The Strategy Signal Quarterly Investment Report - 4Q2025

As a boy of nine or ten, I, like many other kids my age, was fond of climbing trees. I especially liked the large maple tree, maybe sixty feet high, that stood beside my house. In those days, parents were more open to what today seems like particularly risky behavior for a child. That maple tree had very accessible branches and was quite fun to climb as I carefully ascended close to the point where the branches thinned out.

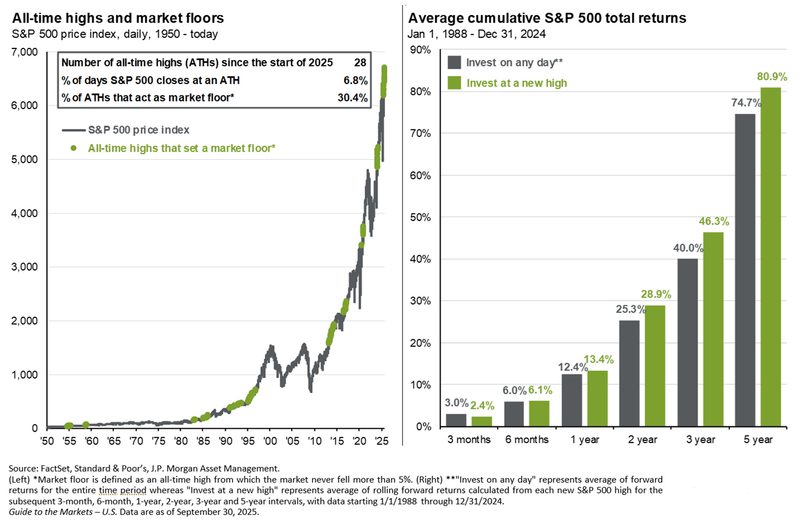

The recent surge in the stock market to new highs reminds me of climbing that maple tree as a child—each new branch represents a fresh record or milestone, but every ascent is shadowed by the risk beneath, requiring constant vigilance and a clear assessment of the environment before reaching higher. In the current market, we believe the primary branches worth gripping for investment decisions are inflation, interest rates, and earnings, and we recommend blocking out extraneous political noise or speculation.

I’ll discuss our take on the economy and markets for the rest of the year in the Outlook section of this report.

Looking back at the third quarter

Major stock indices continued the 2025 rally and surged to new all-time highs in the third quarter as economic growth remained stable, tariff increases were no worse than feared and the Federal Reserve cut interest rates, beginning the long-awaited rate-cutting cycle.

Markets started the third quarter with a continuation of the year-to-date rally thanks, initially, to the passage of the “One Big Beautiful Bill Act” in early July. This legislation contained several pieces of economic stimulus including making the 2017 tax cuts permanent, reintroducing accelerated depreciation and committing billions to the development of domestic industries, providing the markets and the economy with a fresh dose of fiscal stimulus. But while that was the first positive market event in July, it was not the last. Second-quarter corporate earnings results (released in mid-July) were stronger than expected and importantly showed no significant signs that tariffs or policy uncertainty were weighing on results. Finally, in mid-to-late July, the Trump administration announced trade agreements with some of the largest U.S. trading partners including the EU, Japan, and South Korea, while the U.S. and China agreed to extend their trade “truce” as the two sides negotiated toward a larger trade agreement. These trade “deals” reduced investor anxiety stemming from the re-imposition of reciprocal tariffs in early August and lowered trade-related concerns among investors. These factors, along with stable economic and inflation readings, helped to push the S&P 500 steadily higher and the index rose 2.24% in July.

