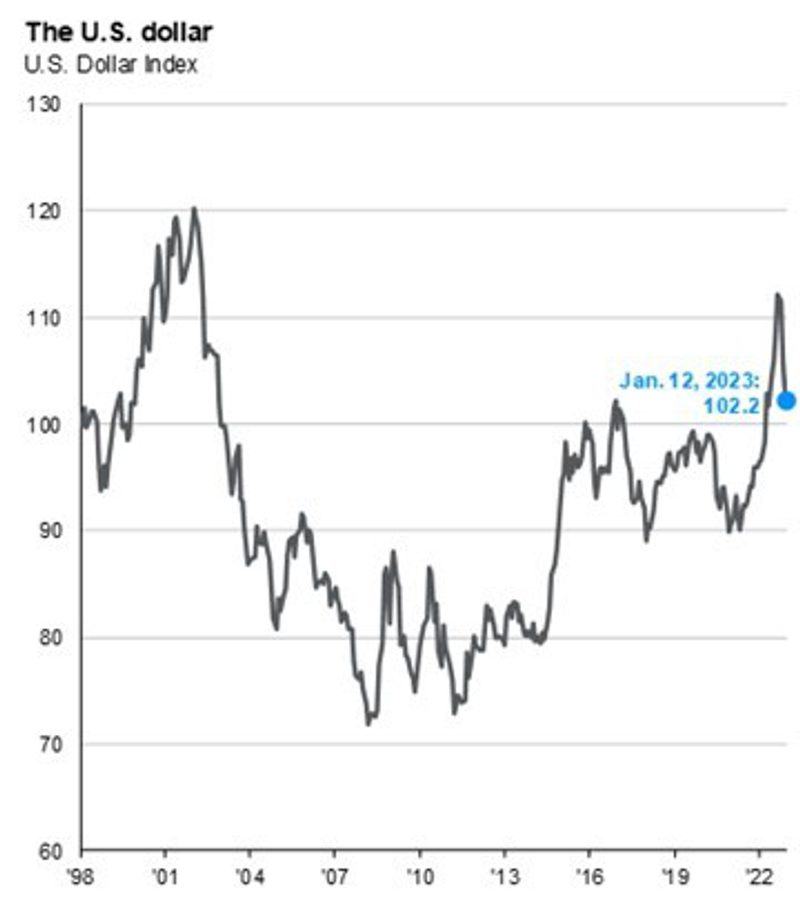

- Reduced international allocation by 20% in the spring to protect against a rising U.S. dollar and economic instability overseas

- Added energy stocks in June to take advantage of strong earnings

- Added growth stock exposure in early fall in light of a slowing economy

A look ahead - our outlook for 2023

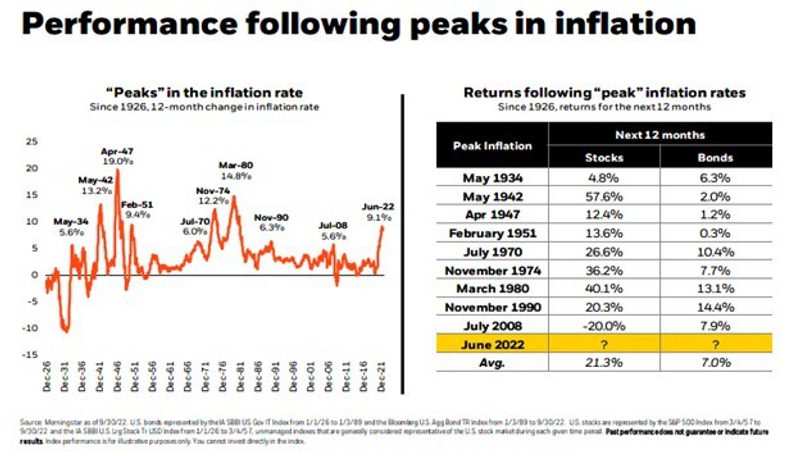

Market history is clear: Declines of the magnitude we saw in 2022 are usually followed by strong recoveries, not further weakness. The S&P 500 hasn’t registered two consecutive negative years since 2002. Market declines such as we witnessed in 2022 have ultimately yielded substantial long-term opportunities in both stocks and bonds.

The stagflation of the 1970s and sky-high interest rates of the early 1980s eventually gave way to the strong economic growth and market rally of the 1980s. The dot-com bubble burst of the early 2000s was followed by substantial market gains into the mid-2000s. The financial crisis, which remains the most dire economic situation we’ve experienced in modern market history, was followed by strong rallies in the years that followed, and not even the worst pandemic in over 100 years could result in sustainably lower asset prices.

The losses in stocks and bonds were driven by decades-high inflation, a historic Fed rate hike campaign and geopolitical unrest. But while those factors were clear negatives for asset prices in 2022, it’s important to note that as we begin 2023, the market is approaching a potentially important transition period that could see each of these headwinds ease in the months ahead.

