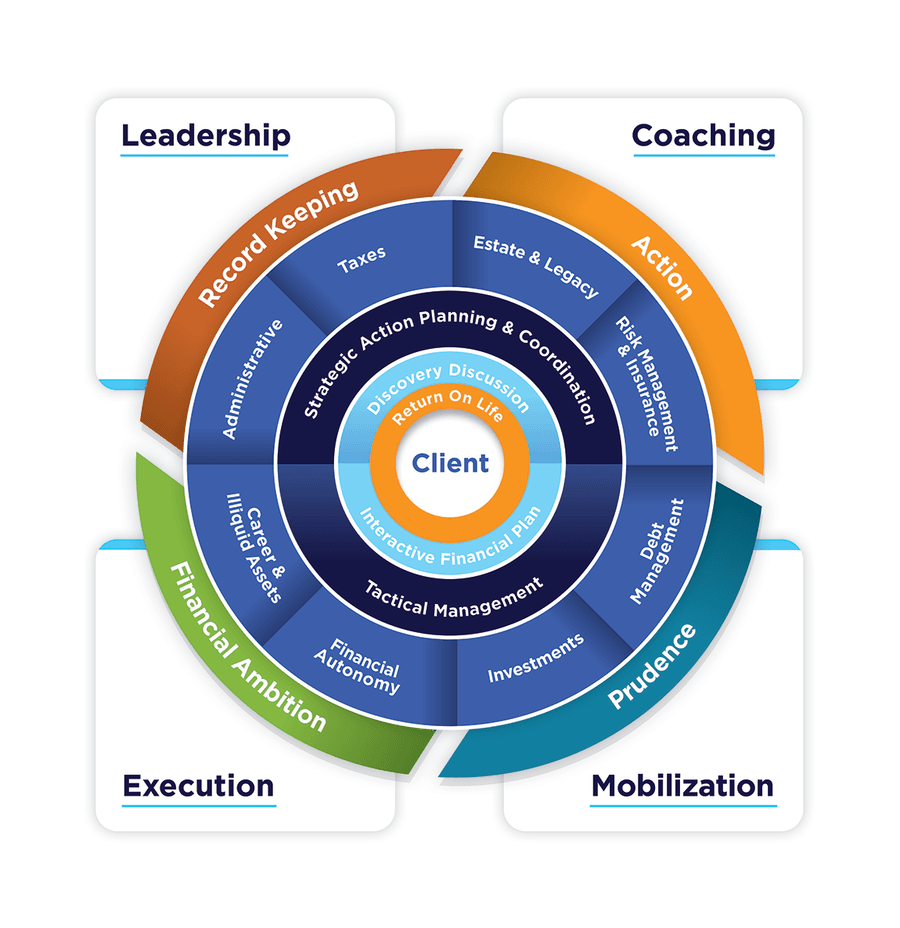

Beyond Invested — It's Your LifePlan

Helping you achieve your goals with clarity and purpose.

Leadership

We start with a Discovery Discussion to understand your financial landscape and priorities. Then, we assess resources and strategies to identify gaps that may hinder long-term success. Clients value these conversations for the clarity they provide — especially during transitions. As trusted advisors, we help you navigate complexity, adapt to change, and move forward with confidence.

Coaching

We provide a range of solutions to address identified blind spots. Our approach relies on meaningful conversations that simplify complexity, prioritize act, and support confident decision making.

Mobilization

Even high achievers face barriers to action — complexity, conflicting advice, or discomfort with change. We help cut through the noise, overcome hesitation, and stay focused on what matters. Our goal: decisive, informed action that turns intentions into results.

Execution

Even the most sophisticated plan remains theoretical without decisive action. For complex financial situations, we prioritize high-impact, low-resistance strategies. We coordinate across all financial areas and align with other financial partners to ensure seamless, strategic implementation.

We Specialize In...

LifePlanning

It’s not just about growing your wealth — it’s about making sure your financial choices support the life you truly want to live. We help you align your money with what matters most, so you can experience a meaningful Return on Life. Our goal is to align your financial decisions with your personal goals and values for a positive Return on Life. Learn more.

Taxes

Through proactive tax planning, you can keep more of what you earn, enhance after-tax returns, and strategically manage complex financial structures across generations. Learn more.

Risk Management

Risk management planning gives you peace of mind by protecting your wealth, lifestyle, and legacy from unforeseen events that could jeopardize what you've worked hard to build. Learn more.

Illiquid Assets

Thoughtful planning around your illiquid assets — such as real estate, private business interests, or collectibles — helps you preserve wealth, maintain control, and avoid forced sales during key life transitions. Learn more.

Business Succession Planning

Business succession planning helps you protect the value you've built, ensure a smooth transition, and give your family, partners, and employees long-term confidence in your vision.

Estate Planning

Estate planning empowers you to protect your wealth, reduce tax burdens, and ensure your legacy is passed on exactly as you intend. Learn more.

Wealth Management

McKinley Carter Wealth Services provides financial services to individuals, families, business owners, and nonprofit organizations.