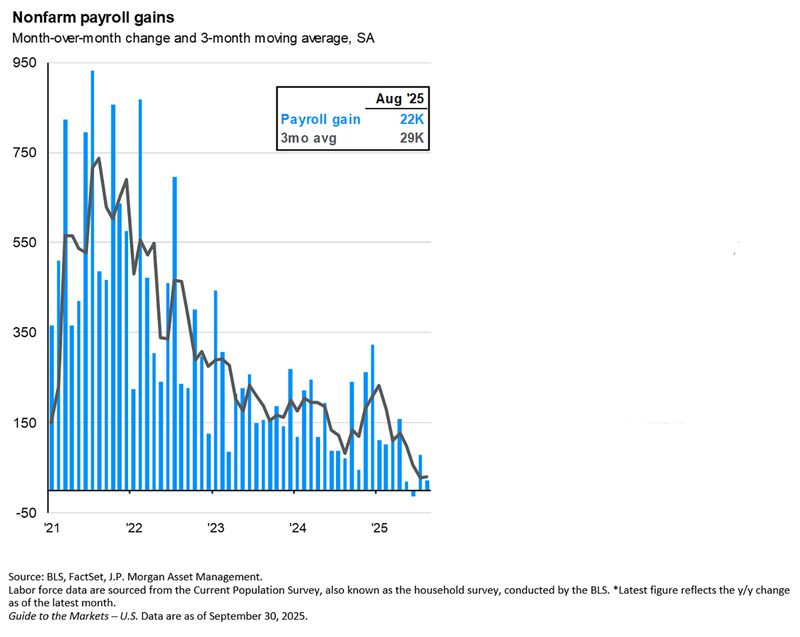

The beginning of August brought an economic surprise, however, that temporarily paused the rally in stocks. The July jobs report, released on August 1st, was much weaker than expected, not just because job growth in July disappointed but also because there were substantial negative revisions to the May and June reports. The underwhelming employment data introduced the idea that the labor market was weaker than expected and that did slightly increase economic slowdown risks. However, the soft employment data also boosted expectations for a Fed rate cut, and at the Jackson Hole Economic Symposium Fed Chair Powell strongly hinted that a rate cut was coming at the September Fed meeting. Rising rate cut hopes helped to offset the underwhelming employment data and stocks ultimately continued their advance, as the S&P 500 rose 2.03% in August.

The rally accelerated in September despite growing signs that the labor market is indeed seeing some deterioration. The August jobs report was another underwhelming print showing just 22,000 jobs added that month, well below the consensus estimate. But like in August, the expectation for Fed rate cuts helped offset that negative employment report and the Fed did cut interest rates at the September meeting. Equally as importantly, Fed members signaled they expected two more rate cuts this year via the “dot plot.” The start of a Fed rate-cutting cycle, which should support the economy, combined with strong AI-related tech stock earnings from Oracle and Broadcom to send stocks higher and major U.S. stock indices all hit new all-time highs following that Fed rate cut, rising 3.65% in September.

In sum, the third quarter was resoundingly positive for the U.S. economy and markets as economic data showed solid growth, inflation readings stayed mostly stable, the Fed cut interest rates, the U.S. reached trade agreements with major trading partners and AI-linked tech companies continued to produce better-than-expected earnings. Given these positives, major U.S. stock indices rallied solidly in the third quarter, just as they should have given this news.