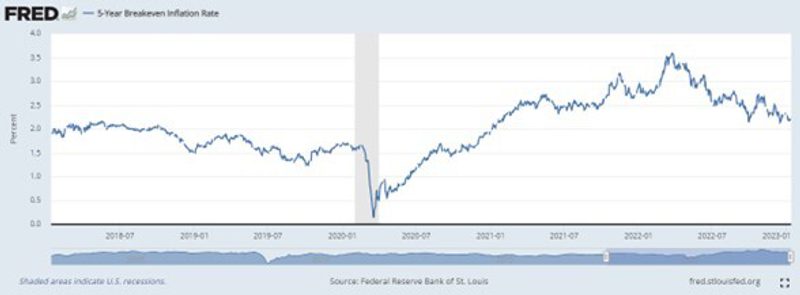

As we stated in our previous reports, many inflation indicators such as the Consumer Price Index (the CPI has fallen from a high of 9.1% in June to 6.5% in December), commodity prices, and the 5-yr. inflation breakeven rate have likely peaked and are headed lower, giving the Federal Reserve fewer reasons to aggressively raise short-term interest rates from this point.

Additionally, all last year, we were of the opinion that the economy was not in recession as unemployment remained historically low and consumers’ balance sheets were in good shape. Furthermore, TSA airline travel data indicated an ongoing willingness of U.S. citizens to spend freely on trips and vacations.

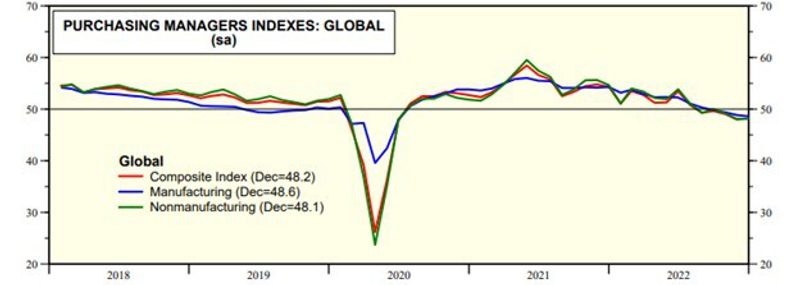

However, there is increasing evidence that the global economy is headed for recession due to the efforts by central bankers across the globe to control inflationary pressures by raising interest rates to stymy economic growth. These efforts are aimed at reducing employment and therefore demand for goods and services. As demand declines, pressure on prices will lessen and inflation will likely decline.

Source: J.P. Morgan, Markit, and Haver Analytics

An unfortunate consequence of these actions is the uncertain impact on corporate earnings and therefore the stock market. While earnings estimates have steadily declined this year, the projections for next year remain in positive territory for large cap and international stocks. Should the analysts’ projections for 2023 be lowered due to more evidence of downward economic pressure, the stock market may have further to fall in the first half of this year. If the economy or corporate America proves to be more resilient than forecasts, it could provide a positive spark for asset markets in early 2023.

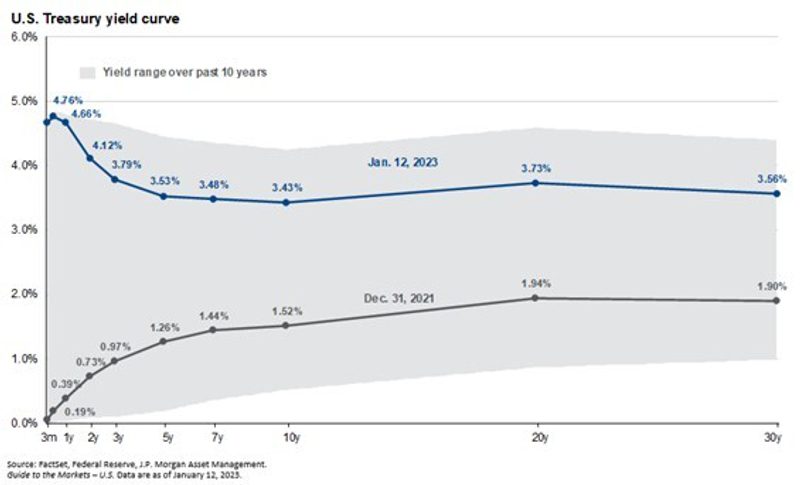

The primary competition for stocks is the bond market and with short-term Treasuries yielding above 4% and corporate earnings estimates in doubt, many investors are now moving their investment dollars to bonds to reduce portfolio risk. This phenomenon has not been experienced in many years as interest rates are back to 2007 levels.

Despite near-term valuation headwinds for stocks, we believe that over the next year we will see stocks outperform bonds as inflation continues to subside, the Federal Reserve stops raising interest rates, and the stock market anticipates an economic recovery in 2024.

International stocks, which have been hurt by the strong U.S. dollar, may see a recovery this year as U.S. interest rates peak and investors take advantage of more attractive valuations found overseas and a weaker dollar.

One caveat to our 2023 forecast is the uncertainty surrounding the Federal Reserve and its goal for core inflation to reach 2%. We believe this goal will likely not be achieved for several years and, if the Fed remains determined to drive inflation down to their target over the next year by raising interest rates higher than current projections, stocks will likely suffer. We will be closely following interest rate trends in 2023 as they will heavily influence the severity of any economic downturn and the impact on employment.

In sum, while markets will continue to be challenged by economic uncertainty, we feel that inflation will ease this year and the economy will avoid a significant recession. Additionally, over the course of 2023, it is not unreasonable to expect that both stocks and bonds will generate positive returns for investors as inflation subsides.