Looking back at the second quarter

Waiting for Godot is a 1953 play by Irish writer and playwright Samuel Beckett, in which the two main characters engage in a variety of discussions and encounters while awaiting Godot, who never arrives. The expression, “Waiting for Godot,” has come to symbolize the futility and pointlessness in waiting for something with no clear resolution. In the first half of 2025, stock and bond markets grappled with uncertainty over the economic impact of multiple challenges.

Despite the slew of bad news in the second quarter (e.g., historically high proposed tariffs on imports from our trading partners around the world, a negative GDP report in Q1, Middle East wars, the continuation of the Ukraine/Russia war, a Federal Reserve content to not lower interest rates, consumer confidence at multi-year lows, an unresolved Congressional tax and spending policy, and second quarter corporate earnings estimates being reduced), markets have thus far looked through the negatives and behave as though bad news (Godot) will not actually arrive in the back half of the year.

I’ll discuss our take on the economy and markets for the rest of the year in the Outlook section of this report.

The Key Events of the Quarter

Market volatility spiked in the second quarter as the S&P 500 dropped sharply in early April following the announcement of sweeping reciprocal tariffs, although those initial losses were slowly and steadily recouped over the remainder of the quarter as initial tariff rates were reduced while economic growth proved resilient and inflation stayed low, allowing the S&P 500 to hit a new all-time high and finish the quarter with a strong gain.

The second quarter started with a thud as, on April 2nd, President Trump announced sweeping and substantial tariffs on virtually all U.S. trading partners. The tariff amounts were significantly larger than markets expected, and their announcement sparked fears of a trade-war-driven economic slowdown, which hit stocks hard as the S&P 500 dropped more than 10% in the days following the tariff announcement. However, that low in the index on April 8th turned out to be the low for the quarter as the rest of April saw the administration take numerous steps to reduce the practical impact of those announced tariffs. A week after reciprocal tariffs were announced, the administration declared a 90-day delay where tariff rates on most trading partners would be just 10%, far below most reciprocal tariff rates. That delay was then followed by more steps to reduce the tariff burden, including important exemptions for key imports such as smartphones, semiconductors, pharmaceuticals, and computers. The delay in reciprocal tariff rates and key category exemptions gave investors some confidence that the trade war would not automatically cause a recession, and that optimism combined with a solid first quarter earnings season to help the S&P 500 rally throughout the remainder of April and close with just a slight loss.

The market rebound accelerated in May as Treasury Secretary Scott Bessent announced he would be meeting with Chinese trade officials in Geneva early in the month. That boosted investor expectations for more tariff relief and those hopes were fulfilled as the meeting resulted in a dramatic reduction in tariffs on Chinese imports from 145% to approximately 30%. That tariff reduction combined with still-solid economic growth further eroded investor concerns that tariffs would cause a recession, and the S&P 500 extended its rebound. Earnings also contributed to the rally thanks to strong results from tech bellwether Nvidia (NVDA), which reminded investors of the growth potential of artificial intelligence (AI). Finally, in late May, the Court of International Trade ruled the administration’s tariffs were illegal under the law used to justify the duties. The case was appealed immediately, and a decision should come in the third quarter, but the initial ruling raised the prospect that tariffs could be eliminated almost entirely by the courts in the coming months. That decision further strengthened the belief that tariffs would not derail the strong economy, and the S&P 500 turned positive year to date and finished May with strong gains.

The rally continued in June although trade headlines, which had driven market moves for the first two months of the quarter, took a back seat to geopolitical concerns after Israel launched a massive attack on Iranian nuclear and military facilities. The hostilities between the two rivals caused oil prices to temporarily spike and that halted the rally in mid-to-late June, as investors again had to consider the prospect of rising oil prices hurting economic growth and boosting inflation. However, that volatility was limited, as following U.S. strikes on Iranian nuclear facilities, a ceasefire was agreed to between Iran and Israel and oil prices dropped sharply, turning negative for the quarter. That decline, combined with rising expectations for rate cuts in the second half of the year, pushed the S&P 500 to new all-time highs in the final days of June.

