President Trump's “One Big Beautiful Bill” was packed with numerous changes to the tax code for both individuals and businesses, and also resolved many of the questions around the tax provisions of the 2017 Tax Cuts and Jobs Act. Check out this summary of the One Big Beautiful Bill Act (OBBBA) changes that will most likely affect your individual income tax picture.

After much debate, this July saw Congress pass a significant update to U.S. tax policy, commonly referred to by the President as the “One Big Beautiful Bill.” The bill was packed with numerous changes to the tax code for both individuals and businesses, and also resolved many of the questions around the tax provisions of the 2017 Tax Cuts and Jobs Act originally to sunset at the end of this year. This article aims to summarize some of the changes from the One Big Beautiful Bill Act (OBBBA) most likely to affect our clients’ individual income tax picture.

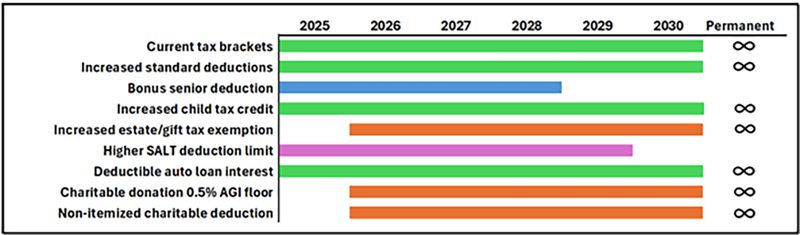

First, and most importantly, the Federal tax brackets lowered by the 2017 Tax Cuts and Jobs Act have been made permanent. Taxpayers will continue working with income brackets of 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In fact, the lowest 2 brackets — 10% and 12% — were widened slightly for 2025, so a little more income can be taxed at those rates versus the 22% rate.

Next, the standard deduction has increased, effective in 2025.

Standard Deductions

| Filing Status | Old Amount | New Amount |

|---|---|---|

| Single | $15,000 | $15,750 |

| Head of Household | $22,500 | $23,625 |

| Married Filing Jointly | $30,000 | $31,500 |

Also, for the 2025-2028 tax years, there is a new bonus deduction available for seniors age 65 or older. The bonus deduction is in addition to all other deductions from income, whether itemized or the standard. Each individual can deduct an additional $6,000, or $12,000, if both qualifying spouses file jointly. This is in addition to the additional standard deduction given to those who are 65+ and/or blind. The senior bonus deduction is phased out as income rises (between $75,000 and $175,000 MAGI for single filers and between $150,000 and $250,000 MAGI for joint filers), so higher-income seniors may receive reduced benefit from it.

Next, the child tax credit amount is being raised from $2,000 to $2,500 per qualifying child starting in 2025, and the credit will be indexed for inflation going forward. As before, only children under age 17 qualify, the entire credit amount is not fully refundable (i.e your credit is partially limited to the actual tax owed), and the credit phase-out remains above higher income levels ($200,000 MAGI for single filers and $400,000 MAGI for joint filers).

The OBBBA also prevented a significant reduction in the Federal gift and estate tax exemption that was coming in 2026. Instead, the exemption will rise to $15 million per person ($30 million per couple), with adjustments for inflation in subsequent years. With the maximum Federal estate tax rate of 40%, this is continued higher exemption amount represents a significant benefit for those with large estates.

Also, the OBBBA made changes to several common income deductions, which may make itemizing one’s deductions more advantageous going forward:

- The SALT (state and local taxes) itemized deduction has been limited to $10,000 for the past several years, but this limit is now raised to $40,000 for 2025. Small upward adjustments are made to this limit for 2026-2029, with the limit reverting to $10,000 in 2030. This deduction is still phased at higher income levels ($500,000 MAGI and above).

- For 2025-2028, up to $10,000 of interest on loans used to purchase certain vehicles for personal use (not business or resale) can be deducted. Only loans taken out or refinanced after December 31, 2024 are eligible, and only certain vehicles will qualify. As before, this deduction is phased out for higher income earners.

- The charitable contribution itemized deduction will be subject to a new 0.5% of Adjusted Gross Income (AGI) floor to be deductible, starting in 2026. This area has some complexity to it, in that different types of property donated to charity still have specific percentages and ceiling limits that apply, but the deductibility floor is new. However, even if a taxpayer does not itemize their deductions, the OBBBA now allows a charitable deduction of up to $1,000 for single filers and $2,000 for joint filers for 2026 and beyond. This deduction is not subject to the same 0.5% AGI floor, but contributions must be made with cash (as opposed to investments or other types of property).

The OBBBA has many other provisions of interest, including deductions on up to $25,000 of “qualified tips” as well as qualified overtime time pay. But perhaps the most noteworthy aspect of the bill is one thing it did NOT include (to the disappointment of many): a tax exemption for Social Security benefits. There had been some ambiguity around this issue prior to the passing of the bill due to the wording of an email sent by the Social Security Administration. That email referenced a White House Council of Economic Advisors analysis of the bill, which estimated that most Social Security benefit recipients would end up with greater total deductions than the sum of their Social Security benefits. This was misconstrued by some to mean that the benefits themselves would become tax-exempt. However, Social Security benefits remain taxable income, as before, with the percentage of benefits subject to taxation still dependent on the level of the taxpayer’s other income.