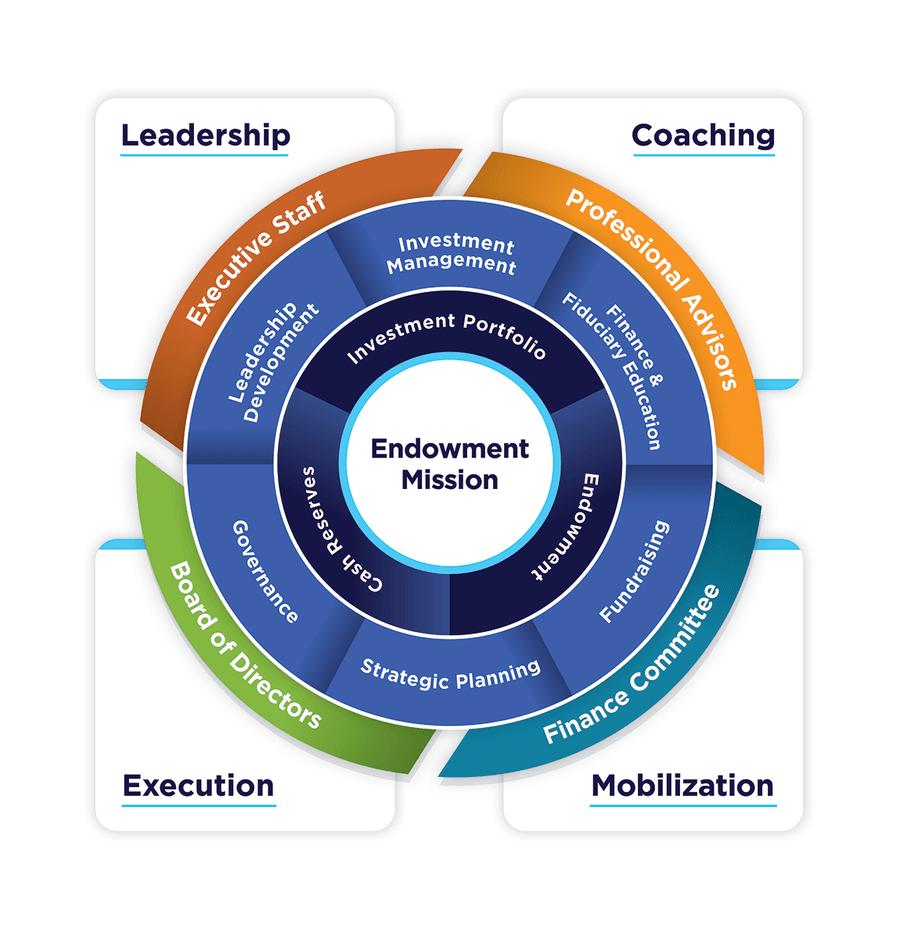

Much more than just investment management

We will, of course, design a diversified, global portfolio that maximizes returns while supporting your mission and values. But it’s our expertise in strategic planning, leadership development and fundraising that can help you thrive in the competitive nonprofit world—and make a difference for a very long time.

An Action Plan to Address All Your Challenges

An Action Plan to Address All Your Challenges

Guidance and advice that addresses both your financial and impact bottom lines.

Fundraising

From assessing your existing initiatives to creating sustainable fund development programs.

Investments

Portfolio administration and management that considers your mission and values.

Strategic Planning

Integrated short- and long-term planning aligned with your financial and non-financial goals.

Governance

Rethinking your governance processes for better decisions and outcomes.

Leadership Development

Through our Board Development and Executive Leadership Training program.

Nonprofit Advisory Services

Discover how the Nonprofit Advisory Services Team at McKinley Carter Wealth Services can help nonprofits achieve greater community impact by taking a strategic approach to endowment development.