Third Quarter Performance Review

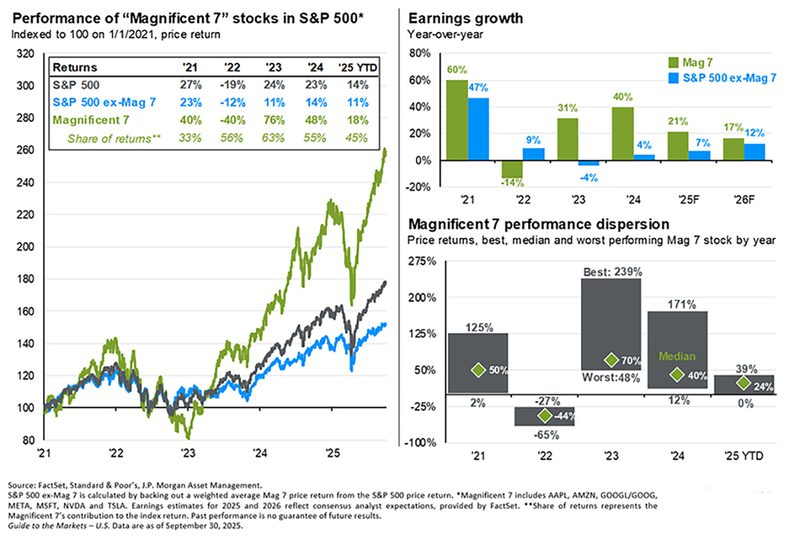

Rising expectations for a rate cut, strong AI-related corporate results, and stable economic growth helped propel the major stock averages solidly higher in the third quarter. According to Bloomberg1, AI-related stocks have accounted for 75% of the S&P 500 returns, 79% of earnings growth, and 90% of capital spending growth since ChatGPT launched in November of 2022. Also, the “Magnificent 7” reestablished their market leadership in the quarter and have easily outperformed the other 493 S&P 500 stocks through the first nine months.

- Starting with market capitalization, small caps outperformed large caps for the first time in 2025 as investors rotated out of large-cap stocks and into more economically sensitive small caps, as they historically have received the most benefit from lower borrowing costs that come with falling interest rates.

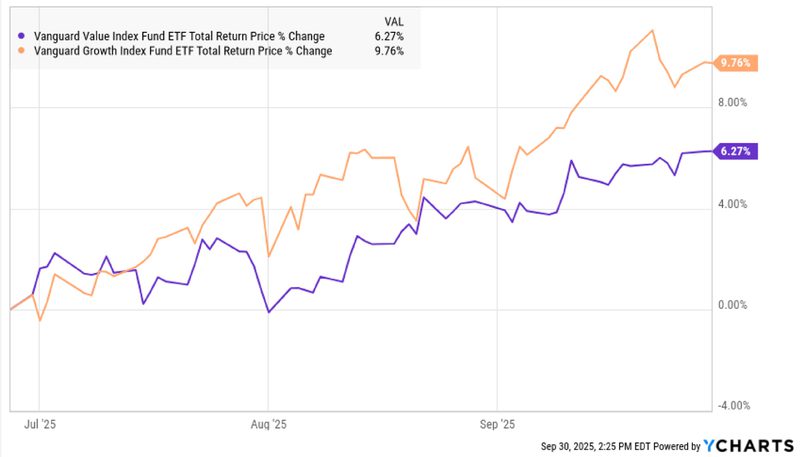

- From an investment style standpoint, both growth and value ETFs were solidly higher in Q3 but growth outperformed value thanks to continued strength in AI-linked tech stocks, continuing a trend from the second quarter.

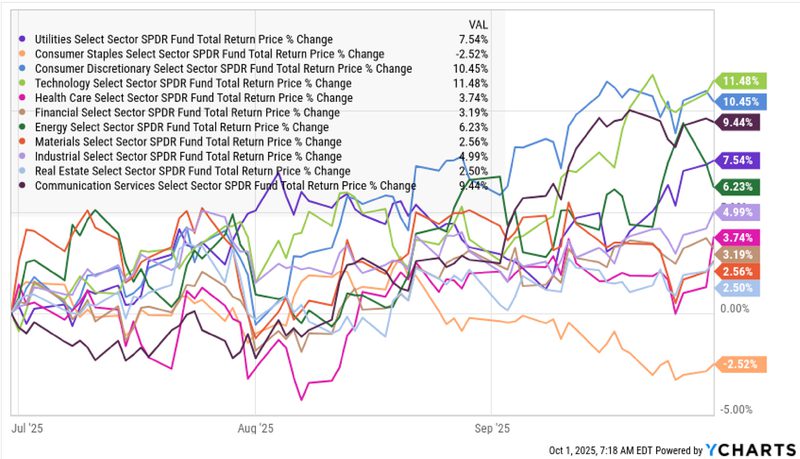

- On a sector level, 10 of the 11 S&P 500 sectors finished the third quarter with a positive return. Tech and tech-aligned sectors (consumer discretionary and communications services) comfortably outperformed other market sectors and posted strong quarterly returns. Positive earnings results from AI-linked tech stocks such as Microsoft, Alphabet, Amazon, Nvidia, Oracle, Broadcom and others kept investor enthusiasm for AI-related investments high and that powered tech and communications services higher. The consumer discretionary sector, meanwhile, benefited from solid economic growth and expected lower interest rates, which should support consumer spending.