In sum, the stock market completed an impressive rebound (S&P 500 up 11.57% and the NASDAQ 100 up 17.85% for Q2) from the steep declines of early April, as steps by the administration to ease the tariff burden helped to boost investor confidence while corporate earnings (reported Q1 numbers) were strong and economic growth proved resilient even in the face of geopolitical uncertainty and elevated policy volatility.

Second Quarter Performance Review

The gains in the S&P 500 in the second quarter were particularly impressive considering the intense selling pressure witnessed in early April, as the market rebound was broad and most indices, sectors and factors logged a positive return for the quarter.

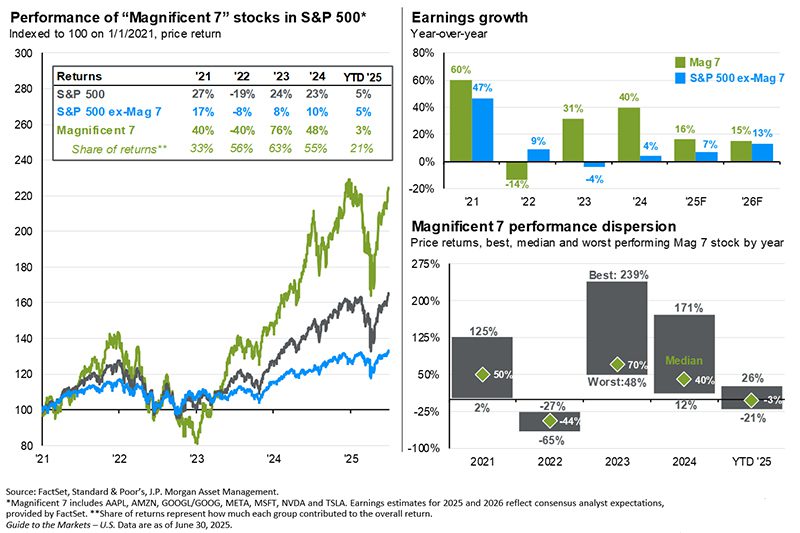

The “Magnificent Seven” stocks (AAPL, AMZN, GOOGL, META, MSFT, NVDA, and TSLA) rebounded sharply in the second quarter and ended June with a YTD return of 3% vs. the 5% return on the other 493 stocks. As the stock market recovered in Q2, investors returned to those stocks felt to be “safer” due to their strong balance sheets and more predictable earnings growth.

- By market capitalization, large caps (S&P 500) outperformed small caps (Russell 2000) in Q2, as they did in the first quarter. A lack of Fed rate cuts, generally elevated bond yields and some soft economic data late in the second quarter weighed on small caps, although they still finished the quarter with a positive gain.

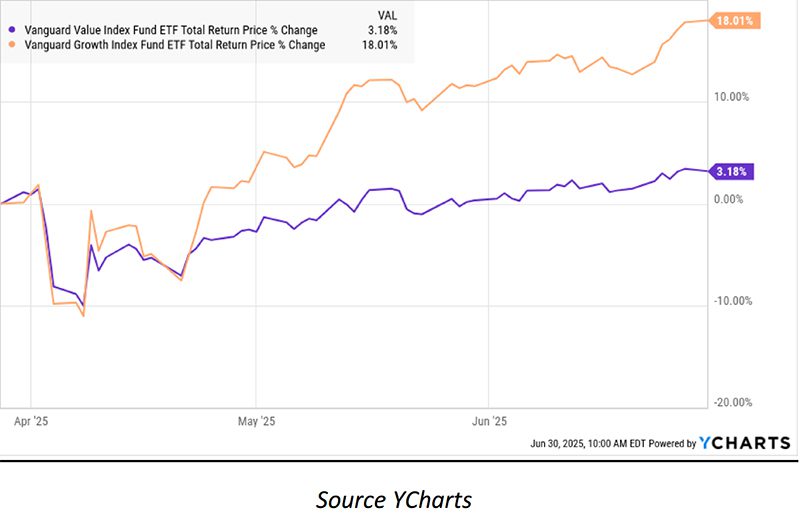

- From an investment style standpoint, growth massively outperformed value in the second quarter, as tech-heavy growth funds attracted value-seeking investors following the April declines. Tariff reductions and exemptions also boosted the outlook for major tech firms while solid earnings from AI bellwethers Nvidia (NVDA) and Oracle (ORCL) helped renew AI enthusiasm amongst investors. Value funds, meanwhile, were weighed down by weakness in energy shares but still managed a slightly positive return for the quarter.

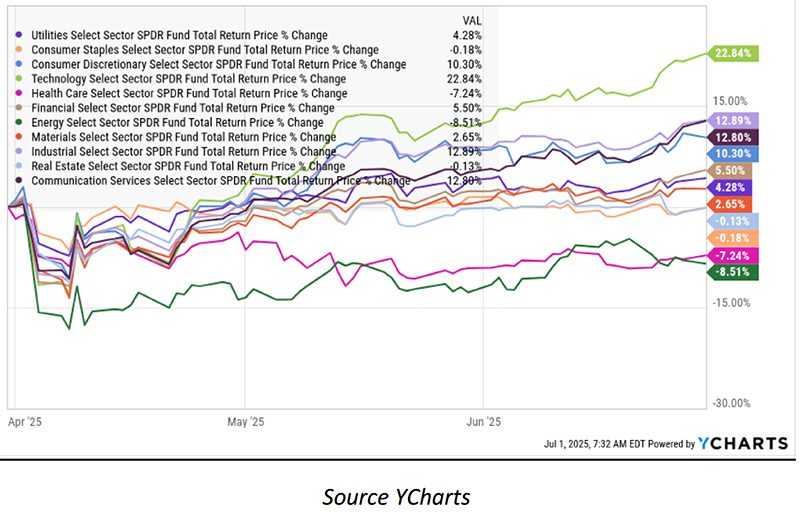

- On a sector level, seven of the 11 S&P 500 sectors finished the second quarter with positive returns. The best-performing sectors in the second quarter were the AI-linked technology and communications services sectors as well as the industrials sector. All three sectors benefited from tariff reductions and exemptions as many companies in these sectors have strong international businesses. Turning to the sector laggards, energy and healthcare posted negative returns for the quarter, as both were pressured by negative industry-specific news. For energy, volatility in oil prices (and a lack of a sustainable rally despite the Israel-Iran conflict) weighed on energy producers, as did general fears of an economic slowdown. For healthcare, uncertainty over pharmaceutical tariffs as well as a legislative focus on reducing prescription drug costs weighed on healthcare stocks.

- Internationally, foreign markets outperformed the S&P 500 for most of the quarter, although the late June surge in the S&P 500 saw that index pass both emerging and foreign developed indices from a performance standpoint. Emerging markets outperformed foreign developed markets due to substantial de-escalation in the U.S./China trade war as well as some encouraging Chinese economic data. Foreign-developed markets also posted strong returns for the quarter thanks to falling interest rates and generally resilient economic growth.

- Commodities saw slight declines in the second quarter due to weakness in oil prices, although a continued rally in gold kept losses for most commodity indices modest. Gold added to the already-impressive YTD returns, aided by the falling dollar (which hit a three-year low in the second quarter) and elevated geopolitical tensions. Oil prices, meanwhile, were volatile but ended the quarter with a modest loss as geopolitical tensions eased following the Israel/Iran ceasefire and in response to some lackluster U.S. economic readings in June.

- Switching to fixed income markets, the leading benchmark for bonds (Bloomberg U.S. Aggregate Bond Index) realized a modest positive return for the second quarter, as stable inflation readings and some cooling of U.S. economic growth late in the quarter boosted demand for bonds.

- Looking deeper into the fixed income markets, longer-duration bonds outperformed shorter-duration bonds because of stable inflation data and slightly underwhelming economic readings. Shorter-term bonds lagged as the Fed remained in a “wait-and-see” approach to rate cuts given the central bank wants to wait to see the impacts from tariffs on both growth and inflation.