Looking at sector laggards, consumer staples was the only sector that finished the third quarter with a negative return. Investor preference for more economically sensitive sectors (given falling interest rates) and tariff related concerns pressured that sector, which finished the third quarter with a modest loss.

- Internationally, foreign markets saw mixed performance vs. the S&P 500 as emerging markets outpaced U.S. stocks in the third quarter while foreign developed markets posted a positive return but relatively underperformed the S&P 500. Emerging markets handily outperformed the S&P 500 in Q3 thanks primarily to a weaker dollar, falling interest rates and a rebound in Chinese economic growth. Foreign developed markets also rallied in the third quarter but lagged the S&P 500, due in part to concerns about fiscal stress and slow growth in the United Kingdom.

- Commodities were solidly higher in aggregate in the third quarter but that result somewhat masked mixed internal performance. Gold surged to fresh all-time highs in the third quarter thanks to elevated inflation and the weaker U.S. dollar. Oil, however, declined as increased production from OPEC+ and concerns about global economic growth weighed on oil prices, especially late in the third quarter.

- Switching to fixed income markets, the leading benchmark for bonds (Bloomberg U.S. Aggregate Bond Index) saw a strong quarterly return despite elevated inflation readings, as expectations for rate cuts and labor market deterioration boosted demand for both short- and longer-term debt.

- Looking deeper into the bond markets, longer-duration bonds comfortably outperformed those with shorter durations as investors reached for longer-term yield amidst underwhelming labor market data. Shorter-duration bonds also saw a positive return, however, as investors anticipated the start of a rate-cutting cycle by the Fed.

- Turning to the corporate bond market, both investment grade bonds and lower-quality, high-yield bonds saw strong gains in the third quarter. Investment grade bonds slightly outperformed high yield bonds as the weakening labor market and slight uptick in economic concerns boosted the attractiveness of higher credit quality corporate bonds.

| U.S. Equity Indexes | Q3 Return | YTD |

|---|---|---|

| S&P 500 | 8.12% | 14.83% |

| DJ Industrial Average | 5.67% | 10.47% |

| NASDAQ 100 | 9.01% | 18.10% |

| S&P MidCap 400 | 5.55% | 5.76% |

| Russell 2000 | 12.39% | 10.39% |

Source: YCharts

| International Equity Indexes | Q3 Return | YTD |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | 4.83% | 25.72% |

| MSCI EM TR USD (Emerging Markets) | 10.95% | 28.22% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | 7.03% | 26.64% |

Source: YCharts

| Commodity Indexes | Q3 Return | YTD |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | 4.07% | 6.09% |

| S&P GSCI Crude Oil | -3.94% | -12.88% |

| GLD Gold Price | 16.87% | 47.05% |

Source: YCharts/Koyfin.com

| U.S. Bond Indexes | Q3 Return | YTD |

|---|---|---|

| BBg US Agg Bond | 2.03% | 6.13% |

| Bbg US T-Bill 1-3 Mon | 1.10% | 3.25% |

| ICE US T-Bond 7-10 Year | 1.76% | 7.20% |

| Bbg US MBS (Mortgage-backed) | 2.43% | 6.76% |

| Bbg Municipal | 3.00% | 2.64% |

| Bbg US Corporate Invest Grade | 2.60% | 6.88% |

| Bbg US Corporate High Yield | 2.54% | 7.22% |

Source: YCharts

What actions did we take in McKinley Carter portfolios last quarter?