- Turning to the corporate bond market, both investment grade and lower quality “high yield” bonds posted solidly positive quarterly returns. High-yield bonds outperformed investment grade debt, however, as generally resilient economic growth and the promise of looming tax cuts gave investors confidence to reach for higher yield and assume more credit risk.

| U.S. Equity Indexes | Q2 Return | YTD |

|---|---|---|

| S&P 500 | 11.57% | 6.20% |

| DJ Industrial Average | 6.52% | 4.55% |

| NASDAQ 100 | 17.85% | 8.35% |

| S&P MidCap 400 | 6.92% | 0.20% |

| Russell 2000 | 7.95% | -1.78% |

Source: YCharts

| International Equity Indexes | Q2 Return | YTD |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 9.77% | 19.92% |

| MSCI EM TR USD (Emerging Markets) | 10.27% | 15.57% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 10.28% | 18.32% |

Source: YCharts

| Commodity Indexes | Q2 Return | YTD |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | -1.46% | 1.94% |

| S&P GSCI Crude Oil | -5.97% | -9.48% |

| GLD Gold Price | 7.29% | 26.02% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q2 Return | YTD |

|---|---|---|

| Bloomberg US Aggregate Bond Index | 1.44% | 4.02% |

| Bloomberg 1-3 Month U.S. Treasury Bill Index | 1.08% | 2.13% |

| ICE US Treasury 7-10 Year Index | 1.75% | 5.34% |

| Bloomberg US Mortgage Backed Securities Index | 1.32% | 4.23% |

| Bloomberg Municipal Index | 0.21% | -0.35% |

| Bloomberg US Corporate Index | 2.04% | 4.17% |

| Bloomberg US Corporate High Yield Index | 3.46% | 4.57% |

Source: YCharts

What actions did we take in McKinley Carter portfolios last quarter?

- In our bond portfolios, we maintained our shorter-than-benchmark duration to lessen long-term interest rate risk and associated volatility.

- In our Dividend Focus and Hybrid models, we removed T. Rowe Price (TROW), Genuine Parts (GPC), Air Products and Chemicals, Inc. (APD), United Parcel Service, Inc. (UPS), and Medtronic (MDT) and added Wells Fargo & Company (WFC), Eversource Energy (ES), Microsoft Corporation (MSFT), T-Mobile US, Inc. (TMUS), and Abbott Labs (ABT) due to better dividend growth.

- In our Earnings Focus and Hybrid models, we removed Novo Nordisk (NVO) and added Intercontinental Exchange (ICE) for better earnings visibility.

- In our tactical allocation approved investments, we added a 25% position in the Technology Select Sector SPDR Fund (XLK) and reduced the Financial Select Sector SPDR Fund (XLF) by 25%. We also removed the preferred stock ETF (PFF) as an approved holding.

Outlook - a look ahead to the rest of 2025

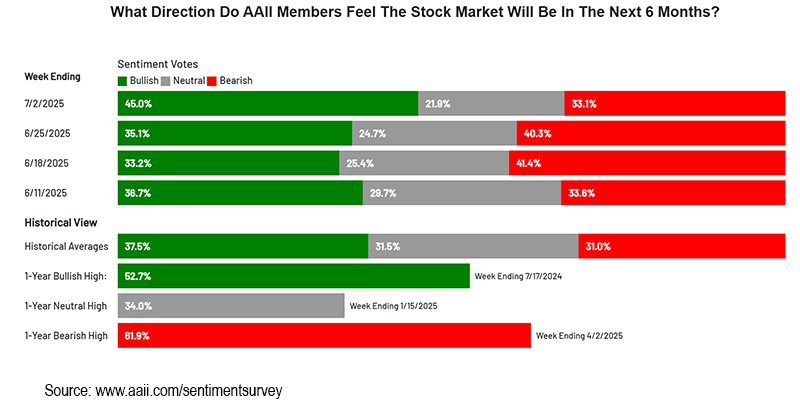

Recent investor sentiment has improved sharply (green bars) as investors have grown more confident in the second half outlook for the economy. While negative sentiment (red bars) in the second quarter reflected a high degree of tariff anxiety and the associated potential for spiking inflation and slowing the economy, recent progress on tariff negotiations, completion of the 2025 tax bill in Congress, The Alanta Fed’s projection of solidly positive Q2 GDP, and better than expected corporate earnings and inflation data have encouraged investors to believe that their worst fears may not arrive in the second half just as Godot never arrived in “Waiting for Godot.” In addition, jobs growth, low unemployment, and subdued unemployment claims bode well for consumer spending.