- In our fixed income portfolios, we maintained our exposure to high yield and nontraditional bonds as well as a shorter-than-benchmark duration to lessen long-term interest rate risk and associated volatility.

- In our ActiveTrack models, we added additional small cap exposure due to the Federal Reserve’s messaging that they planned to begin reducing the Fed Funds rate. A lower rate environment within the context of a positive economic backdrop has historically been a productive time for small cap stocks.

- In our Dividend Focus models, we removed United Healthcare (UNH) and added Ecolab (ECL), a defensive growth compounder due to its global leadership in water, hygiene, and infection protection solutions.

- In our Earnings Focus models, we removed W.W. Grainger (GWW) and added Quanta Services (PWR) for better earnings visibility. Quanta is a leading provider of energy and communications infrastructure solutions in North America. Additionally, we removed Fiserv (FI) and replaced it with Ralph Lauren Corporation (RL) in order to add exposure to the high end consumer market and we removed United Healthcare (UNH) and replaced it with Amphenol (APH), a leader in high margin electrical connectors that take advantage of secular growth themes like industrial automation and AI.

Outlook - a look ahead to the fourth quarter of 2025

Markets begin the final quarter of 2025 in a decidedly positive macroeconomic environment as the Fed is cutting interest rates, tariffs have not disrupted the U.S. economy (so far), broader economic growth remains stable and investment enthusiasm for AI-linked tech stocks remains high. In addition, international equity markets continue to show gains as foreign governments are introducing growth initiatives.

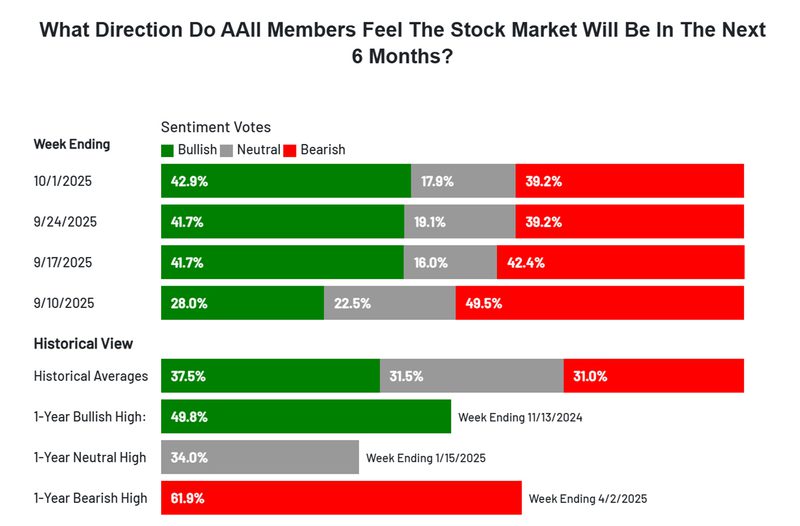

Recent investor sentiment has improved sharply (green bars) as individual investors have grown more confident in the fourth quarter’s outlook for the stock market. While negative sentiment (red bars – 39.2%) still reflects an elevated degree of bearishness (a good contrarian indicator) relative to the historical average of 31%, lower interest rates and positive earnings estimates have encouraged bullish investors to believe that the seasonal strength usually found in the final months of the year will manifest itself once again in 2025.

AI and tech enthusiasm has driven the valuation of the S&P 500 to a historically high level. While elevated valuation, by itself, isn’t a negative influence on stocks, the high valuation does underscore the need for market fundamentals to remain positive in order to support the rally. Fortunately, history shows that all-time market highs often lead to more highs.

Climbing Trees

While we are keenly aware of risks to equity and bond markets after strong rallies, we remain cautiously optimistic about both, though less so for longer-term bonds. Using our analogy of climbing trees, we maintain our overweight position on stocks due to our focus on the primary branches of the investment decision tree: inflation, Interest rates, and earnings. Analyzing these three factors allows us to cut through extraneous “noise” in the economy and to concentrate on what the data tell us about the investment landscape.

Inflation:

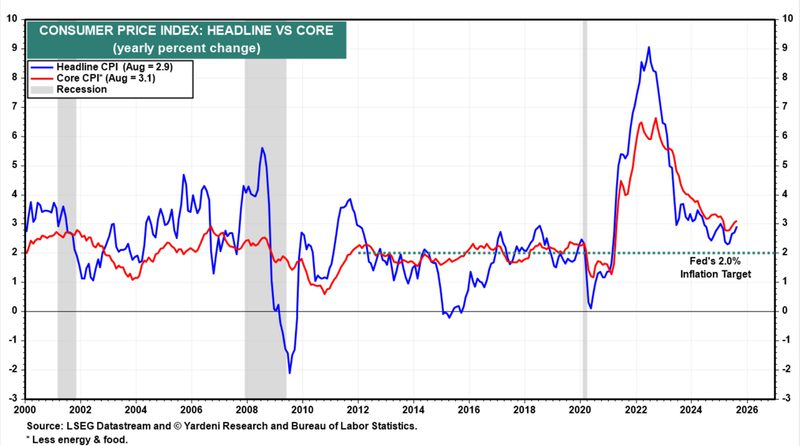

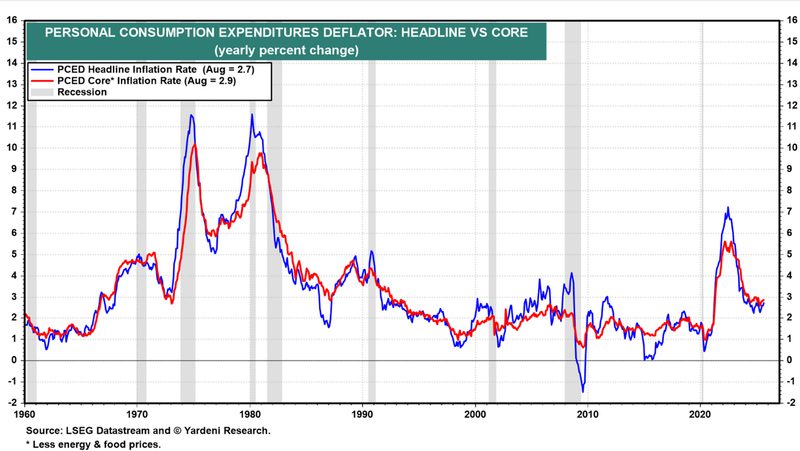

Inflation, much like the wind on tree branches, impacts stability; when it blows hard—forcing price hikes and eroding purchasing power—investors must decide whether the supporting branch can hold their weight. With core inflation at 2.9% year over year, steady but persistent, the current environment hints at manageable but ever-present risk. Analysts expect inflation trends to directly influence Federal Reserve behavior, and thus market direction.

Despite a downward trend in inflation data this year, current CPI and PCE (the Fed’s preferred inflation indicator) indexes are “stuck” at levels above the Federal Reserve’s 2% target level after a recent increase. Meanwhile, tariffs are now starting to impact broader parts of the U.S. economy and while analysts generally believe tariffs will produce only a one-time price increase and not create broader inflation, that outcome remains uncertain. Bottom line, there is a chance that tariffs further boost inflation in the fourth quarter and that could result in the Fed having to reconsider future rate cuts, which would produce a negative surprise. While current inflation levels are not a near-term negative for stocks, we would say they are, at best, a neutral indicator for further equity appreciation.

Interest rates:

Interest rates represent the actual strength and flexibility of each branch climbed. Lower rates offer sturdy, easy-to-grip branches for consumers and companies—supporting borrowing, spending, and revenue growth, and pushing stocks higher. When rates rise, those same branches stiffen and crack, deterring risk and slowing earnings growth.