Geopolitical risks undoubtedly have risen with direct conflict between Israel and Iran (including U.S. involvement in the war) and no progress on a ceasefire on the now three-year-long war between Russia and Ukraine. However, the market views these conflicts as largely isolated and not at risk of spreading into a larger regional war that could disrupt oil production or the global economy. Because of that, markets have largely ignored the increase in geopolitical tensions.

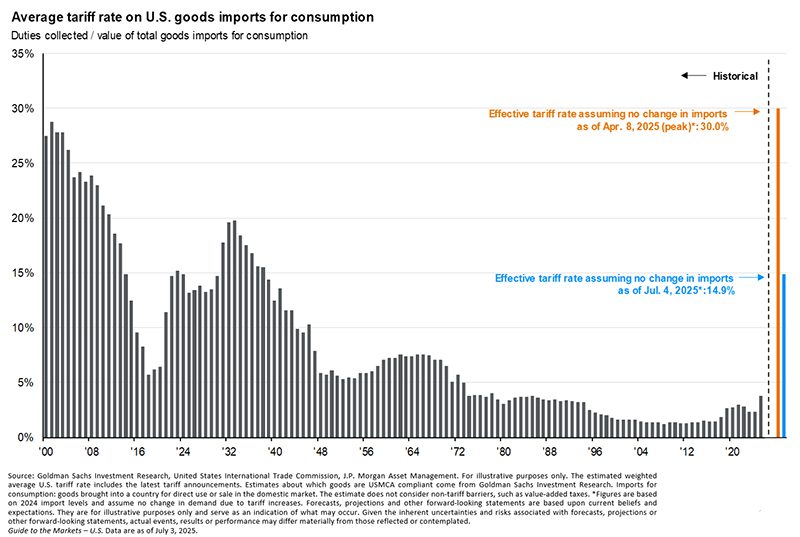

The markets begin the third quarter following an impressive first half recovery, as the S&P 500 hit a new all-time high despite much-larger-than-expected tariffs on U.S. imports, a dramatic increase in policy volatility and more hostilities in the Middle East. Moves by the Trump administration to ease the tariff burden combined with the court decision invalidating reciprocal tariffs boosted market confidence that neither the administration nor the courts would allow tariffs to derail economic growth. That belief helped stocks look past what are still historically high tariff rates (blue bar).

Cautionary Notes

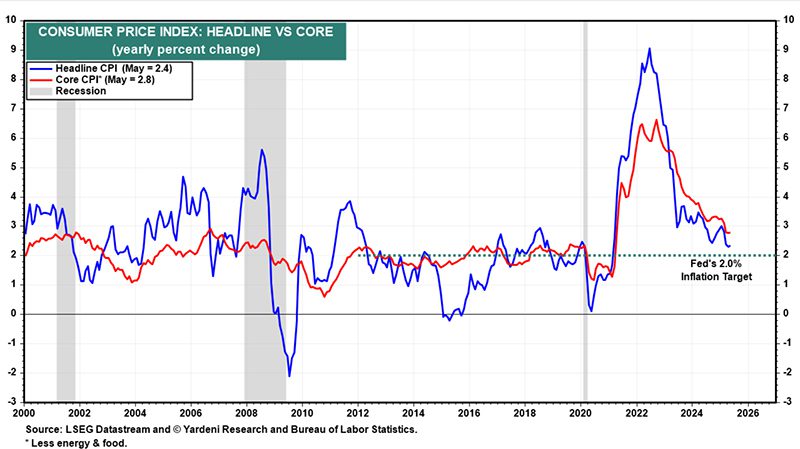

- Tariffs matter to the markets primarily because, if not properly executed, they could cause an economic slowdown, or worse, stagflation, where growth slows but inflation rises. Fears of a tariff-induced slowdown or return of stagflation were contributing factors behind the April decline in stocks. Positively, economic data remained mostly resilient throughout the second quarter and there are no major economic indicators pointing to a material slowing of growth or a sudden rise in inflation. That resilient data in the face of tariffs and geopolitical turmoil contributed to the market rebound in the second quarter.

- While the market was impressively resilient over the past three months, it would be a mistake for investors to become complacent in this environment, because there remain a lot of risks facing the economy and markets. The market has assumed that tariffs won’t rise substantially from current rates, but there’s no guarantee of that. To that point, the deadline for the reciprocal tariff delay is August 1st (originally, July 9th) and if that deadline is not extended, we could see tariff rates on major trading partners surge once again. Regardless, the reality is that global tariff rates are at multi-decade highs and it’s still uncertain how that will impact the economy in the months ahead.

- Turning to geopolitics, while the various conflicts have not negatively impacted global markets, risks remain elevated. If Iran takes steps to disrupt global oil production or transit, that will boost oil prices and create a new headwind on markets. Similarly, if these isolated conflicts begin to spread into larger regional conflicts that will also lift oil prices and weigh on stocks and bonds.

- Stock market valuations on U.S. large cap stocks are historically expensive, leaving them susceptible to pullbacks.

- Finally, investors still expect two interest rate cuts from the Federal Reserve between now and year-end; however, the unknown impact from tariffs on economic growth and inflation make rate cuts in 2025 far from certain. If the Federal Reserve does not cut rates in the coming months, that will increase concerns about an eventual economic slowdown and that could weigh on markets.

Our Position on Markets

While we are keenly aware of risks to the equity and bond markets, we remain cautiously optimistic about both. We maintain our overweight position on stocks due to our focus on the “three legs” of the investment markets’ stool: Inflation, Interest rates, and Earnings. Analyzing these three factors allows us to cut through extraneous “noise” in the economy and to concentrate on what the data tell us about the investment landscape.

Inflation:

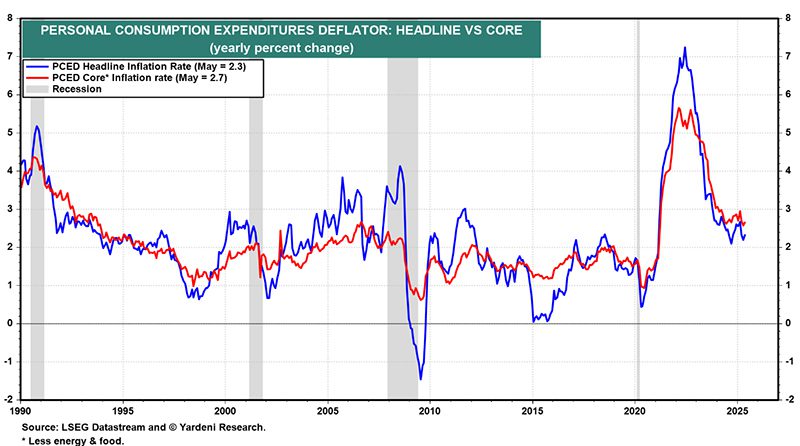

Current CPI and PCE (the Federal Reserve’s favorite indicator) inflation data support stock and bond valuations as they make progress toward the Federal Reserve’s 2% target. Any near-term increase in inflation due to tariff increases is not expected to carry over into next year.

Interest rates:

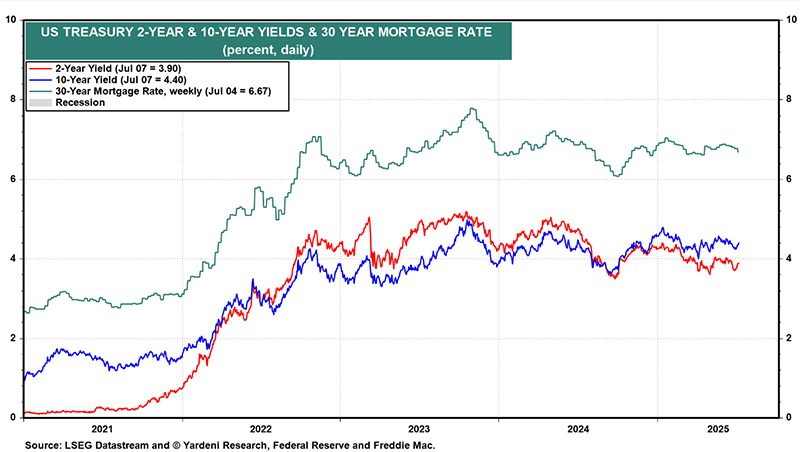

With the 2-yr. and 10-yr. Treasury bond yields (as well as the 30-yr. mortgage rates) having come down, current interest rates are supportive of stock prices. We prefer bonds that are intermediate in length (4-6 yrs.) as they represent attractive yields with less principal volatility than longer bonds.

Earnings:

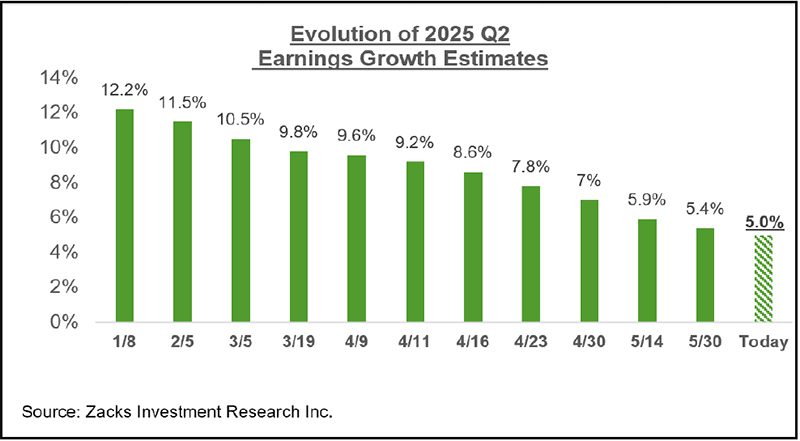

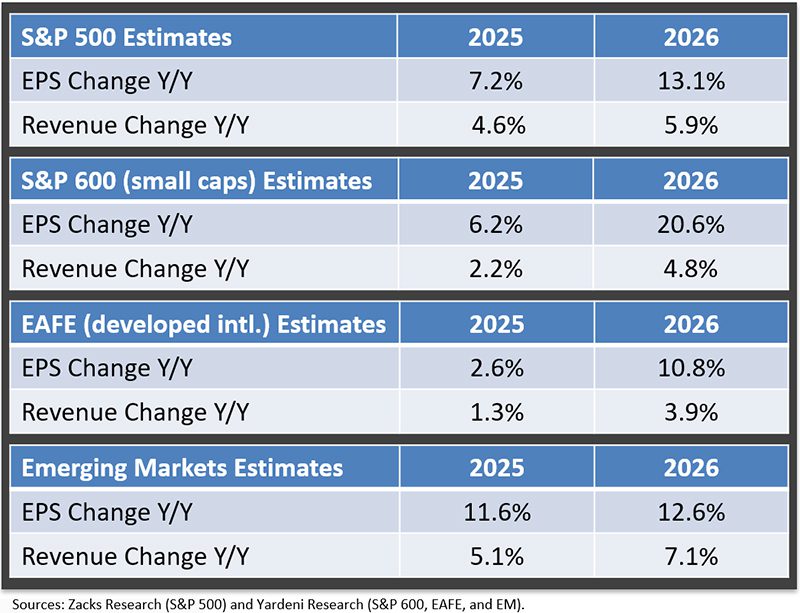

While Q2 earnings estimates have been steadily reduced this year, 2026 numbers have remained consistent. This is important as markets tend to look to next year’s estimates once the calendar turns to July. Also, a weaker U.S. dollar is benefitting large U.S. multinational companies.

Barring an unexpectedly weak third and fourth quarters, the current earnings trajectory is supportive of U.S. stocks, and the weaker dollar benefits the performance of foreign stocks. We monitor the earnings estimate changes weekly and will adjust our outlook if conditions warrant, but for now, we see no evidence that earnings projections for the next year are deteriorating.