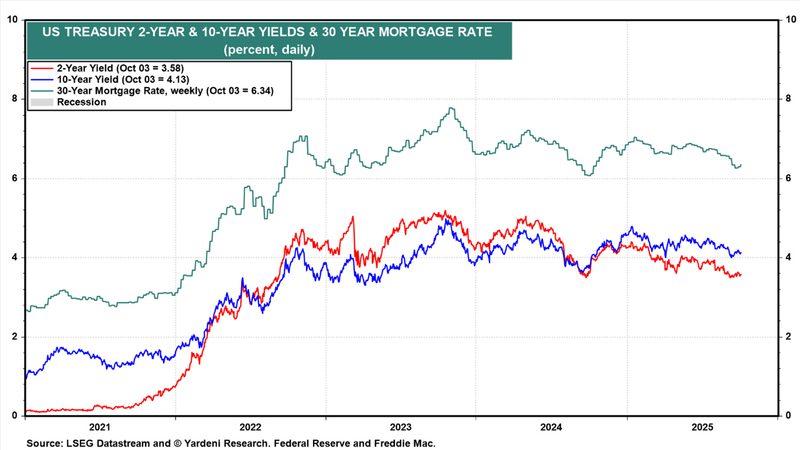

As the growth in employment has slowed markedly in recent months, the Federal Reserve lowered the Fed Funds rate by 0.25% in September. With inflation data remaining above the Fed’s target of 2%, slowing jobs growth and weak consumer confidence are the motivating factors for the Fed in reducing rates further this year.

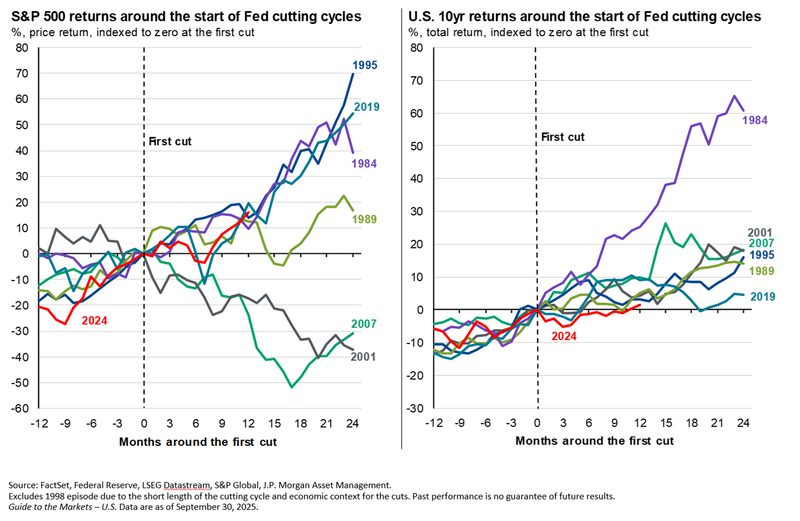

Recent Federal Reserve signals suggest the potential for two rate cuts in the coming quarter, helping to explain market optimism even as economic data give mixed signals. Historically, Fed rate cuts bode well for stock and bond prices if the economy is on sound footing.

With the 2-yr. and 10-yr. Treasury bond yields (as well as the 30-yr. mortgage rates) having come down, current interest rates are supportive of stock prices. For fixed income investments, we prefer bonds that are intermediate in length (4-6 yrs.) as they still represent attractive yields with less principal volatility than longer bonds in the event of rising rates.

Earnings:

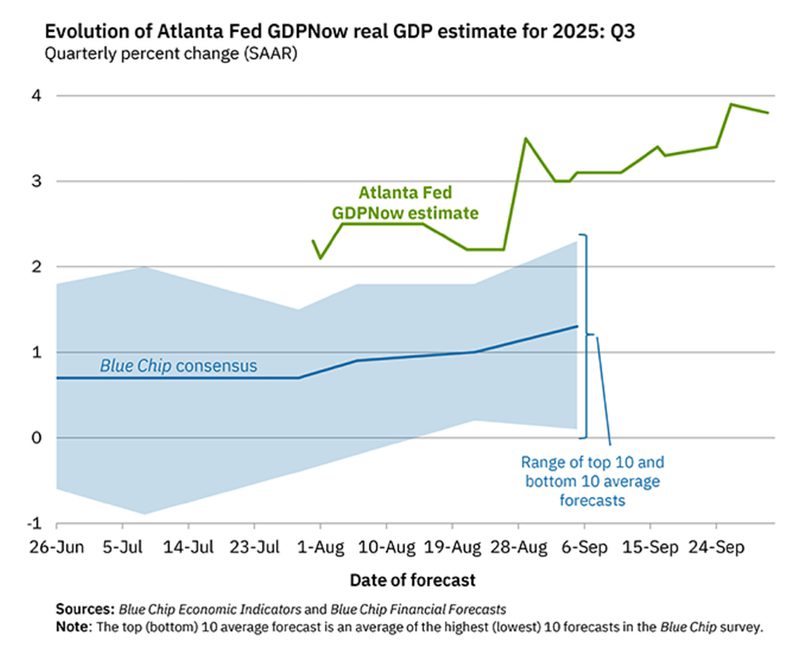

Earnings, the direct result of economic growth and company performance, are every climber’s next foothold. Strong corporate profits enable continued upward momentum, just as a firm branch allows the next move higher. Conversely, weak earnings or cautious forward guidance can cause hesitancy—or retreat. Despite turbulent tariff headlines and mixed economic signals, strong earnings from select sectors (such as technology and financials) have justified this climb. Additionally, third-quarter GDP estimates from the Atlanta Fed (3.8%) are quite strong.

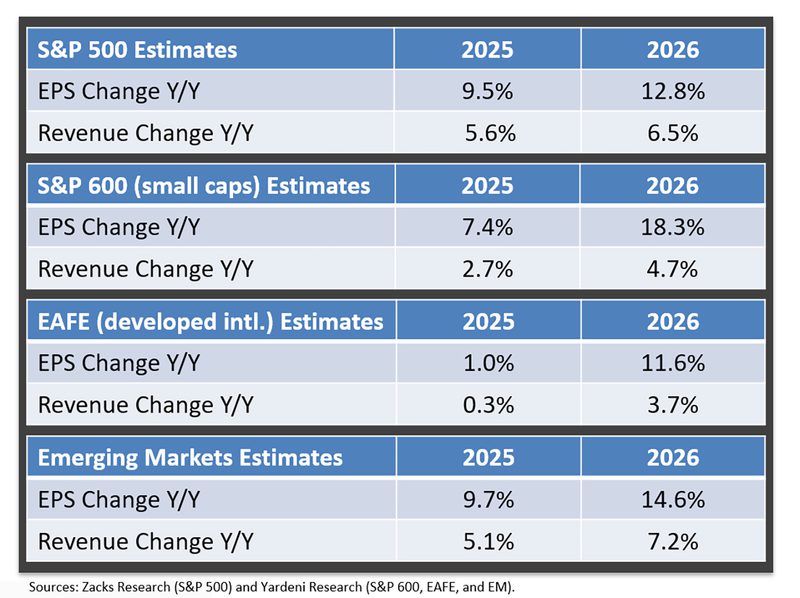

The current earnings trajectory is supportive of U.S. stocks, and the weaker U.S. dollar should continue to benefit the performance of foreign stocks. Additionally, U.S. companies’ profit margins continue to lead the world despite tariff concerns. We continue to monitor earnings estimates changes and will adjust our outlook if conditions warrant, but for now, we see no evidence that earnings projections for the next year are deteriorating.

Conclusion

Just as climbing a tree as a child demanded focus on each branch’s safety and underlying strength, the current record highs in markets call for vigilance. Ignoring distractions and focusing primarily on inflation, interest rates, and earnings offers the clearest blueprint for prudent investing, no matter how high the market climbs.

1Eye On the Market, Michael Cembalest, J.P. Morgan, Sept. 24, 2025